Matt McClain-Pool/Getty Images/Andrew Harnik/AP

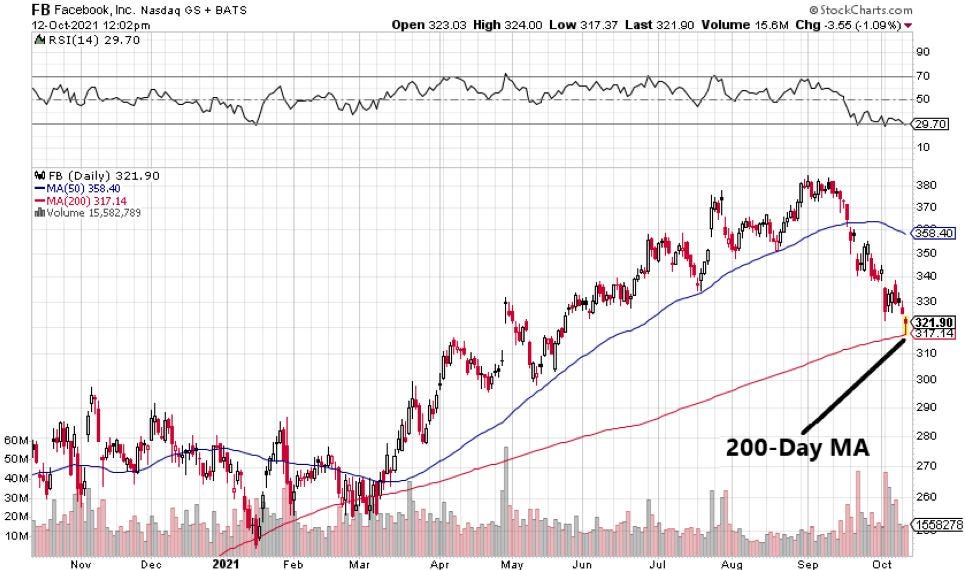

- Facebook stock fell more than 2% on Tuesday, testing its key 200-day moving average as support.

- The social media company has fallen 17% from its record high reached on September 1.

- The decline in shares of Facebook was accelerated by the allegations from a whistleblower.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Facebook stock fell more than 2% on Tuesday, extending a month-long decline that has been accelerated by allegations from whistleblower Frances Haugen that the social media firm put profits before its users' well being.

Haugen testified to Congress last week that Facebook's engagement-based algorithms have helped fuel civil discord and that the company doesn't do all that it can do to remove hateful and false content from its platforms. That, combined with an hours-long outage of Facebook properties including Instagram and WeChat last week, have sent shares tumbling.

Shares fell to a key support level that hasn't been tested since early March: the rising 200-day moving average. As of Tuesday afternoon, the average stood at $317.14, while Facebook stock hit an intraday low of $317.37.

Moving averages are a lagging trend-following indicator that technical analysts use to smooth out price movements and help identify the direction of the current trend.

Traders view the the 200-day moving average, which is the average daily closing price of a stock over its previous 200 trading sessions, as a benchmark that often represents areas of significant support or resistance for a security.

If Facebook stock manages to decisively hold above its 200-day moving average, investors will likely look to the shorter-term 50-day moving average as the next key resistance level to be tested. The 50-day moving average currently sits at $358.40, representing potential upside of 11% from current levels.

Shares of Facebook are nearing bear-market territory, being down 17% from its record high reached on September 1, and investors are now hoping that the share price will stage a rebound at this crucial support level. The rising slope of the 200-day moving average would suggest to traders that the direction of the trend will remain up.

But Facebook has work to do in assuring investors that the company will be able to navigate Haugen's testimony, the recent Instagram outage, and ongoing headwinds from Apple's recent iPhone privacy update, which has hampered the reach of its advertising clients.