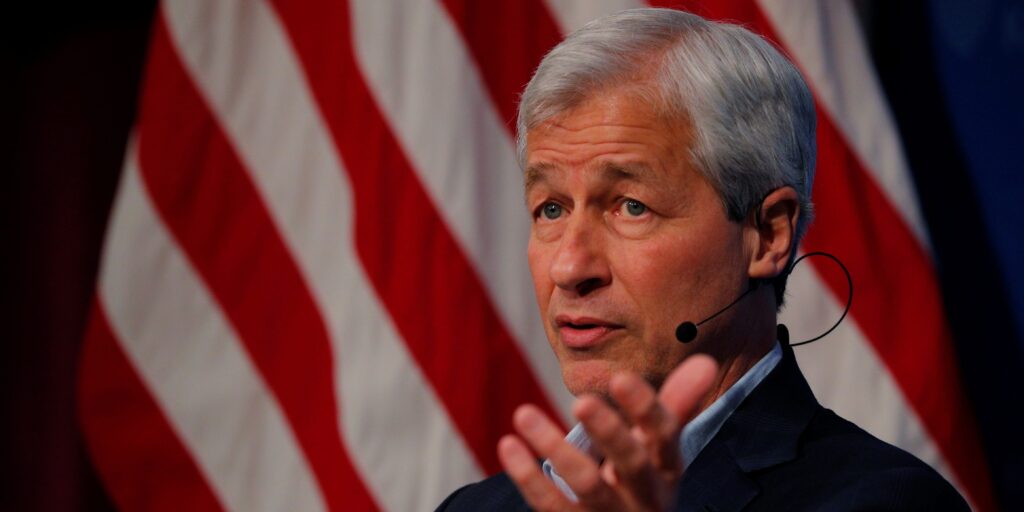

- The bottom 20% of American earners have been left out of the economic boom, Jamie Dimon said.

- Their incomes have hardly budged for 20 years, fueling societal problems, the JPMorgan CEO said.

- People can't get a mortgage or afford a home, and communities have been hit by drug abuse and crime.

The US economy may be the envy of the world, but many Americans are deeply discontent. One reason is they've largely missed out on the boom times, Jamie Dimon says.

"The bottom 20% of America have not done particularly well over the last 20 years," the JPMorgan CEO told The Wall Street Journal this week. "Incomes barely went up."

"Suicide, fentanyl, crime, inflation — there are a lot of negative effects," he continued. "Some people can't get mortgages, can't buy their home."

Dimon likely meant that stagnant wages have fueled rates of depression, drug abuse, and crime as people feel they just can't get ahead.

That may be particularly true when they're paying more for food, energy, and housing due to inflation — and have higher monthly payments on their credit cards and cars due to higher interest rates.

Those painful issues have translated into widespread disillusionment with the US economy. A full 51% of respondents to a New York Times survey in late February rated the economy as poor, and another 23% described it as only fair. Moreover, 40% or those surveyed said the economy was worse than a year earlier.

Economic growth has slowed from 3.4% in the fourth quarter of 2023 to 1.6% last quarter, official data showed this week. But a recession is yet to strike, unemployment remains historically low at under 4%, and inflation has dropped from more than 9% two summers ago to below 4% in recent months.

Record home prices and booming markets are often good news for homeowners with stock portfolios. But they don't benefit others to the same degree — and can even hurt them if rising house prices drive up rents and companies raise prices to bolster profits and boost shares.

"There's parts of society who's kind of struggling, parts of society who's not," Dimon said. "You can see why that has people upset."

The billionaire banker also emphasized the current situation isn't as rosy as many think. He warned of stubborn inflation, interest rates staying higher for longer, and a potential recession — echoing comments he made in his annual letter, to analysts, and in recent interviews.