- There's $4.5 trillion in cash on the sidelines that could serve as the "firepower" needed to move the stock market higher in April, according to Fundstrat's Tom Lee.

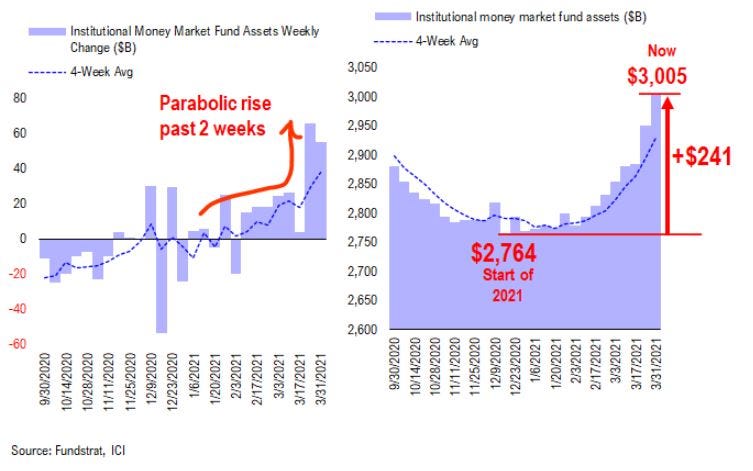

- Since the start of the year, institutional cash balances have surged 9% to $3 trillion, according to Lee.

- "Institutional investors are even more cautious now," Lee said in a note on Sunday.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

The stock market's recent rally will continue in April as $4.5 trillion in "firepower" makes its way into stocks, according to Fundstrat's Tom Lee.

In a note on Sunday, Lee said "conditions [are] in place for a significant rally to continue into April." Those conditions include a stronger-than-expected March jobs report, giving investors a bullish outlook for the US economy.

Additionally, Lee highlights that the COVID-19 vaccine rollout is well ahead of schedule as the US vaccinates on average 3 million people per day.

But the biggest driver of imminent stock market gains will likely be the significant rise in cash on the sidelines since the start of the year, according to Lee.

"Institutional investors are even more cautious now," Lee said, pointing to a 9% increase in institutional cash balances since the start of the year. Institutions have raised $241 billion in cash and currently sit on a $3 trillion cash pile.

On top of that, retail investors have $1.5 trillion in cash.

"Pretty shocking rise in institutional money market cash balances [means] investors not bullish," Lee said. The $4.5 trillion cash pile now represents "tons and tons of firepower" that "bodes well for April equity gains," Lee added.

To capitalize off the potential future stock market gains, Lee advised investors to continue buying cyclical stocks that are poised to benefit from a reopening of the physical economy.

"The case for cyclicals is fundamentally attractive and has the most capacity to positively surprise," Lee said.