- It was a chaotic 2021 thanks to retail-investor mania and surging demand for private company investments.

- Managers like Paul Singer’s Elliott Management and Ken Griffin’s Citadel enjoyed banner years.

- But many macro funds lost money on bets that wrongly predicted the direction of interest rates.

Overall hedge funds did well in 2021 despite fears of inflation and renewed regulatory oversight with a new administration in office.

The industry hit the $4 trillion mark in total assets, according industry data tracker Hedge Fund Research, and fund liquidations in the third quarter fell to their lowest mark since 2006. The average hedge fund made roughly 9% through November, and the space is set for its third straight year of positive returns — comforting investors who were concerned that the industry couldn’t handle volatility anymore.

But 2021 also introduced new variables and players that hedge funds hadn’t battled before. The year started with a short squeeze executed by stuck-at-home day traders and ended with a new coronavirus variant upending plans around the world. An under-the-radar family office started a cascade of events that left banks with billions in losses. Tensions abroad have made global investors weary.

In short, it was a chaotic year marked by big themes that are still relevant today and raising questions about how money managers will navigate these issues in 2022.

Will retail traders remain a variable “smart money” investors must understand, track, and account for? Will investments in private company stock continue to be a gold mine for concentrated stock-pickers searching for growth? Will China continue to make it difficult for foreign investors to get exposure to its most valuable companies?

Last year's winners and losers — and those who fell somewhere in-between the two labels — are mostly connected to these larger, global themes that will determine how the multi-trillion-dollar industry progresses in 2022 and beyond.

Ken Griffin, winner

He started the year with an appearance in front of Congress, which is usually a sign of hellacious days ahead. But Citadel founder Ken Griffin ended the year, once again, as one of the industry's big winners. His firm's flagship fund, Wellington, outperformed other multi-strategy rivals with returns over 24% for the year, and Citadel Securities continued to be a money-printing operation for the billionaire, despite the controversy that the firm's relationship with Robinhood invited during the GameStop saga. And he ended 2021 with a big personal purchase: A first-edition copy of the US constitution, which cost the Harvard alum a smooth $43.2 million.

Star macro investors, losers

After 18 months of outperforming and raising capital, the biggest macro investors in the world were hit hard in the second half of last year. Funds like Alan Howard's Brevan Howard, Chris Rokos' eponymous manager, and Jeffrey Talpins' Element all lost money this year, in part due to missed calls on interest rates. There were still bright spots in the macro world, most notably CastleKnight Management, which is run by billionaire David Tepper's nephew Aaron Weitman. The young fund put up returns north of 70% last year, after making 21% in 2020.

Tiger Cubs' private portfolios, winners

While the retail trader revolution was the most shocking trend to hit hedge funds in 2021, the industry's ever-growing love for private company stock may be the most lasting. After making fortunes investing in public companies, managers like Coatue, Tiger Global, D1, and more — which had previously only dabbled in startups — dove into the space last year, muscling out venture capital firms, inflating their own returns, and largely getting out their founders' way. While private companies lack the liquidity public companies offer, late-stage start-ups have been less volatile than public peers, protecting these large investors' portfolios.

And there's demand for more, as one of the industry's most anticipated launches, from Lone Pine managing director Mala Gaonkar, plans to be heavily invested in privates.

Tiger Cubs' public portfolios, losers

For all the love these funds received for their aggressive private investments, managers like Tiger Global and D1 struggled — relative to the industry and their uber-successful histories — in their public portfolios. The Wall Street Journal reported that Dan Sundheim, the billionaire founder of D1, told investors in December that his public book had fallen by 12% in just half a month. Sundheim's fund was also caught in the short squeeze that slammed Gabe Plotkin's Melvin Capital at the start of the year.

Chase Coleman's Tiger Global has made billions betting on Chinese start-ups, but as the country continues to crack down on foreign involvement in its economy, several of billionaire Chase Coleman's holdings, like Didi Global, now risk being delisted from the New York Stock Exchange.

Lone Pine's performance in its long-short fund Lone Cypress might be most indicative of what these managers' 2021 would've looked like without their ample private bets; Lone Cypress was down roughly 2% through November.

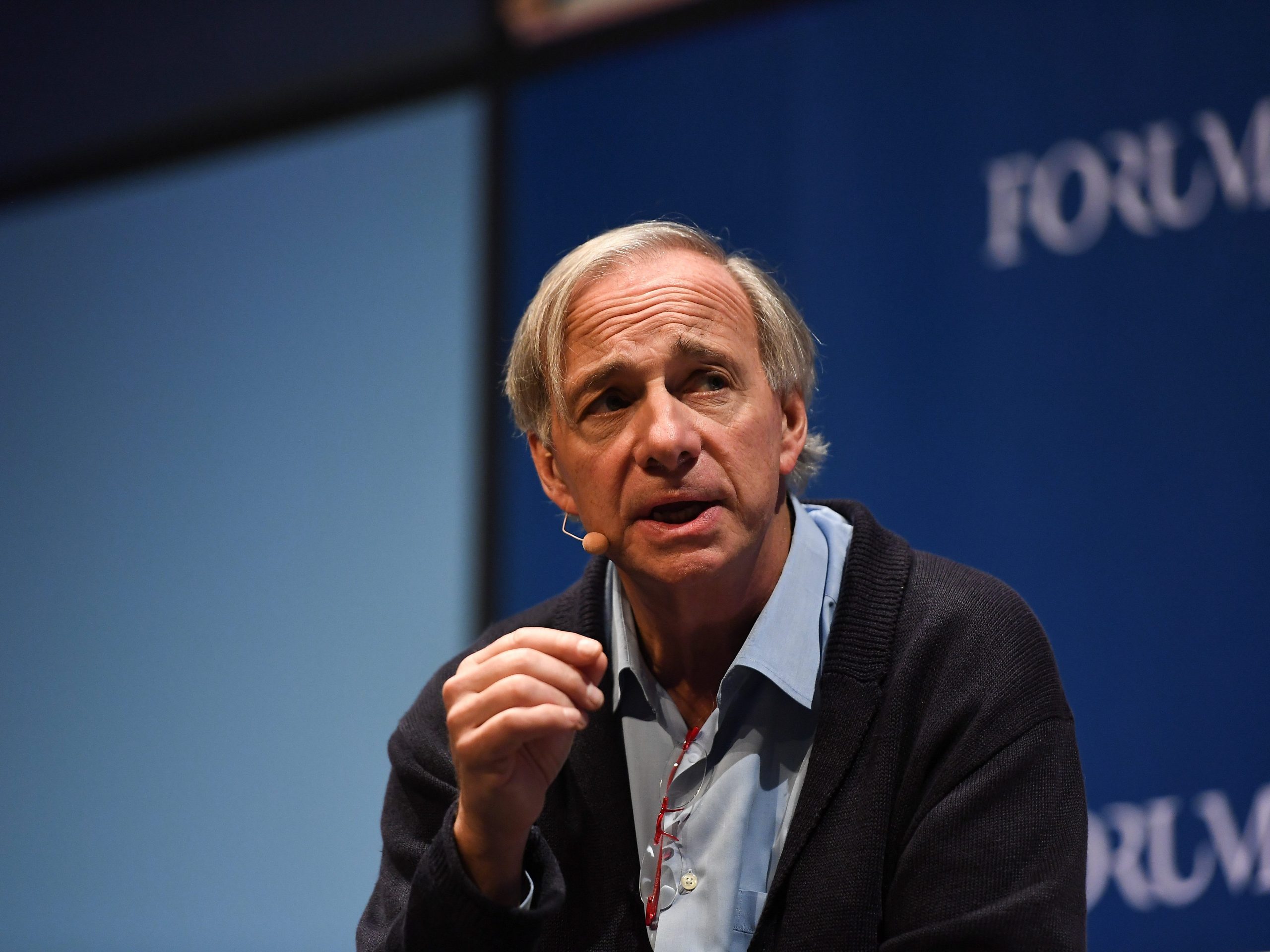

Ray Dalio, in between

Billionaire Ray Dalio lost his firm's CEO David McCormick to politics and had to apologize for comments he made about China, which happens to be one of Bridgewater's biggest investors. But the eccentric macro investor's knowledge of and long-running relationship with China's decision-makers will only help his fund and its investors in the coming years. After a tough stretch of performance for the world's largest hedge fund, the firm made money last year despite losses at many macro giants.

Activists, winners

Elliott's Paul Singer got his CEO atop Twitter. Engine No. 1 took on Exxon, and won. And Engine Capital — which is unrelated to Engine No.1 — was up over 30% last year and is engaging with the board of Kohl's, a current target for the $330 million fund. The current reality for mega-cap companies facing large activist campaigns is that it is often easier to simply settle than undergo a long, public, expensive fight, which is how companies like AT&T, Chipotle, and more have ended up giving these funds what they want.

SEC disclosure rules, losers

The Securities and Exchange Commission has a lot of rules for large investors, and yet there were two major events in 2021 where the regulations failed to do what they were designed to.

One item managers are allowed to keep secret (in the United States) is their short book, which helps funds betting big against troubled companies keep their edge and protect against any market manipulation against them. But betting against companies via put options — which Plotkin's Melvin Capital did — is public knowledge. That resulted in a catastrophic January for his high-flying firm thanks to Reddit-coordinated retail traders seeing his positions in stocks like GameStop and AMC, diving into the stock with abandon and pushing prices up to atronomical levels. The realization of how these traders caught onto Melvin's positions has forced Plotkin and Sundheim to change how they short companies.

But the SEC's disclosure requirements somehow did not catch Bill Hwang's aggressive moves at his family office, Archegos Capital, which used swaps to shield just how large his exposure had gotten at several companies including Viacom. A negative analyst report on the stock caused the company's price to fall, creating a domino effect of margin calls and selling at Archegos that ultimately resulted in billions of losses at Hwang's bank lenders.

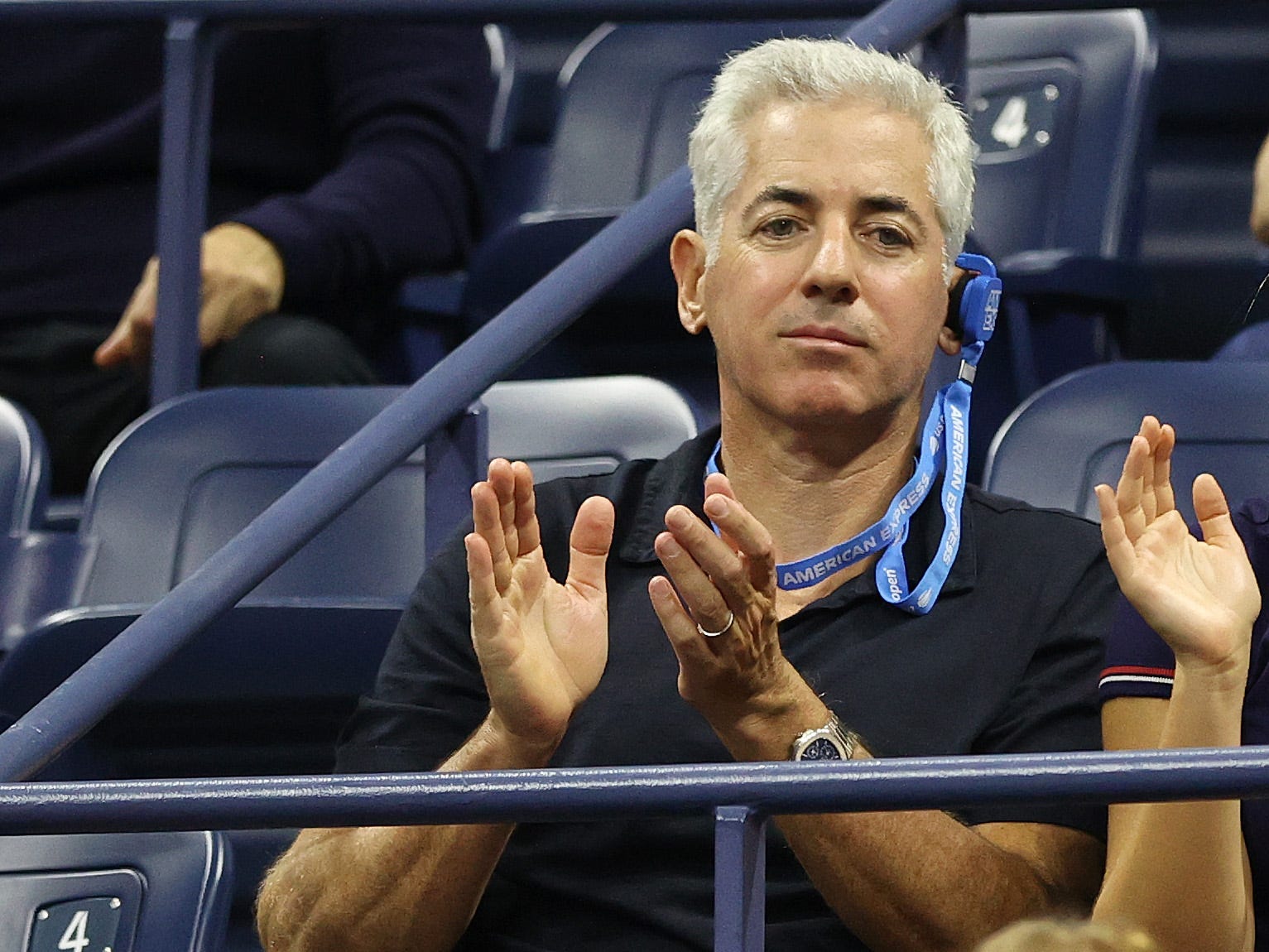

Bill Ackman, in between

It was another strong year for Pershing Square's hedge fund, which rode big positions in Chipotle and Lowe's to returns north of 26%. But no one was paying attention to the fund's performance after Bill Ackman SPAC's massive and convoluted deal fell through in the summer, leaving the billionaire with few options and a quickly approaching deadline to make a deal. He is being sued by SPAC shareholders over the structure of the trust, and has since added layers of financial engineering in response to the latest roadblock. The trust is now trading for less than what it went public at.