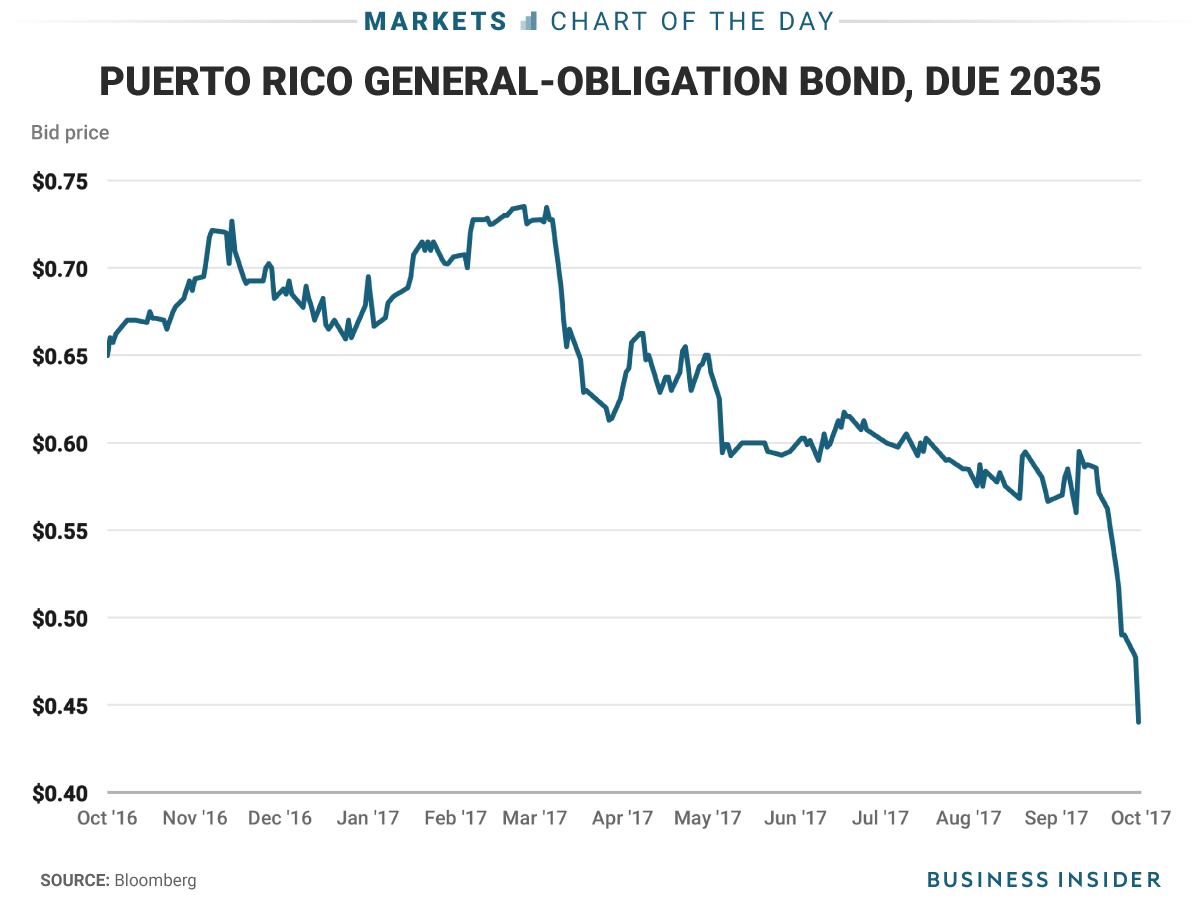

A benchmark Puerto Rico bond fell to record lows Wednesday after President Donald Trump said the US territory’s debt would have to be written off.

“You know they owe a lot of money to your friends on Wall Street,” Trump said in an interview with Fox News on Tuesday. “We’re gonna have to wipe that out … You can say goodbye to that. I don’t know if it’s Goldman Sachs, but whoever it is, you can wave goodbye to that.”

The general-obligation bond due in 2035 fell to a record low price of 34 cents on the dollar, down from 44 cents on Tuesday, according to Bloomberg.

“I can’t think of any time when a president has opined on a muni bankruptcy case,” said Greg Clark, the head of municipal research at Debtwire. “We’re in – I guess it’s fair to say – uncharted waters with the president’s comments,” he told Business Insider.

So-called GO bonds are distinct because the municipality that issues them commits to repaying bondholders through all its available resources, including taxes and revenues from other projects. Puerto Rico’s benchmark GO bond had already been falling since Hurricane Maria ravaged the island and destroyed much of its infrastructure two weeks ago.

Complicating Puerto Rico's recovery is the fact that before the hurricane, it had about $70 billion in debt it said it could not repay. In May, it filed for the US's largest-ever local-government bankruptcy.

"I hate to tell you, Puerto Rico, but you've thrown our budget a little out of whack," Trump said while visiting the island on Tuesday.

The shares of companies that insure Puerto Rico's debt also dropped Wednesday. MBIA fell 11%, Ambac Financial fell 6%, and Assured Guaranty declined 4%.

But following Trump's comments, Mick Mulvaney, the director of the Office of Management and Budget, told CNN that "we are not going to bail them out," adding that he wouldn't take Trump "word for word."

Isaac Boltansky, a policy analyst at Compass Point, said the legality of debt forgiveness was still in question.

"Addressing the island's debt burden should absolutely be part of the broader recovery discussion, but threats to wipe out bondholders appear more bombastic than actionable," Boltansky said in a note. "Our sense is that President Trump's comments were meant to empathize and possibly catalyze, but we do not believe his statements represent an actual threat to extrajudicially wipe out bondholders."