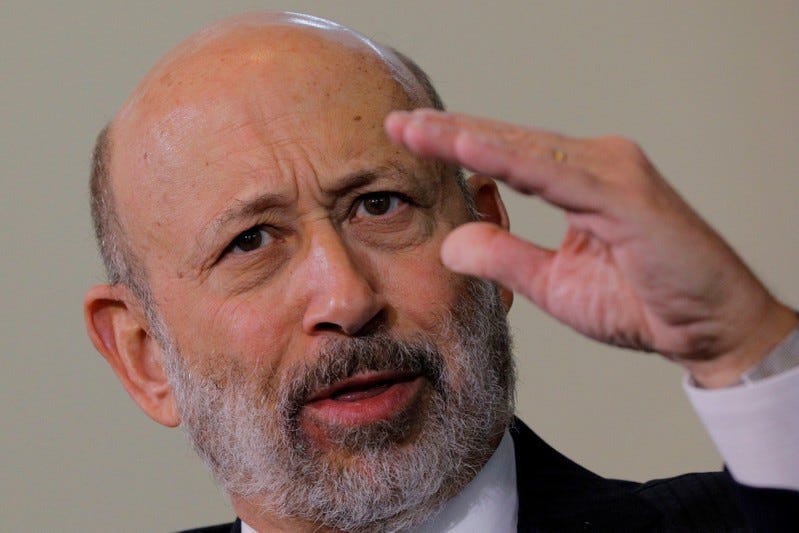

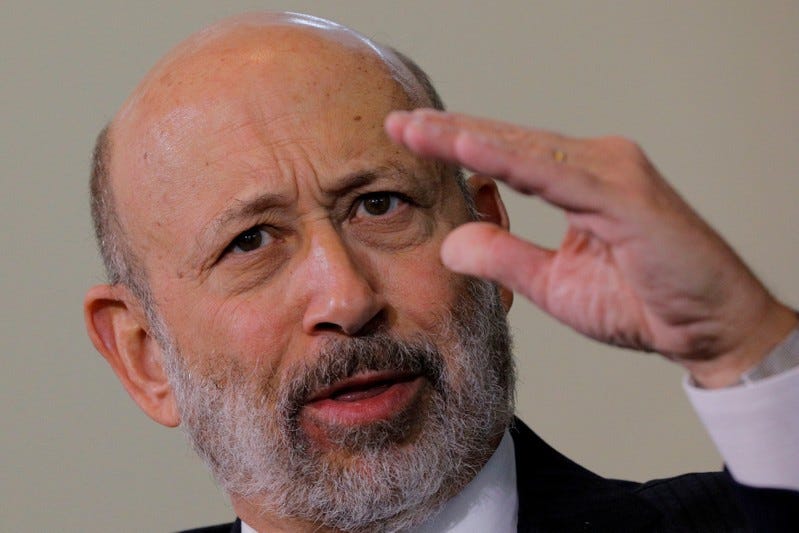

Thomson Reuters

- Lloyd Blankfein, ex-chair and CEO of Goldman Sachs, tore into his Wall Street compatriots, calling them enablers of President Donald Trump who had collectively “put a clothespin on our nose.”

- “He was delivering what ‘we’ wanted … we weren’t ignorant of the kind of risks we were taking. We repressed them,” Blankfein told The New York Times.

- Blankfein, who left Goldman in 2018, said he never counted himself a Trump supporter. In September, he seemed to suggest that public markets were ready for Joe Biden to win the presidency.

- Visit Business Insider’s homepage for more stories.

Lloyd Blankfein, the ex-chair and CEO of Goldman Sachs, tore into his Wall Street compatriots, calling them enablers of President Donald Trump who had collectively “put a clothespin on our nose.”

Blankfein said financial firms put up with Trump simply because of what he could deliver, mainly lower corporate taxes and fewer regulations.

“He was delivering what ‘we’ wanted. We put a clothespin on our nose. We weren’t ignorant of the kind of risks we were taking. We repressed them,” Blankfein said in a plainspoken interview with The New York Times.

He said Wall Street knew all along that Trump’s personal character was problematic, maybe even a threat to national security. “Character really counts,” Blankfein said, adding that some traders were playing “the ethics thing close to the line.”

Blankfein, who left Goldman in 2018, said he never counted himself a Trump supporter. In September, he seemed to suggest on Twitter that public markets seemed ready for Joe Biden to win the presidency.

"Perhaps folks think their stocks and 401(k)s will do better with higher taxes and increased regulation than with nastiness and scorched earth," he wrote at the time.

But as the Dow and Nasdaq both climbed to record highs, the upper echelon of Wall Street traders mostly remained silent.

Matteo Colombo/Getty Images

The Dow gained 49% between Trump's inauguration and the February 2020 crash caused by the pandemic. Even amid the pandemic, markets soared. They haven't cooled yet. Both the Dow and S&P 500 were set to touch new records on Friday, days after Trump supporters ransacked the halls of Congress.

With the ever-increasing gains, Wall Street executives turned a blind eye, said Blankfein.

"And if they were very, very profitable, you could get seduced and rationalize it in saying, 'You know something? I know this is not good, but he's delivering what I want,'" he said.

In the days since the Capitol siege, some executive in Silicon Valley and elsewhere have begun speaking up.

Apple's Tim Cook, who has often met with Trump, said the riots were a "sad and shameful chapter." Google CEO Sundar Pichai called the attacks "the antithesis of democracy." In a statement, JPMorgan Chase CEO Jamie Dimon said: "This is not who we are as a people or a country. We are better than this."

According to Blankfein, it in was many people's self-interest to overlook obvious flaws, including the notorious Access Hollywood tape that made news days before the 2016 election.

"So, yes, they supported him. And I think that support is not undone by some one-minute-to-midnight deathbed confession that, 'Oh my God, this was too much for me,'" he said.

But Blankfein stopped short of saying business leaders should always speak out about their personal feelings.

"My view is business leaders owe their platform to their company, and therefore they shouldn't appropriate it for personal things, but rather they should take positions on those issues where it's in the wheelhouse of the company's expertise and their expertise," he told The Times.