Happy hump day. Phil Rosen here, coming to you from the NFT.NYC conference in Times Square.

I've been rubbing shoulders all week with startup founders, JPEG holders, and Web3 enthusiasts who ooze bullishness for digital assets, even as crypto navigates a tough bear market. I even met one guy who shared how he bought a Bored Ape NFT for under $2,000.

That's all fine, but today we're turning our attention to Tesla.

Let's break it down.

If this was forwarded to you, sign up here. Download Insider's app here.

1. Tesla investors cheered Musk's comments on Tuesday. The CEO's remarks moved the stock in a big way, with shares of the EV-maker jumping as much as 12% after its closely watched CEO confirmed a workforce reduction as well as reports that demand for its cars is surging.

"As anyone knows who has tried to order a Tesla, the demand for our cars is extremely high and the wait list is long," Musk said via video link at the Qatar Economic Forum during his interview with Bloomberg.

"This is not intentional," Musk added. "We are increasing production capacity as fast as humanly possible."

Tesla's in the process of reducing its workforce by 3.5%, and Musk said "we grew a little fast in some areas."

The broader Nasdaq, meanwhile, enjoyed a strong start to the short week, rebounding by about 3% Tuesday after stocks saw their worst weekly decline since the start of the pandemic in March 2020.

Over the last five days, Tesla's stock price has been volatile, but is up roughly 10.8%.

In other news:

2. US stock futures slipped early Wednesday and bond yields moved lower after Tuesday's rally. Oil prices slumped, too, as President Joe Biden is expected to call for a US gas tax holiday. Here is your market wrap.

3. On the docket: Celestial Biolabs, International Parkside Products, and New Light Apparels, all reporting. Plus, Fed Chair Jay Powell is heading to Capitol Hill today for remarks that could hint where the US economy turns next.

4. In certain US cities, home price appreciation has outpaced wages. One expert said, when there's a deviation in home prices above inflation and wages, that's historically a sign of a bubble. These are the top 15 cities to monitor.

5. Morgan Stanley's Mike Wilson said US stocks could crash another 20%. Wilson, who correctly predicted the current sell-off, said indexes have further to fall as inflation puts added pressure on company earnings. He's anticipating markets will stay in the red even if the economy avoids a recession.

6. A dispatch from the NFT.NYC conference: A top metaverse CEO broke down his vision for what comes next for the popular SandBox platform. The crypto bear market hasn't decreased the company's daily user base, the exec explained to me during a Tuesday interview. "We want to be the Manhattan of the metaverse…but our vision isn't to replace reality."

7. Deutsche Bank said the US is spiraling toward a deeper recession than previously expected. Deutsche was the first big bank to predict a US recession in April, and now it's heightening its warning signals. Get the full details on the report.

8. Goldman Sachs said investors should target these specific stocks that look inexpensive in the current landscape. The bear market has dragged on valuations for certain companies, but the firm's analysts said some are still attractive bets even if earnings are slashed. See the list of 16 stocks here.

9. A real-investor who owns over 100 units shared his strategy for finding great deals right now. Michael Zuber is focused on "days on market" as a key indicator — he said don't buy property that's been listed less than 15 days.

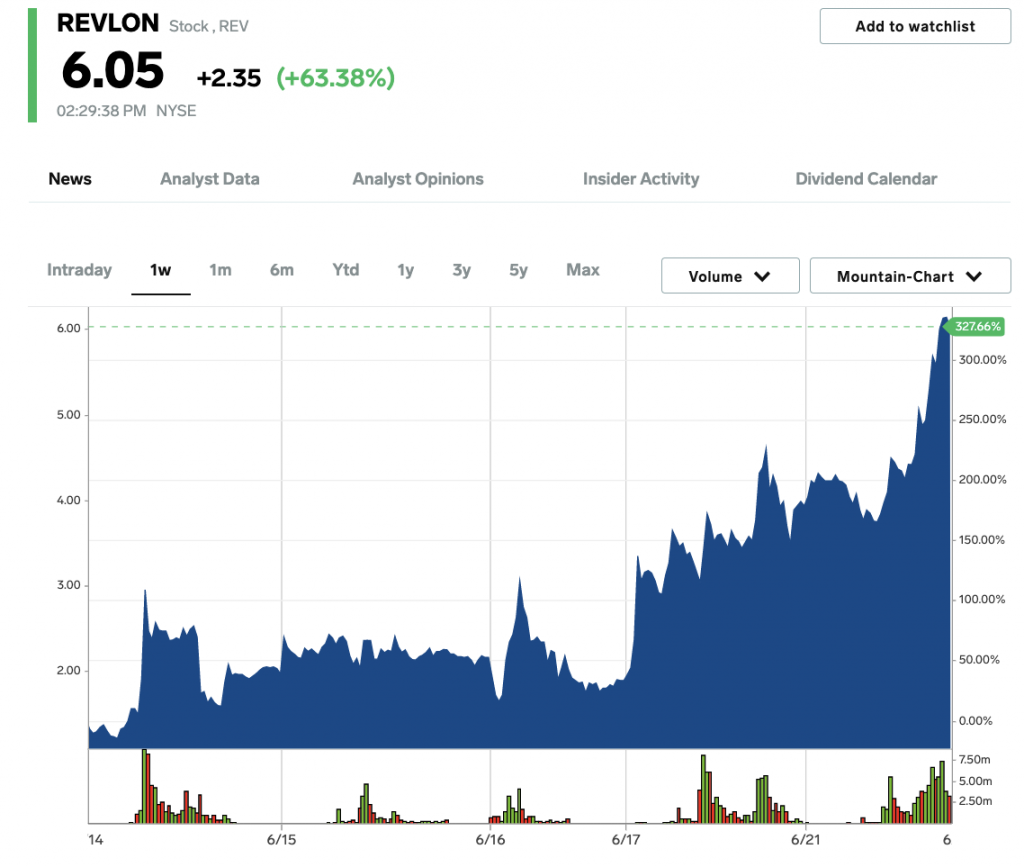

10. Revlon stock surged as much as 65% on Tuesday. Retail traders have piled into the cosmetics maker after it declared bankruptcy — and it's surged more than 400% in a week.

Keep up with the latest markets news throughout your day by checking out The Refresh from Insider, a dynamic audio news brief from the Insider newsroom. Listen here.

Curated by Phil Rosen in New York. (Feedback or tips? Email [email protected] or tweet @philrosenn.) Edited by Max Adams and Lisa Ryan in New York.