Fears over escalating trade tensions with China and rising US interest rates helped trigger a brutal stock-market sell-off that caused the S&P 500 to lose as much as 7% in October, and both of those issues are showing no sign of slowing down.

President Donald Trump on Wednesday took his latest shot at China, announcing that he is seeking to pull the US out of the Universal Postal Union, which allows Chinese producers to ship items to the US at significantly low rates even compared to some US domestic shipping rates.

Meanwhile, the Federal Reserve’s minutes from its September meeting were released on Thursday, showing that policymakers broadly agreed this year’s fourth interest-rate hike is coming in December. The Fed’s tightening has strengthened the dollar, which has made it more expensive for companies to bring overseas revenue back into the US.

But you don’t have to panic. Armed with the right information, you can steer clear of those firms that will be hit the hardest by the stronger dollar and Trump’s tariffs. That means identifying and staying away from companies that have high revenue exposure to China.

Goldman Sachs is here to help. The banks maintains an index of US companies that get a large percentage of their sales from China, and filtered 20 stocks it says should take biggest hit in the event of a prolonged trade war.

Here are 20 companies that Goldman listed, in an order from sales least exposed to China to the most.

20. Apple

Ticker: AAPL

Industry: Technologies

Market cap: $1.06 trillion

% of China sales: 20%

Source: Goldman Sachs

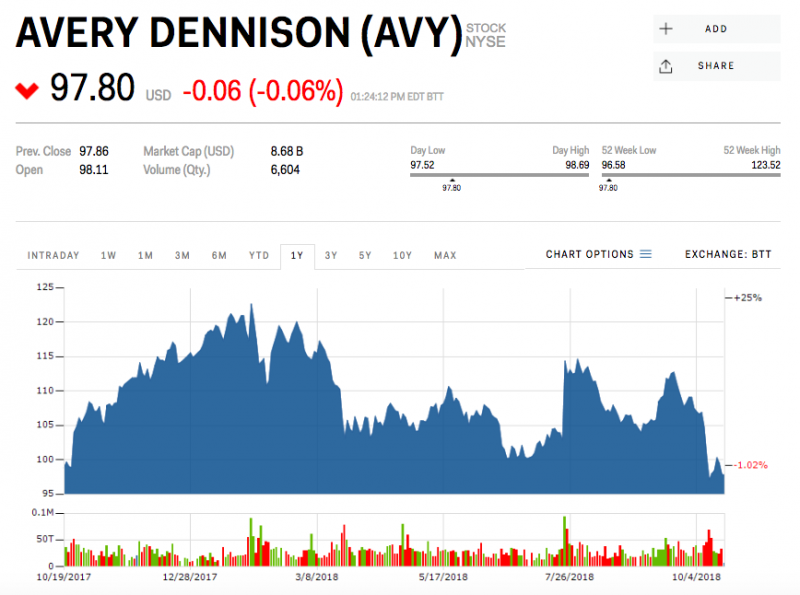

19. Avery Dennison

Ticker: AVY

Market cap: $8.68 billion

% of US sales: 20%

Source: Goldman Sachs

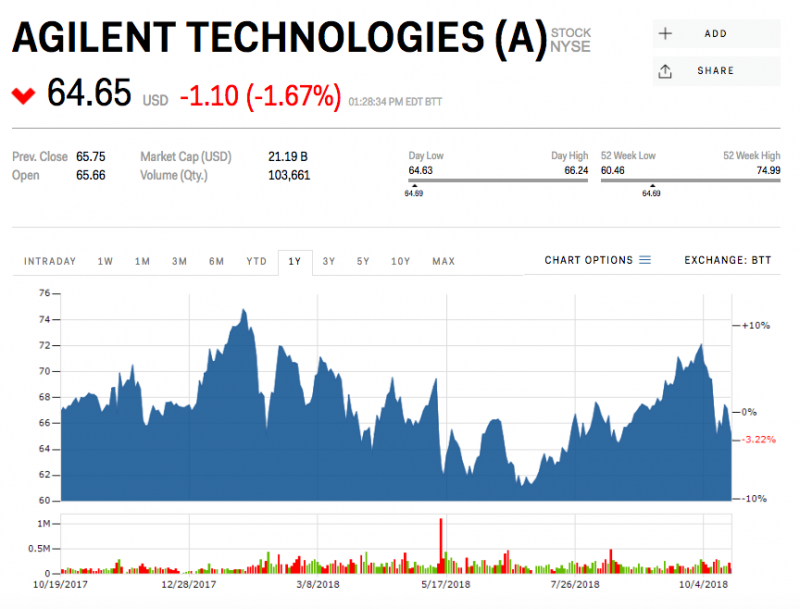

18. Agilent Technologies

Ticker: A

Industry: Healthcare

Market cap: $21.19 billion

% of US sales: 20%

Source: Goldman Sachs

17. Corning

Ticker: GLW

Industry: Technology

Market cap: $26.2 billion

% of US sales: 22%

Source: Goldman Sachs

16. Intel

Ticker: INTC

Industry: Technology

Market cap: $211.26 billion

% of US sales: 24%

Source: Goldman Sachs

15. Xilinx

Ticker: XLNX

Industry: Technology

Market cap: $19.77 billion

% of US sales: 26%

Source: Goldman Sachs

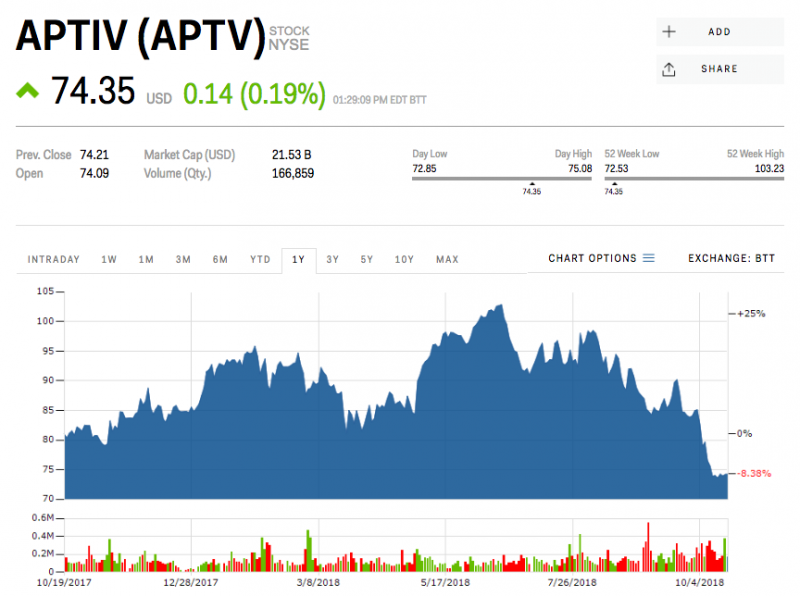

14. Aptiv

Ticker: APTV

Industry: Automobile

Market cap: $21.53 billion

% of US sales: 28%

Source: Goldman Sachs

13. Amphenol

Ticker: APH

Industry: Technology

Market cap: $25.4 billion

% of US sales: 29%

Source: Goldman Sachs

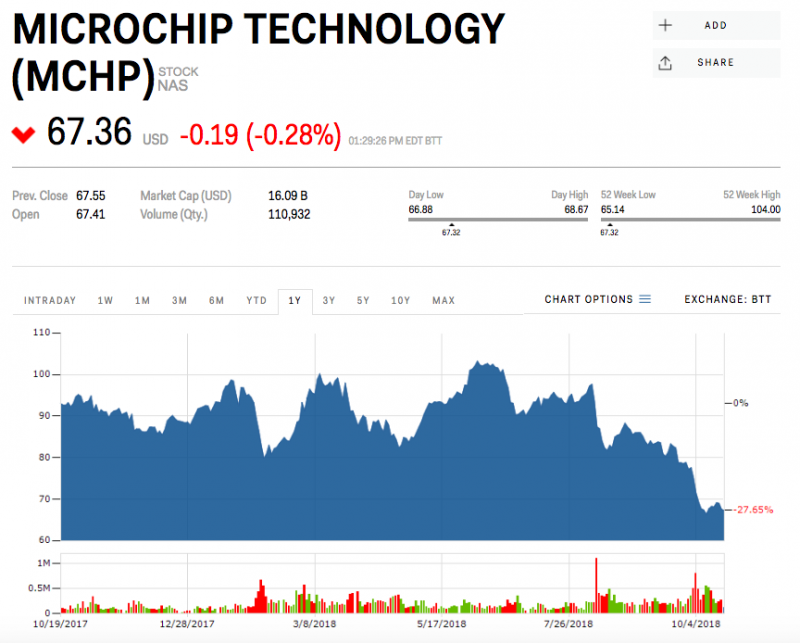

12. Microchip Technology

Ticker: MCHP

Industry: Technology

Market cap: $16.09 billion

% of US sales: 30%

Source: Goldman Sachs

11. Advanced Micro Devices

Ticker: AMD

Industry: Technology

Market cap: $26.52 billion

% of US sales: 33%

Source: Goldman Sachs

10. A.O.Smith

Ticker: AOS

Industry: Industrials

Market cap: $6.85 billion

% of US sales: 35%

Source: Goldman Sachs

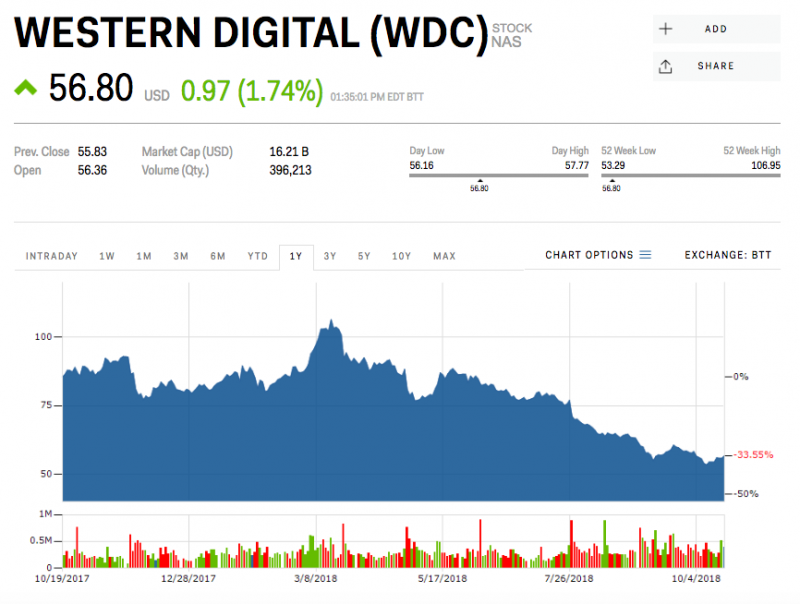

9. Western Digital

Ticker: WDC

Industry: Technology

Market cap: $16.21 billion

% of US sales: 39%

Source: Goldman Sachs

8. IPG Photonics

Ticker: IPGP

Industry: Industrials

Market cap: $7.48 billion

% of US sales: 44%

Source: Goldman Sachs

7. Texas Instruments

Ticker: TXN

Industry: Technology

Market cap: $97.95 billion

% of US sales: 44%

Source: Goldman Sachs

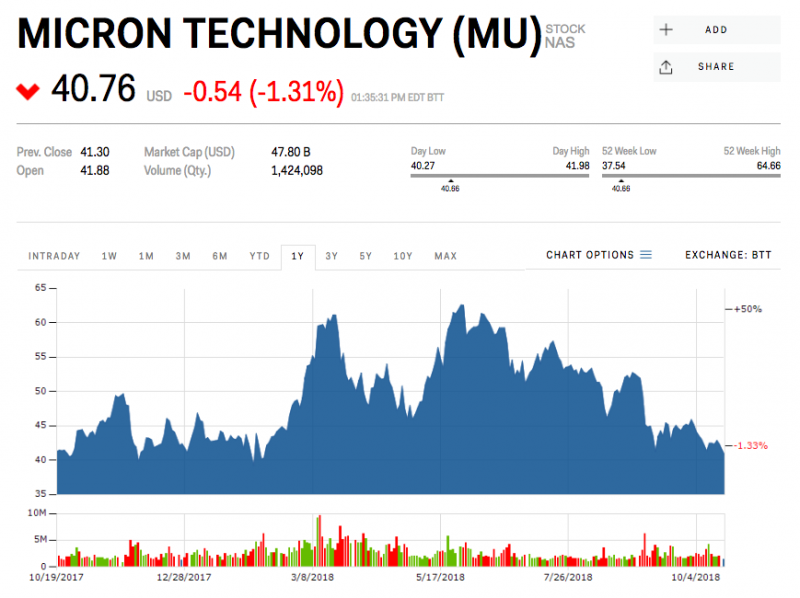

6. Micron Technology

Ticker: MU

Industry: Technology

Market cap: $47.8 billion

% of US sales: 51%

Source: Goldman Sachs

5. Qorvo

Ticker: QRVO

Industry: Technology

Market cap: $9.4 billion

% of US sales: 52%

Source: Goldman Sachs

4. Broadcom

Ticker: AVGO

Industry: Technology

Market cap: $98.53 billion

% of US sales: 54%

Source: Goldman Sachs

3. Qualcomm

Ticker: QCOM

Industry: Technology

Market cap: $96.42 billion

% of US sales: 65%

Source: Goldman Sachs

2. Wynn Resorts

Ticker: WYNN

Industry: Consumer service

Market cap: $12.67 billion

% of US sales: 73%

Source: Goldman Sachs

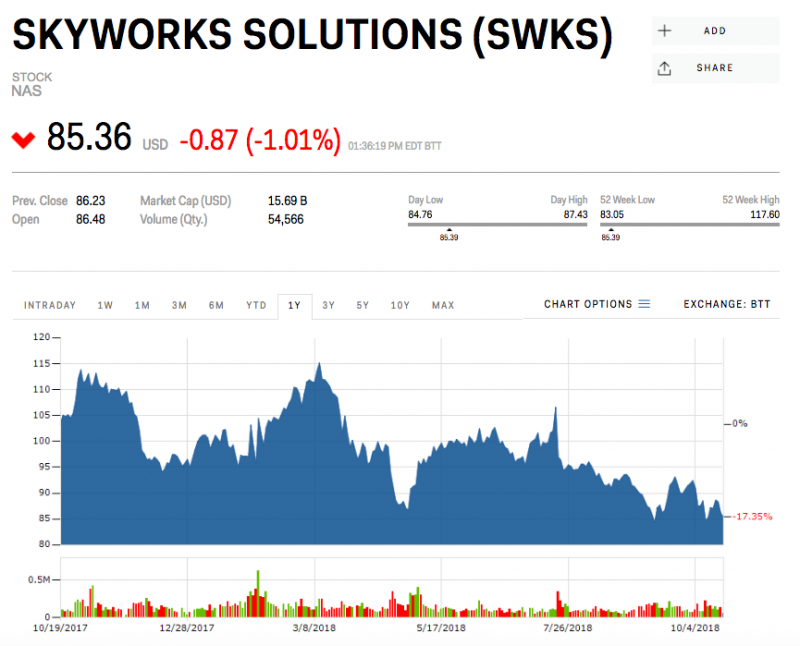

1. Skyworks Solutions

Ticker: SWKS

Industry: Technology

Market cap: $15.69 billion

% of US sales: 83%

Source: Goldman Sachs

SEE ALSO: