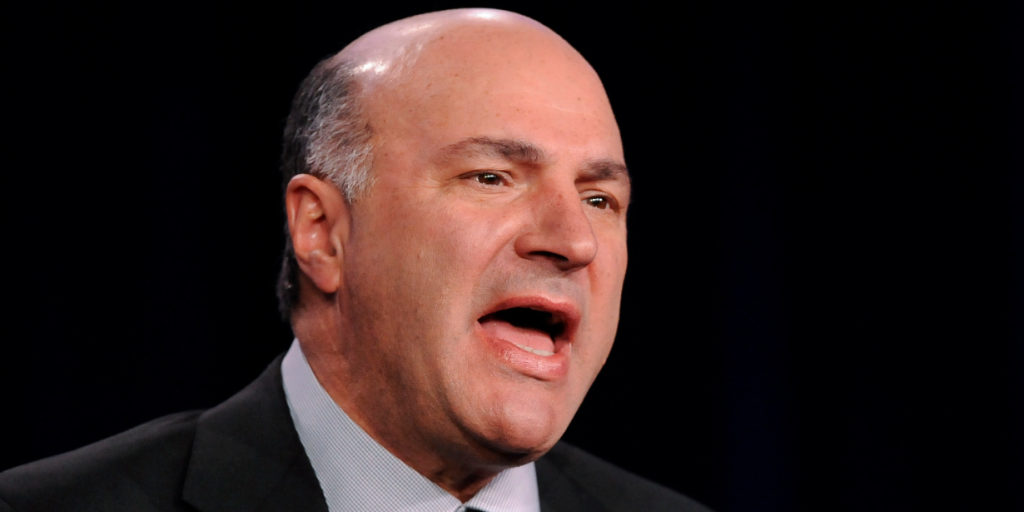

REUTERS/ Gus Ruelas

- Kevin O'Leary said he wants cryptocurrencies to be regulated in the US because people don't want to be "cowboys" about it.

- "I don't want to get involved in crypto if the regulator says it's not okay," he told CNBC.

- There'd be another trillion dollars worth of buying into bitcoin if regulators class crypto as a security, he said.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

"Shark Tank" investor Kevin O'Leary has called on US regulators to set some rules around the cryptocurrency market, saying that no one in finance wants to be "cowboys" about it.

"We want the regulator to actually make some decisions about crypto, because none of us that are in financial services want to actually be cowboys about this," he said on CNBC's "Capital Connection" in an interview published Monday. "I don't want to get involved in crypto if the regulator says it's not okay."

The US has no single regulatory agency that oversees the crypto market, as digital assets aren't classified as "securities." SEC Chairman Gary Gensler has called the cryptocurrency industry "the Wild West," and recently urged Congress to provide the agency with more authority to regulate it.

"I can't afford to be offside. I cannot afford to be non-compliant," O'Leary said. "If the regulator finally allowed financial services companies to call it an asset, put it into an ETF in the United States – like they have in Canada and other countries – I'd figure there'd be another trillion dollars worth of buying into bitcoin. And we don't have that yet, but that's the opportunity."

Some portfolio managers say although many are excited about bitcoin ETFs, it's a massive contradiction because crypto investors shouldn't need a product like that to get into the crypto market. However, traditional investors want an ETF so they can speculate on bitcoin's price.

The SEC is yet to approve a bitcoin ETF, but is currently considering applications from more than 20 entities, including billionaire Mike Novogratz's Galaxy Digital, VanEck, Valkyrie Investments, and FirstTrust/SkyBridge.

"I think, at the end of the day, over the next couple of years, that will happen," O'Leary said. "That's why there's so much interest right now."

O'Leary, popularly known as "Mr. Wonderful," also mentioned the SALT event, which will take place in New York from September 12-15. He said the premier hedge fund industry conference, hosted by crypto enthusiast Anthony Scaramucci's SkyBridge, is about the future of decentralized finance and cryptocurrencies.

"There is not a single hotel room available in New York," he said. "We are jam-packed. This is like 'Bitcoin 2021.' All the institutions are coming to the conference to discuss this very topic."