President Donald Trump is considering a 20% tariff on imports of steel and possibly a number of other goods, Axios says.

According to the report, Trump held a meeting with key advisers on Thursday and was heavily in favor of the tariffs despite their warnings of the economic implications.

The pending decision comes after Trump set up a task force to look into steel import practices a few months ago.

The move is not surprising, given that Trump made free trade one of the central topics of his campaign after criticizing China, Mexico, and Japan.

He suggested putting a 45% tariff on Chinese imports, said he would declare China a currency manipulator on his first day in office, proposed taxing imports from Mexico, said he’d “rip up” trade deals, and called the Trans-Pacific Partnership, or TPP, “a rape of our country.”

At post-election rallies, Trump said that "we have to look at it [trade] almost as a war," asking "Who the hell cares if there's a trade war?"

Trump said China specifically is committing "the greatest jobs theft in the history of the world."

Following the election, Willem Buiter, chief economist at Citi, wrote in a note to clients that protectionist trade policies might spark a global trade war, "which could easily trigger a global recession."

Deutsche Bank has also addressed the negative risks of the Trump trade agenda. A team from the firm wrote in a December note that "the biggest threat to growth is a possible protectionist turn, which could depress global trade and even trigger trade wars."

While the Deutsche Bank report did not predict a coming collapse in international trade, the possible moves from Trump could be the first domino in a broader change in global change.

Additionally, a tariff of any kind is likely to spark a reaction from major US trading partners such as China. Chinese officials reportedly weighed options for how to respond to hostile trade moves by Trump when he took office.

Given the newest moves by Trump, we've broken down just how a protectionist trade scenario could affect the US economy and the geopolitical order.

A macroeconomic drag

While the 20% tariff would only apply to certain goods like steel, semiconductors, and household appliances, it could lead to higher costs and possibly a slight drag to GDP growth. The bigger fear for economists is what it signals going forward.

Michael Gapen, a chief US economist at Barclays, in December estimated the economic drag that broader tariffs on imports from China and Mexico, two of Trump's favorite targets, may have on US GDP growth.

One idea floated by the Trump team previously was a 15% tariff on Chinese imports and a 7% tariff on Mexican imports - modestly above their current levels of 2% to 10%, depending on the good. In this scenario, Gapen estimated that the US would see a 0.5% reduction in annual GDP growth in the year after implementation.

Meanwhile, Buiter said Citi estimates trade and other policy uncertainties could be a 1% drag on US GDP over the next year.

And should Trump eventually follow through with any of these policies, the US risks retaliatory measures from other countries.

"If tariffs are more punitive and lead to a public trade spat with China, markets will get nervous, especially if a sharp, retaliatory, [Chinese yuan] depreciation looks like a realistic response," said Ajay Rajadhyaksha, head of macro research at Barclays.

If other countries follow this pattern, it could lead to a downward spiral or litigation at the World Trade Organization.

"Depending on the specific measures, retaliatory action from elsewhere could be expected, while the risk of trade and currency wars could grow," said Janet Henry, chief global economist at HSBC.

Making it more expensive for consumers

An increase in tariffs could be passed through to individual Americans by companies in the form of higher prices.

Parts for consumer items are made abroad, so increasing tariffs could make it more expensive to import these parts for goods. To protect corporate profits and margins, companies could hike prices - which is not ideal for consumers.

A crucial thing to consider here is that this type of price increase is not caused by the virtuous wage and price increase cycle, but rather by an exogenous shock to prices without a boost to the labor market. In plain English, that means that while parts manufactured in China instantly become more expensive for Americans under tariffs, wages do not necessarily go up by the corresponding amount to offset this cost increase.

Theoretically, companies could avoid tariffs by increasing production in the US. However, the problem is that labor is more expensive in America, so even if companies brought production to the US, the increased labor costs could push prices up, too.

A 'nail in the coffin' of the post-World War II economic order

Not only could Trump's moves affect US consumers, they also could upend macroeconomic policies that have been in place for more than half a century. As Buiter notes, these policies have increased worldwide prosperity and been positive developments for the US.

From the Citi economist's note (emphasis ours):

"We stress the potential multipliers of changes in the US position on international trade: the US has been the champion of free trade and open borders for decades. A retreat from globalization by the US would likely lead to reciprocal actions from other countries, and reinforce the latest shift towards de- globalization and could be another nail in the coffin of the liberal global economic world order that has supported prosperity since 1948."

Taking it a step further, Trump already removed the US from the TPP - the landmark free trade agreement that aims to slash tariffs and promote economic growth among 12 nations in the Pacific Rim excluding China.

And that could have major implications for the future of the economic and geopolitical order in Asia Pacific, given that the deal was arguably more about the US's long-term position in Asia than about the near-term financial advantages.

Americans want jobs

Mainstream economists generally agree that free trade is good for an economy in the long run - even though some people will benefit less, particularly in the short term - while trade-restrictive measures hurt consumers.

However, some voters across developed economies believe free trade hurts their countries, which is likely a reflection of their personal experiences.

In the US, 89% of Americans said they think the loss of US jobs to China is a somewhat or very serious issue, according to Pew Research statistics previously cited by Bank of America Merrill Lynch's Ethan Harris and Lisa Berlin.

Moreover, only 46% of Americans said they think NAFTA was good for the economy. But it's not just Americans who are skeptical - Japanese farmers, for example, have been staunchly against the TPP.

There's some empirical evidence to back up those grievances. In January, labor economists David Autor, David Dorn, and Gordon Hanson published a paper showing that increased trade with China caused some big problems for US workers.

From the paper's meaty abstract (emphasis ours):

"China's emergence as a great economic power has induced an epochal shift in patterns of world trade. Simultaneously, it has challenged much of the received empirical wisdom about how labor markets adjust to trade shocks. Alongside the heralded consumer benefits of expanded trade are substantial adjustment costs and distributional consequences. ...

"Adjustment in local labor markets is remarkably slow, with wages and labor-force participation rates remaining depressed and unemployment rates remaining elevated for at least a full decade after the China trade shock commences.

"Exposed workers experience greater job churning and reduced lifetime income. At the national level, employment has fallen in US industries more exposed to import competition, as expected, but offsetting employment gains in other industries have yet to materialize."

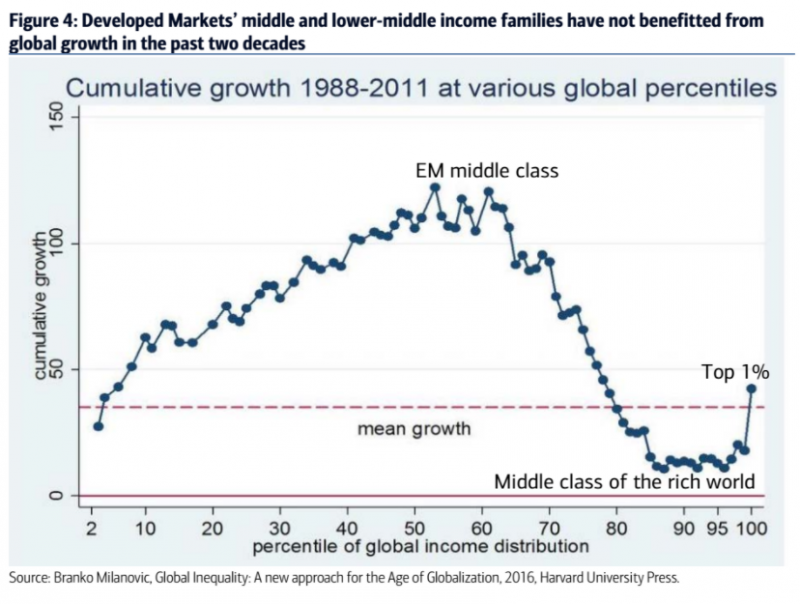

Moreover, most of the economic gains from globalization have been for the middle class in emerging markets - not the middle class in developed markets such as the US.

Below is one of the more popular charts illustrating this, from the economist Branko Milanovic, via BAML's Ajay Singh Kapur and Ritesh Samadhiya in June.

Though Trump has zeroed in on workers' anxieties over job losses, it's important to note that automation has had at least as much of an impact on jobs as trade in recent years. And crucially, automation not only hits manufacturing, but also affects jobs that require advanced degrees, such as neuroradiology.

"From a political perspective, I don't think the focus on trade is misplaced. It's effective because it has an 'other,'" Alexander Kazan, a strategist at Eurasia Group, said in a video for the Eurasia Group Foundation. "When you talk about technology, it's much more amorphous. It's this sense that we all lose. So I think politically it's less effective."

Uncertain future

Ultimately, a lot will depend on how far Trump takes the tariff idea and the response from the countries that face the new taxes.

While previous president's used tariffs to try and combat unfair trade practices, a sweeping and public tariff like Trump is considering would likely open the door to a greater response from the countries impacted by the move.

Some observers say it's unclear how much anti-trade rhetoric Trump genuinely intends to carry out. Additionally, there is a strong contingent within Trump's own party that is supportive of free trade.

The possible tariff, however, would be the first concrete sign that a protectionist trade will play a major factor in the Trump policy agenda.