French presidential candidate Marine Le Pen is not the biggest fan of the euro.

“The euro is not a currency,” she said earlier this month. “It is a political weapon to force countries to implement the policies decided by the [European Union] and keep them on a leash.

“Look at what happened to the Greeks when they said no to austerity, as they were right to do: Liquidity for the banks was cut off.”

Le Pen, who leads the far-right National Front party, said if she became president, then she would assemble European Union leaders and the European Central Bank and ask them to replace the euro with a basket of new national currencies analogous to the European Currency Unit.

Bloomberg’s Helene Fouquet reported earlier how exactly this might play out, citing Le Pen’s adviser Bernard Monot:

"France's currency would probably be called the 'new French franc' and it would initially be equivalent to the euro, Monot said. The French state would pledge to limit its fluctuations against the EU currency basket to a maximum of 20%, though Monot said movement up to 10% would be more normal. There's no timetable as yet for introducing the new currency and if the other euro nations decline to adopt their national currencies again, then the new franc would float freely."

Some economists have argued that if Le Pen pursued this strategy, then the "new franc" might weaken sharply against the euro.

"The new franc would clearly not remain at parity with the euro for very long," Jessica Hinds, the European economist at Capital Economics, wrote in a note to clients. "The key question, therefore, is what would happen then."

She continued in greater detail:

"To assess this, it is useful to look at France's competitive position. Standard measures include manufacturing unit labor costs, since the bulk of exports are produced by this sector. On this measure, France has fared worse than the euro-zone since 1999. Indeed, the relative increase in France implies that a depreciation of 15% in real terms is needed to restore France's competitiveness to where it was in 1999. However, since other competitiveness measures such as export prices show that France has fared better than the euro-zone over this period, a fall of 5-10% seems more likely.

"But a bigger nominal depreciation would be needed. After all, a sudden, sharp drop in the franc would raise import prices, such that higher inflation would partly offset the effects of a depreciation. Granted, the fact that the French economy is fairly closed by eurozone standards might limit imported inflation. Nonetheless, a fall of about 10-15% against the euro appears to be plausible."

Of course, before Le Pen can take France off the euro, she must first win the election.

The first round will be held April 23, and the second round will take place May 7.

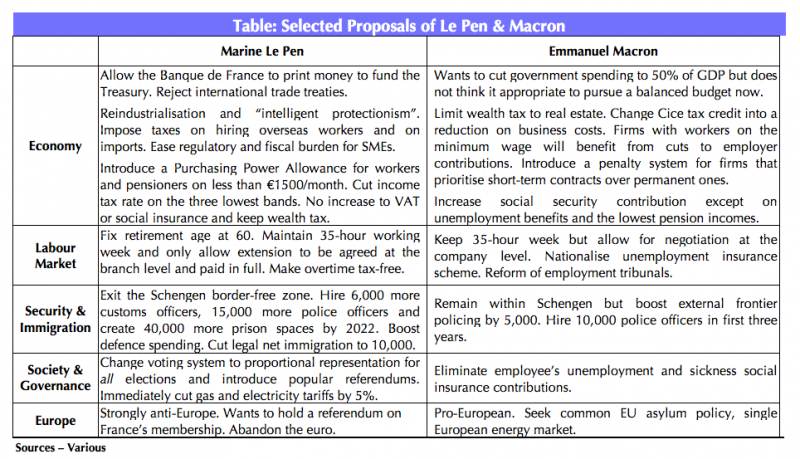

Recent opinion polls suggest that it looks increasingly likely that the final showdown in May will be between Le Pen and centrist Emmanuel Macron, who is running as an independent.

Polls suggest that Le Pen would come out on top in the first round but would be defeated in the second round - though, of course, things in politics could change quickly.