Facebook reported lower-than-expected quarterly results last week, resulting in an initial 24% stock drop before eventually leveling out to a 19% dip.

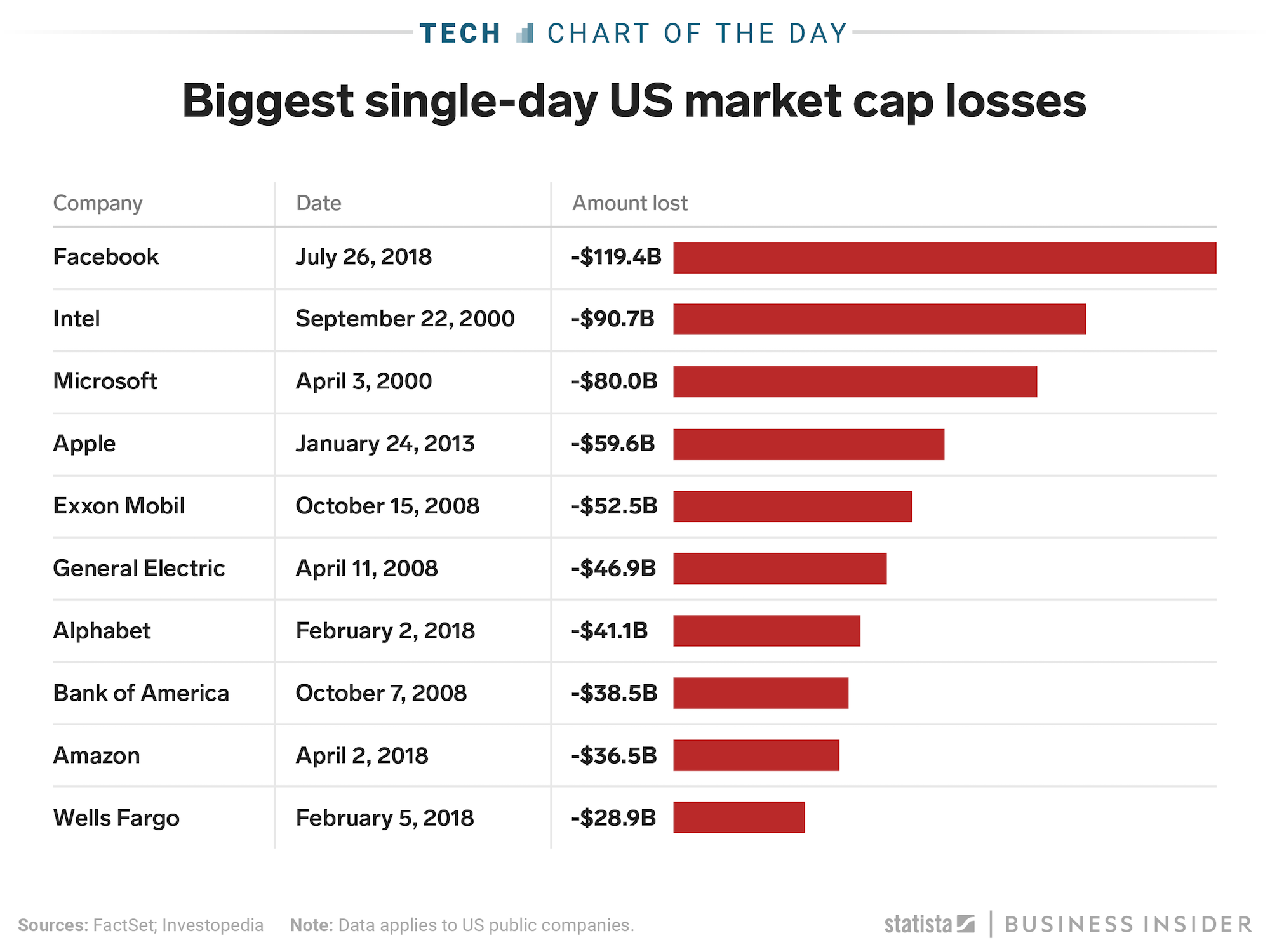

It was enough to cause Facebook’s market capitalization to plummet $119.4 billion as the company’s disappointing results – as well as a discouraging upcoming quarterly forecast – caused a massive stock market sell-off.

As this chart from Statista shows, the almost $120 billion drop is the biggest single-day market cap loss suffered by a US public company, beating out Intel’s $90 billion drop in 2000.

Despite the record-breaking loss, Facebook’s current price of $174.89 is still above its share prices in late March following news that data company Cambridge Analytica harvested millions of user profiles illegitimately.