The story of 1MDB has it all: missing billions, Hollywood celebrities, and high-flying investment bankers. A scandal involving Malaysia’s state-owned investment fund has become one of the most notorious alleged frauds of all time.

The fallout has been widespread. More than $4.5 billion was misappropriated from the fund during the scheme that lasted from 2009 through 2015, according to the US Department of Justice. It’s also triggered investigations in at least six countries, including Singapore, Malaysia, the United States, and Switzerland.

Earlier this week, the Malaysian government filed criminal charges against four people involved in the scheme, including former employees of Goldman Sachs, a superrich Malaysian businessman, and a former executive of the fund.

Below we’ve listed the key figures intertwined with the scandal, from whistleblowers who sought to expose the scheme to the public to the alleged masterminds.

Najib Razak

In 2009, former Malaysian Prime Minister Najib Razak set up the state-owned investment fund 1MDB, whose full name is 1Malaysia Development Berhad. The fund was meant to attract foreign investment and boost economic development in Malaysia. But according to prosecutors for the Malaysian government, Najib and his second wife, Rosmah Mansor, funneled money from the fund to enrich themselves.

Malaysian investigators say that $681 million was transferred into Najib's personal accounts, while the country's then attorney general claimed the money was a donation from Saudi Arabia's royal family.

Najib lost power in a general election in May and Malaysia's new government swiftly renewed investigations into the former prime minister, who is now facing a string of charges including abuse of power and money laundering related to 1MDB. Malaysian authorities raided properties linked to him and his wife earlier this year and seized luxury handbags, jewelry, watches, and other goods worth millions of dollars.

A senior Malaysian government minister told the BBC that Razak was the high-ranking "Malaysian Official #1" related to the 1MDB scheme described by the US Justice Department.

He has constantly denied any wrongdoing.

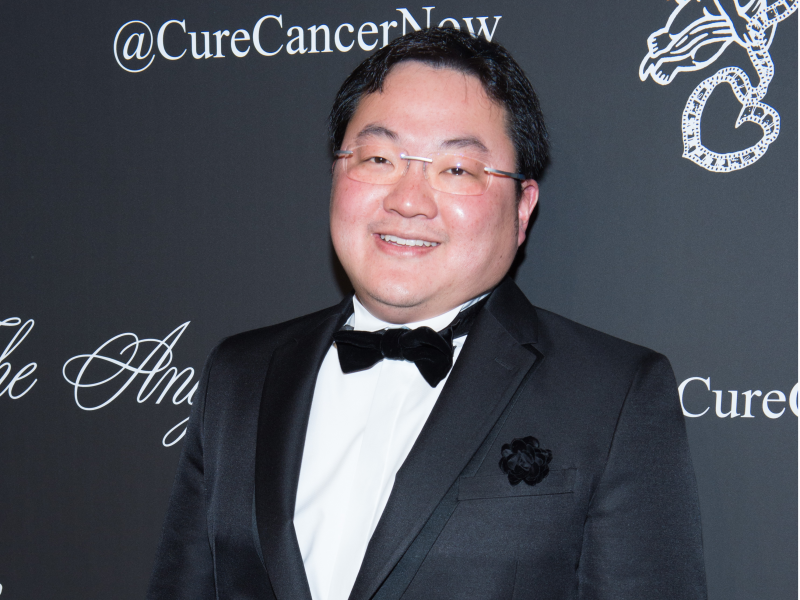

Jho Low

At the center of the 1MDB scandal is the fugitive Malaysian financier Low Taek Jho, popularly known as Jho Low. He was believed by US investigators to be the mastermind orchestrating the scandal.

Court filings show Low advised on the creation of 1MDB but didn't hold a formal position at the fund. He is also the owner of a Swiss bank account, Good Star Limited, through which millions of dollars were funneled from the 1MDB fund into the US. The filings show the money was used by him and associates to purchase luxurious properties, artworks by Monet and Picasso, jewelry, and more.

The 37-year-old is known for his lavish lifestyle, mysterious wealth, and social circle, which included Leonardo DiCaprio, Paris Hilton, and top bankers from Goldman Sachs.

Born to a wealthy Asian family, Low was raised in Malaysia. His father founded an investment holding company called MWE Holdings Bhd, and his grandfather Low Meng Tak reportedly amassed family fortunes through mining and liquor-distilleries businesses.

Low studied at Wharton's business school. Previously he attended London's Harrow School, during which he was believed to have met Riza Aziz, the former Malaysian prime minister's stepson.

Now an international fugitive, Low is wanted in Malaysia for multiple criminal charges. While China is believed to be the preferred hideout for this Malaysian financier, his whereabouts remains unknown.

Low has denied wrongdoing. On December 17, a spokesman at a Australian-based PR firm released a statement through his lawyers, claiming that he "cannot get a fair trial in Malaysia." The statement came right after the Malaysian government's move to file criminal charges against Low and three other individuals, among whom were two former partners of Goldman Sachs.

Riza Aziz

Riza Aziz is the stepson of Najib Razak, a friend of Jho Low, and a cofounder of a movie-production company called Red Granite Pictures. The Los Angeles-based company coproduced the Hollywood blockbuster "Wolf of Wall Street" starring DiCaprio.

Court filings say that he misappropriated money originating from 1MDB to finance a number of movies including the aforementioned blockbuster and "Dumb and Dumber To." The company has agreed to pay $60 million to settle the allegations.

Timothy Leissner

Goldman Sachs underwrote three bond deals in 2012 and 2013 for the Malaysian state investment fund, raising a total of $6.5 billion. The bank earned roughly $600 million in fees.

Timothy Leissner, the former Southeast Asia chair and one-time partner at Goldman, was the lead banker who arranged the bond sales. He pleaded guilty to DoJ's charges of bribery and money laundering related to 1MDB on August 28.

In his plea, which was unsealed in November, Leissner admitted to conspiring with other Goldman employees to bribe officials to secure the bond deals. He has been ordered to forfeit $43.7 million resulting from his crimes.

The 1MDB saga has dealt another blow to Goldman's reputation, which the firm has worked hard to restore since the 2008 subprime-mortgage crisis. The Malaysian government this week filed criminal charges against subsidiaries of Goldman and its former bankers, Leissner and Roger Ng, over their role in the scheme, seeking jail terms as well as fines.

Malaysia's new Prime Minister Mahathir Mohamad said the country wanted to recoup some of the misappropriated funds and the massive fees that Goldman earned from the bond sales.

Roger Ng

Ng Chong Hwa, aka Roger Ng, is a former Goldman partner and the head of its Southeast Asia sales and trading department. During his term at Goldman, he was a deputy to Tim Leissner, who has pleaded guilty to charges on bribery and money laundering.

Ng was among the four people who appeared in the criminal charges brought up by Malaysian government this week. Ng reportedly played a key role in facilitating $1.75 billion bond deal that Goldman arranged for 1MDB in 2012. He left the firm in April 2014.

He was arrested in November in Malaysia at the request of American authorities and is fighting extradition to the US.

Malaysian prosecutors on Wednesday charged Ng with four counts of abetting Goldman Sachs to provide misleading information about the bond offerings. Ng appeared in court and pleaded not guilty to all charges.

Andrea Vella

Italian banker Andrea Vella is the former cohead of Goldman's Asian investment-banking department. Vella hasn't been charged, but The Wall Street Journal reported he is believed to be the "Co-Conspirator #4" in the Justice Department's fillings related to 1MDB scheme, who was described as an Italian national "employed as Participating Managing Director and acted as an agent" of Goldman since 2007.

Goldman placed Andrea Vella on leave in October, Bloomberg reported, citing people familiar with the matter.

Jasmine Loo Ai Swan

Jasmine Loo Ai Swan, a Malaysian who studied law in the UK, is the former general counsel of 1MDB. She was a main point of contact between lMDB and Goldman in connection with three bond offerings by lMDB in 2012 and 2013, according to a court filing.

Loo was a constant guest of Jho Low's lavish parties, according to Sarawak Report, a website created by British journalist Clare Rewcastle Brown, who has followed the story about Malaysia's 1MDB scandal.

Xavier Andre Justo

Xavier Andre Justo, a Swiss national and former director at PetroSaudi International, is a key figure in the case. He shared information on the bribery scheme with Rewcastle Brown and set off investigations in several countries.

He leaked data obtained from PetroSaudi, a London-based oil-services company, which includes hundreds of thousands of emails that showed PetroSaudi's joint venture with 1MDB. He was sentenced in 2015 for blackmailing and attempting to extort his former employer.

Clare Rewcastle Brown

Clare Rewcastle Brown is a British journalist behind the investigative website Sarawak Report. She helped expose the 1MDB scandal and initially faced so much political scrutiny that she was given police protection in London. She was also subject to constant harassment and was banned from Malaysia by the government.

Brown worked with whistleblower Xavier Justo throughout the course of her reporting to understand the extent of the partnership between PetroSaudi and 1MDB.

Brown is also the sister-in-law of former UK prime minister Gordon Brown.