For seven years after the financial crisis, it was all about Davos Man.

The Davos Man was at the World Economic Forum in Davos, Switzerland, the annual global meeting of minds with the mission of improving the state of the world through global partnership.

Now, in the wake of the election of Donald Trump and the UK’s decision to leave the EU, another type of individual is moving to the forefront: Joe Six-Pack. (We note that both of these individuals are men, but that’s a topic for another day.)

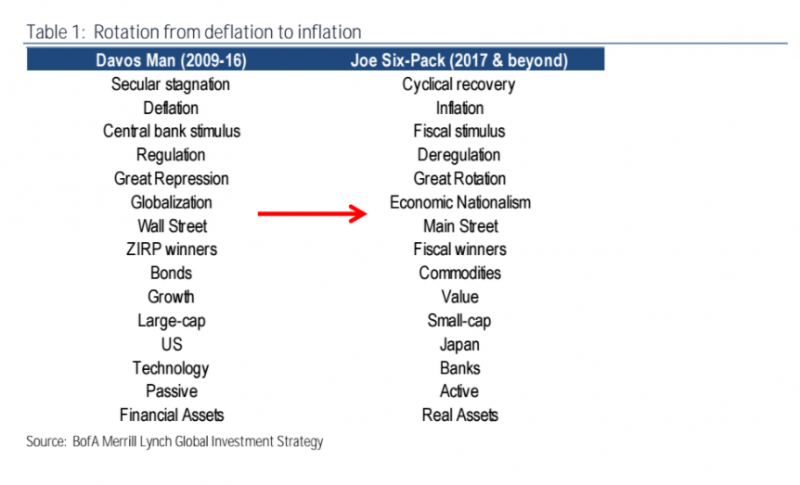

Where the “Davos” man lived in a world of secular stagnation, regulation and globalization, the world of All-American “Joe Six-Pack” is one of recovery, deregulation and economic nationalism.

Growth stocks give way to value stocks, bonds to commodities and the emphasis on Wall Street to Main Street.

That's according to a note by Bank of America on Thursday and summed up by the chart below.

Here's what it means for assets as we head into a period of nationalism (Joe Six-Pack) from an era of globalization (the Davos Man).

Elements of Bank of America's predictions are already happening. After the financial crisis, the US experienced a period of low rates, slow growth and President Obama-led regulation. The "Joe Six-Pack" world sees President Trump's proposed policies of fiscal stimulus, infrastructure spending, deregulation and protectionist measures along with a Fed rate hike cycle.

Earlier this month, the president ordered a review of Dodd-Frank, the 2010 financial regulatory law, and directed the secretary of labor to review the fiduciary rule, a regulation set to go into effect in April. His policies on immigration and potential protectionist measures like a border tariff also support Bank of America's theme of economic nationalism.

The team believe that a "further rotation is likely as deflation ends and inflation, fiscal stimulus and economic nationalism begin."