Hello, and welcome to Power Line, a weekly clean-energy newsletter from Business Insider.

Here’s what you need to know:

- Sign up here to get Power Line in your inbox every Friday.

- Most of our coverage is available exclusively to BI Prime subscribers. If you’re looking for a discount on a subscription to BI Prime, click here.

- I’m looking for people who have moved from the oil sector to clean-energy focused companies. Is that you? Or do you know someone? Send me an email.

After two days in Miami – where I did not get even the suggestion of a tan – I jumped into a few little-known industries that experts say are shaping the future energy economy. And seeing as it’s the last day of January, I took one last opportunity to look back at 2019.

Do you eat? Then you probably rely on hydrogen gas - and chances are, it's dirty.

First, some context: Hydrogen is an element - the lightest one, actually.

- So light, that we once used it to make blimps like the Hindenburg float.

- We don't do that anymore, thankfully. But hydrogen gas still plays a major role in our economy.

- It's used in the production of steel, refined oil, and ammonia - which is used, in turn, to make fertilizer to grow food.

The big problem: Today, pretty much all of that hydrogen comes from fossil fuels. Of course.

- The industry emits 830 million metric tons of carbon dioxide each year as a result, according to the International Energy Agency.

The big opportunity: You can also make hydrogen gas by splitting molecules of water using a process called electrolysis.

- It requires electricity, as the name would suggest, but if you use renewable power then the resulting hydrogen gas is emissions-free. Industry calls it green hydrogen.

- Green hydrogen is becoming more economically viable as the price of renewables plummets.

- Plus, as more clean energy comes online, there are periods when there is literally too much energy on the grid. Experts say: Why not use it to make hydrogen?

Hydrogen could really do so much more

Yep, we're still talking about this gas. Because like this Sunday's halftime show, it has BIG potential. (Don't expect any more sports references from me.)

And here's why:

- When you burn hydrogen as a fuel source it produces a ton of energy and only water and heat as byproducts. No carbon emissions.

- You can also use it in a fuel cell, which is similar to an electrochemical battery.

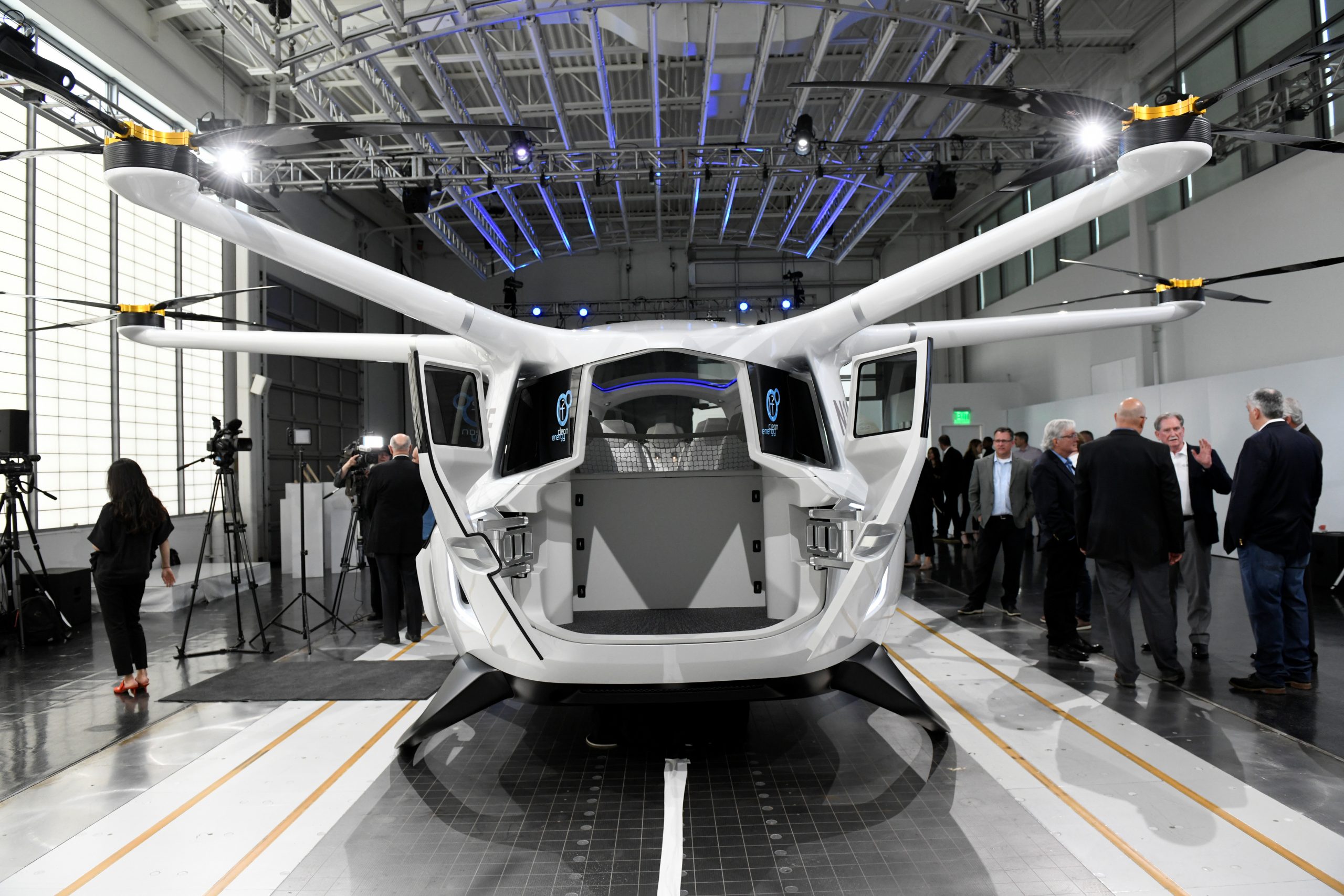

So then, where are my hydrogen cars and helicopters at?

- There are, in fact, thousands of hydrogen vehicles on the road, sold by Toyota, Hyundai, and other automotive giants. There's a chopper in the works, too.

- But owing to its chemical properties, hydrogen is difficult to transfer and store. As a result, it's still expensive and fueling infrastructure is limited. (Startups are working out this problem.)

- Experts I spoke to said hydrogen fuel cells will become more common - but they'll most likely be adopted by heavy duty vehicles and trains, for which lithium-ion batteries are less practical.

If you're looking for more hydrogen, read my full story here. I'm ready to move on.

The other little-known industry I'm watching

A leading clean-tech research firm released its list of the top 100 startups last week, and a large chunk of them fall into the category of distributed energy resource (DER) management.

OK, OK … that word jumble isn't likely to bring anyone to the edge of their seat, but it really should.

What is DER? I cover it here, but basically it's a fancy way of describing something that could store or discharge power to the grid that's not part of the region's central energy source, such as the utility.

- That includes things like Teslas, in-home battery packs, rooftop solar panels, and even refrigerators.

And DER management? It's essentially tools or software to make sure that all of those different energy sources on the grid are integrated.

- DER management a win-win for customers and utilities: Theoretically, the consumer would be compensated for discharging energy back to the grid, while the utility has more power sources to draw from in times of need.

- By times of need, I mean when there's a lull in clean energy sources, such as during long cloudy spells in a region dependent on solar.

FYI: Experts told me another sector to watch is building energy management. That includes everything from smart thermostats to sensors that measure the energy use of individual appliances in your home.

These battery startups scored the biggest deals in 2019

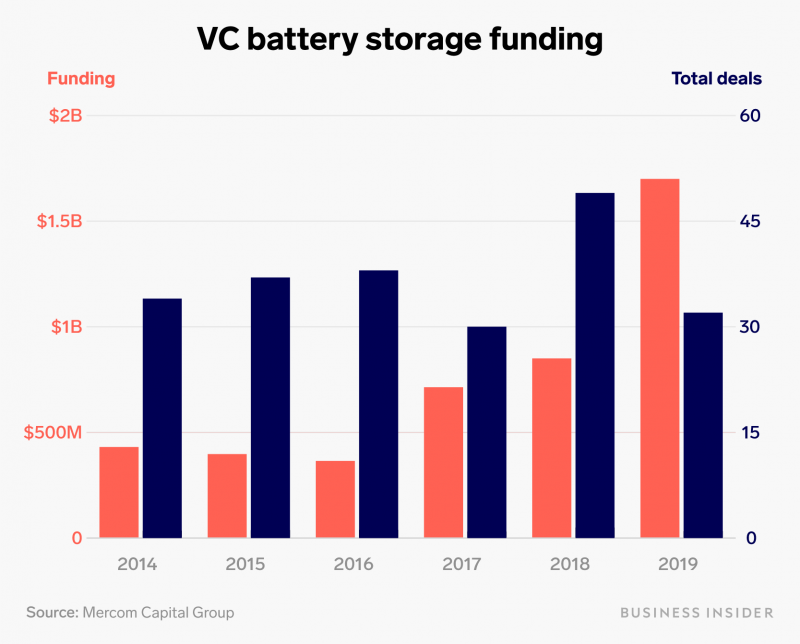

It's funny. When I started on this beat, a prominent clean energy investor said "don't invest in batteries." But last year, VC funding of battery tech doubled. Ha ha.

So who scored the biggest deals? The full list is here, with data supplied by Mercom Capital Group.

- Startups developing lithium-ion batteries, largely for electric vehicles, like Sweden's Northvolt were big winners. Li-ion is likely to dominate the battery market for years to come, analysts say.

- Companies developing alternative technologies for long-duration storage like Form Energy, which I profiled last week, also scored deals. If we want to get close to 100% renewable energy, experts say we need longer-lasting batteries.

The top energy firms supplying clean energy to corporate giants in 2019

This morning, I took a look at the winners in a record year for corporate buying of clean energy.

- Corporations like Google and Facebook signed contracts to purchase 19.5 gigawatts of renewable energy in 2019 - 44% more than in 2018, which was already a record year.

- BloombergNEF, which supplied the data, says corporate sustainability commitments - which are raining from the sky - have something to do with it.

So you know: A watt is a measure of the amount of energy used in a given moment, and a gigawatt (GW) is a billion watts.

- That's a lot of power, equivalent to the energy capacity of a little over 3 million solar panels, 431 utility-scale wind turbines, or 100 million LED bulbs, according to the US Department of Energy.

What I'm interested in: the companies on the other side of these deals that are supplying all of that renewable energy. See the list of top 10 here.

- They're mostly big US-firms like 7X Energy. And that makes sense because US companies bought most of the power in 2019 (though the top company was French).

- Twice as much of the energy is coming from wind vs. solar in these deals. Read why some mega investors think wind is a way better investment.

3 big stories I didn't cover

- Planting billions of trees won't simply solve climate change. James Temple outlines several shortcomings to that approach for MIT Technology Review.

- Renewable energy is on pace to overcome natural gas in the US. Last year, the U.S. Energy Information Administration said natural gas would remain the top energy by 2050. Now, it says renewables will take the top spot.

- It was a good year for Tesla's storage and solar businesses, Greentech Media's Emma Foehringer Merchant reports.

Finally, a few updates

- Lithium-ion battery startup Advano raised $18.5 million from investors including iPod inventor Tony Fadell and Peter Thiel.

- The carbon capture startups Climeworks and Svante announced they're forming a partnership to scale up their technologies. They'll remain financially independent.

- Smart-grid startup AutoGrid announced a partnership with Schneider Electric.

That's it! Have a great weekend. PS: Here's a cute lizard I saw in Miami.