Paul Singer’s Elliott Management is getting aggressive.

Earlier this year, the $28 billion activist hedge fund wanted to replace Arconic’s chairman, Klaus Kleinfeld, and nominate five board members.

Arconic was spun out of Alcoa and focuses on manufacturing aerospace components. Elliott is the company’s biggest shareholder.

“As we noted in our letter to Arconic’s Board earlier this week, shareholder support for change at Arconic has been overwhelming,” an Elliott spokesman said in an emailed statement to Business Insider back on February 16. “[We] think it is long past time for the Board to begin a constructive dialogue to put new leadership in place.”

Several other Arconic shareholders, such as First Pacific Advisors and Lion Point Capital, have voiced support for Elliott.

After a few weeks of no action, Elliott has taken things to the next level.

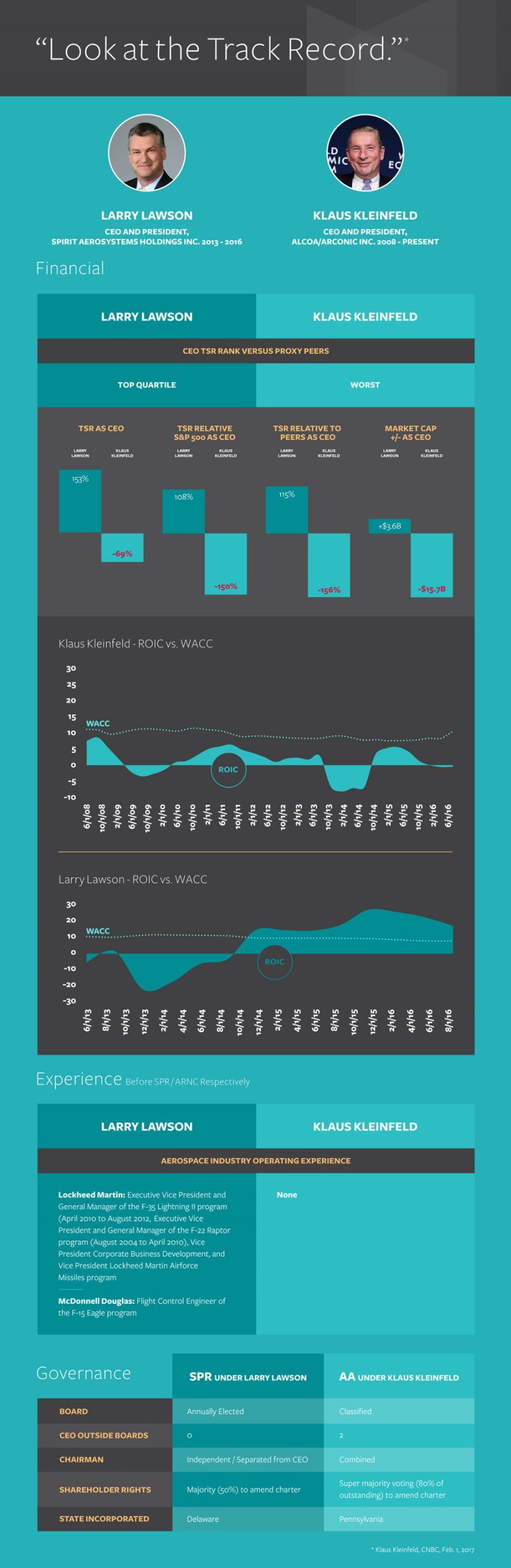

The hedge fund published a website attacking Arconic's current management team. On the website, the fund wrote that current Arconic CEO Kleinfield "suggested Arconic shareholders 'look at the track record.'"

So they did.

The statement is followed by an infographic comparing Kleinfield's record with the record of the CEO candidate Elliott wants to install, Larry Lawson.

Arconic did not immediately reply to a request for comment.

Check out the stats below: