- JPMorgan Chase is cutting back on the benefits of its wildly popular Chase Sapphire Reserve credit card.

- According to a leaked internal document, the company is eliminating price protection, limiting the number of guests cardholders can take to a Priority Pass airport lounge, and eliminating accelerated earning on travel purchases that go toward the annual $300 travel credit.

- The changes are set to take place August 26.

Changes are coming later this year to the wildly popular Chase Sapphire Reserve credit card, cutting the value of some of its perks.

Details started to trickle out online Friday from customers who had heard the company was planning reductions to three of the premium travel card’s suite of benefits.

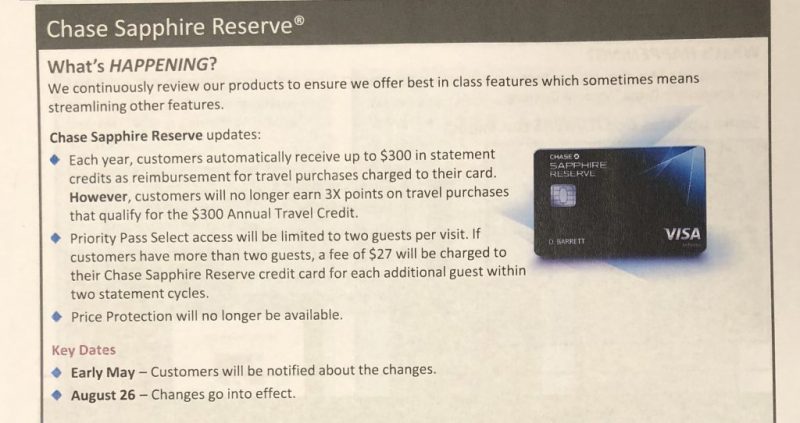

An internal document leaked over the weekend on the website Doctor of Credit detailed the looming changes:

- Elimination of price protection on purchases. Previously, customers could get a refund of up to $500 per item - up to $2,500 per year - if the price dropped in the 90 days following the purchase.

- Limiting the number of guests a cardholder can bring to a Priority Pass lounge to two. Previously, the complimentary Priority Pass membership allowed cardholders to bring an unlimited number of guests to the more than 1,200 lounges in the program. Authorized users also get two guests, but any additional guests will cost $27 each.

- Eliminating accelerated earning on travel purchases that go toward the annual $300 travel credit. All travel and dining purchases had received 3x in Ultimate Rewards points. This slight tweak means only travel purchases above and beyond the $300 annual travel credit earn Ultimate Rewards points. That's a reduction in 900 Ultimate Rewards points, which is worth $13.50 when cashed in through the Chase Ultimate Rewards portal.

A Chase spokesman confirmed the authenticity of the document, which says customers were set to be notified this month, while the changes will go into effect August 26.

"We are always evaluating our products to offer the right mix of rewards, benefits, and experiences that provide the most value to our customers - and those they tell us they value most," the company said in a statement to Business Insider.

Check out the document below:

Why reduce the benefits?

The Sapphire Reserve set off a phenomenon when it launched in 2016 with package of outlandishly generous travel rewards, and the card's popularity has continued to soar. However, its profitability has come under question, with some analysts estimating the card wouldn't be profitable for several years.

At its investor day earlier this year, JPMorgan said it lost $900 million in 2017 from "card headwinds," which it attributed to the Sapphire Reserve and "other notable items," according to a company presentation.

But it also revealed that the card cleared a crucial hurdle, with 90% of Sapphire Reserve customers renewing and ponying up for the $450 annual fee. It said it expected headwinds to reverse in 2018.

"These Sapphire Reserve customers ... are not only profitable as a single product relationship, but they are an extremely attractive base into which we will deepen. And we are seeing an impressive more than 90% renewal rate for these cards," CFO Marianne Lake said during the presentation.

Given the enthusiasm and positive messaging from Chase, why devalue the benefits?

It's unclear what exactly prompted the changes, or how much money Chase stands to save from them.

They're not without industry precedent, however.

Priority Pass lounges have become saturated with visitors following the complimentary access granted by cards like the Sapphire Reserve as well as the American Express Platinum, and the Citi Prestige, according to a recent report from The Wall Street Journal.

American Express and Citi do not offer unlimited Priority Pass guest access like the Sapphire Reserve does, so the change is in keeping with competitors in the premium credit card space.

Eliminating price protection could amount to considerable savings, given that customers could receive up to $2,500 in refunds out of Chase's pocket annually. Again, it's unclear how many people actually took advantage of this perk or how much it was costing Chase, but tech apps like Earny and Sift have emerged in recent years that automatically track your purchases and file refund claims on your behalf, streamlining and simplifying the process.

Chase previously announced it was eliminating price protection and return protection for its co-branded credit cards with United Airlines.

Citi reduced its price protection policy earlier this year, but didn't eliminate it entirely.