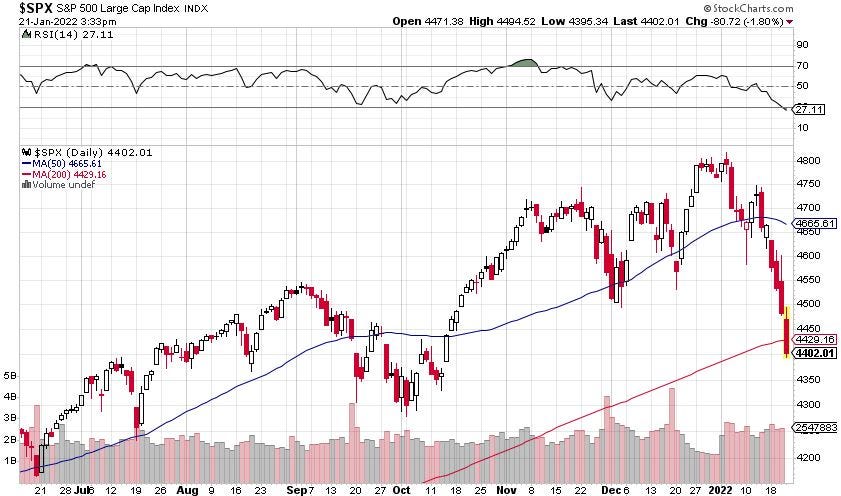

- All major stock market indices traded below their 200-day moving averages on Friday as volatility soared.

- A decisive drop below the widely followed technical indicator suggests more weakness ahead.

- But there is little indication of stress in the credit markets that would point to a broader systemic issue hurting stocks.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

All three major stock market indices were below their 200-day moving averages on Friday as volatility soared.

The Nasdaq 100 and Dow Jones closed below the widely followed technical indicator on Thursday, while the S&P 500 broke below the key level Friday afternoon. The moving average helps traders identify the underlying trend of a security or index.

Decisive consecutive daily closes below the 200-day average would suggest more weakness ahead. And it comes at a time when the Federal Reserve is preparing to jump start a new cycle of interest rate hikes and quantitative tightening after flooding the market with liquidity during the COVID-19 pandemic.

Meanwhile, Wall Street's fear gauge soared as much as 52% this week, with the VIX hitting 29 and reaching its highest level since early December.

The trend of interest rates remains higher, and that could continue to put pressure on high-growth tech stocks that have little-to-no earnings, according to Chris Murphy, Susquehanna International Group's co-head of derivatives strategy.

"Until the strong negative correlation between US Treasury yields and equities breaks down, it will be hard for an extended rally to form," he explained in a Thursday note.

Year-to-date, the Nasdaq 100 is down 11% while the S&P 500 is down 8%. The last time they traded below their respective 200-day moving averages was in the second quarter of 2020.

While there tends to be a lot of volatility and so-called head fakes when the stock market trades around that indicator, Murphy pointed out that signs of capitulation among investors are starting to percolate.

"We have highlighted a plethora of capitulation indicators over the past few days including: 10% correction in the [Nasdaq], term structure inversions in [Nasdaq] and [S&P 500], AAII bull/bear at lows, extreme shifts in sentiment and positioning," he said.

For the week ending January 19, the percent of bullish investors responding to AAII's sentiment survey fell to 21%, representing its lowest level since summer of 2020. At the same time, bearish responses surged to 47%, its highest level since spring of 2020.

But washed-out sentiment is seen by some traders as a contrarian indicator. Earnings season is also set to heat up over the next two weeks, with more than 60% of the S&P 500 and 70% of the Nasdaq 100 set to report by February 4. Solid results and commentary from corporate America could remind investors that the underlying driver of stock market returns — earnings — are expected to rise despite imminent interest rate hikes.

And there is little indication of stress in the credit markets that would point to a broader systemic issue hurting stocks. Demand for high-yield bonds has remained strong relative to treasuries.

For now, the stock market's roughly 10% decline after nearly two years of unrelenting gains is a reminder to investors that stocks do, in fact, go down.