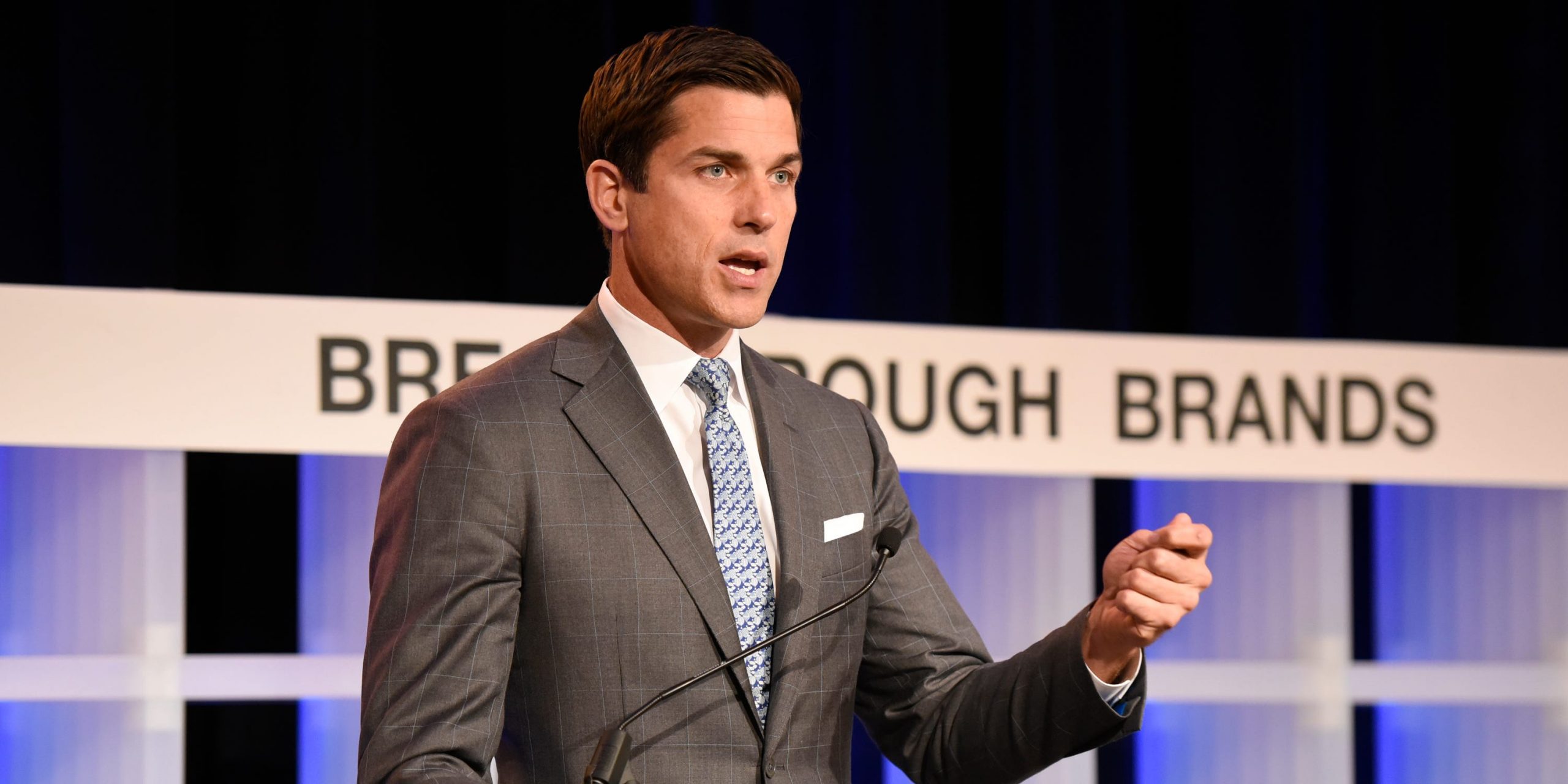

- Former NYSE President Tom Farley said SPACs have become a "mania" in a recent interview.

- Farley argued SPAC sponsors should be more tethered to their growth projections.

- The former NYSE President added that he believes there will be a "pullback" for SPACs going forward.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Tom Farley, former president of the New York Stock Exchange, says SPACs have become a "mania," and he believes sponsors should be more tethered to their lofty growth projections.

In an interview with CNBC on Tuesday, Farley said that he was "very nervous" about excessive liquidity adding to the SPAC boom and what might happen if that liquidity gets pulled out from under the economy.

"Ultimately, we're going to have to stop spending. Ultimately, we're going to have to raise rates. The party is going to have to slow down for a bit. I suspect it will be coming sooner rather than later," Farley said.

When asked about the rise of SPACS, Farley said, "it's become a mania," and added, "there are some really great people out there running SPACs, but there's also a lot of knuckleheads."

Farley said he believes there will be a "pullback" going forward as the SPAC market has overheated.

"So I suspect there will be a pullback. Right now, there's something like 400 open SPACs. There's no way there will be 400 really good deals for investors for those 400 SPACs. I think it will be a good kind of culling or washing out," Farley said.

The former NYSE president added that he is "concerned about is seeing investors get hurt" because there have been some deals where the "valuation is completely untethered from financial reality."

Farley said it is critical for sponsors to be more tethered to the growth projections they release to the public.

"I'd like to see sponsors be a little more tethered to those projections, hold onto their stock holdings for those projections," Farley said.

He said he tied up his sponsor shares in his first SPAC deal for three years and that he believes other sponsors should make similar commitments.

When asked if regulation may end up playing a role in SPAC mania, Farley said he would rather see the markets take care of it and mentioned a recent article that showed short-sellers are moving into SPACs.

To Farley's point, short-sellers have tripled their bets against SPACs to $2.7 billion since the beginning of the year. Still, that pales in comparison to the $166 billion in SPAC-led deals that were announced in the first quarter of 2021.