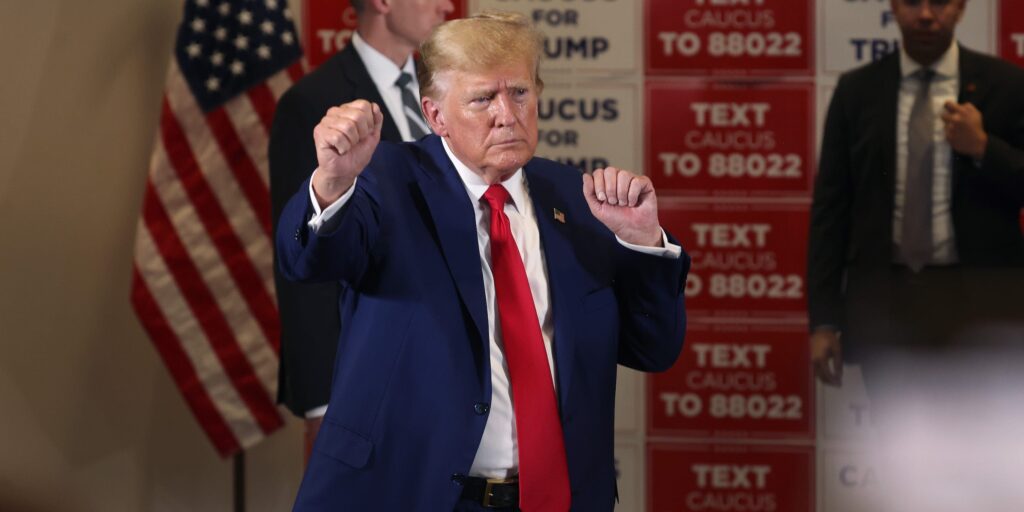

- Trump Media and Technology Group soared as much as 59% on Tuesday after it went public via a SPAC merger.

- The Truth Social parent began trading under the "DJT" ticker symbol on Tuesday.

- Former President Donald Trump owns about 58% of the social media company, a stake that is now worth billions.

Trump Media and Technology Group soared as much as 59% on Tuesday after it officially went public via a SPAC merger and adopted the ticker symbol "DJT."

The stock-price surge is a boon to former President Donald Trump's net worth, as he owns about a 58% stake in the company that according to Bloomberg is worth more than $4 billion.

Trump now has a total net worth of about $6.5 billion, though the bulk of that wealth is on paper as Trump is unable to sell his shares in Truth Social until a six-month lock-up period expires. Still, there's a possibility that he gets a waiver from the company's board, which consists of close allies like his son Donald Trump Jr. and former Rep. Devin Nunes.

Trump Media and Technology Group now trades on the Nasdaq exchange. Former Congressman Devin Nunes is the CEO of the company, while Trump has stepped down as Chairman of the company as he ramps up his 2024 campaign for the Presidency.

Truth Social competes with Elon Musk's social media company X, and it has turned into Trump's preferred online venue to share updates after he was banned from major platforms following the January 6 storming of the US Capitol.

Shares of the Digital World SPAC have surged in anticipation of the completed business merger with Truth Social following more than two years of blockades from the SEC and shareholder votes. Year-to-date gains for the SPAC that has since turned into Trump Media and Technology Group hit 354% on Tuesday.

This isn't the first time Trump has used his initials as the ticker symbol for one of his publicly traded companies. Trump used the same ticker symbol for Trump Hotels and Casino Resorts when it went public in 1995. That company eventually filed for bankruptcy.

Digital World Acquisition turned into a meme-stock after the company announced its intent to merge with the former President's social media company, with a trading frenzy sending the stock to as high as $175 per share in October 2021.

Digital World stock now trades at about $72 per share, representing a decline of about 59% from its record high.