Hello, welcome back to Insider Advertising, your weekly look at the biggest stories and trends affecting Madison Avenue and beyond. I'm Lara O'Reilly, Insider's media and advertising editor. If this was forwarded to you, sign up here.

As always, my inbox is open for your thoughts, tips, and perfectly shot pet portraits (more on those later). You can find me at [email protected].

Let's take you straight to the news:

- Google and Facebook went from strength to strength in Q2 …

- … but get ready to see the impact of Apple's tracking changes next quarter

- Advertisers enter 'make goods' negotiations with the Olympic broadcaster NBCU

Ain't no stopping us now

Justin Sullivan: Getty Images

We're deep into earnings season, and it was a solid second quarter for the digital advertising giants.

A year after reporting its first-ever revenue decline, Google's parent, Alphabet, rebounded with its best-ever quarter. Ad revenue grew 69% year-over-year to $50.4 billion, driven largely by Google search ads and retail advertisers.

YouTube's ad business jumped 84% to $7 billion. And it looks as if next quarter will be strong for the video property, too. Ad-industry sources told Insider that YouTube's sales representatives had a barnstorming US upfront this year. (The NewFronts presentations ran in May.) Of course, it's a fairly easy narrative to sell: Traditional TV viewership continues to fall, while YouTube use continues to climb.

Still, some of the volume commitments that YouTube secured were fairly eye-popping. Sources said in some of the sales talks, particularly for tentpole sports, YouTube was pushing for - and in some cases able to secure - 30% price hikes. When contacted for comment, a Google representative didn't respond specifically to the company's NewFronts performance but pointed toward company blog posts from earlier in the year highlighting how many people watched YouTube on their main TV screens.

Google's duopoly buddy, Facebook, also had a solid quarter, reporting $29.1 billion in revenue versus the $27.9 billion analysts had expected. Facebook's chief operating officer, Sheryl Sandberg, said on the earnings call that its strongest verticals were those that performed well during the coronavirus pandemic: e-commerce, retail, and CPG.

Elsewhere: Twitter and Snap also reported earnings beats in Q2. And, for all you "triopoly" fans: Amazon is due to report earnings after today's market close.

Track to the Future: Part II

Shayanne Gal/Insider

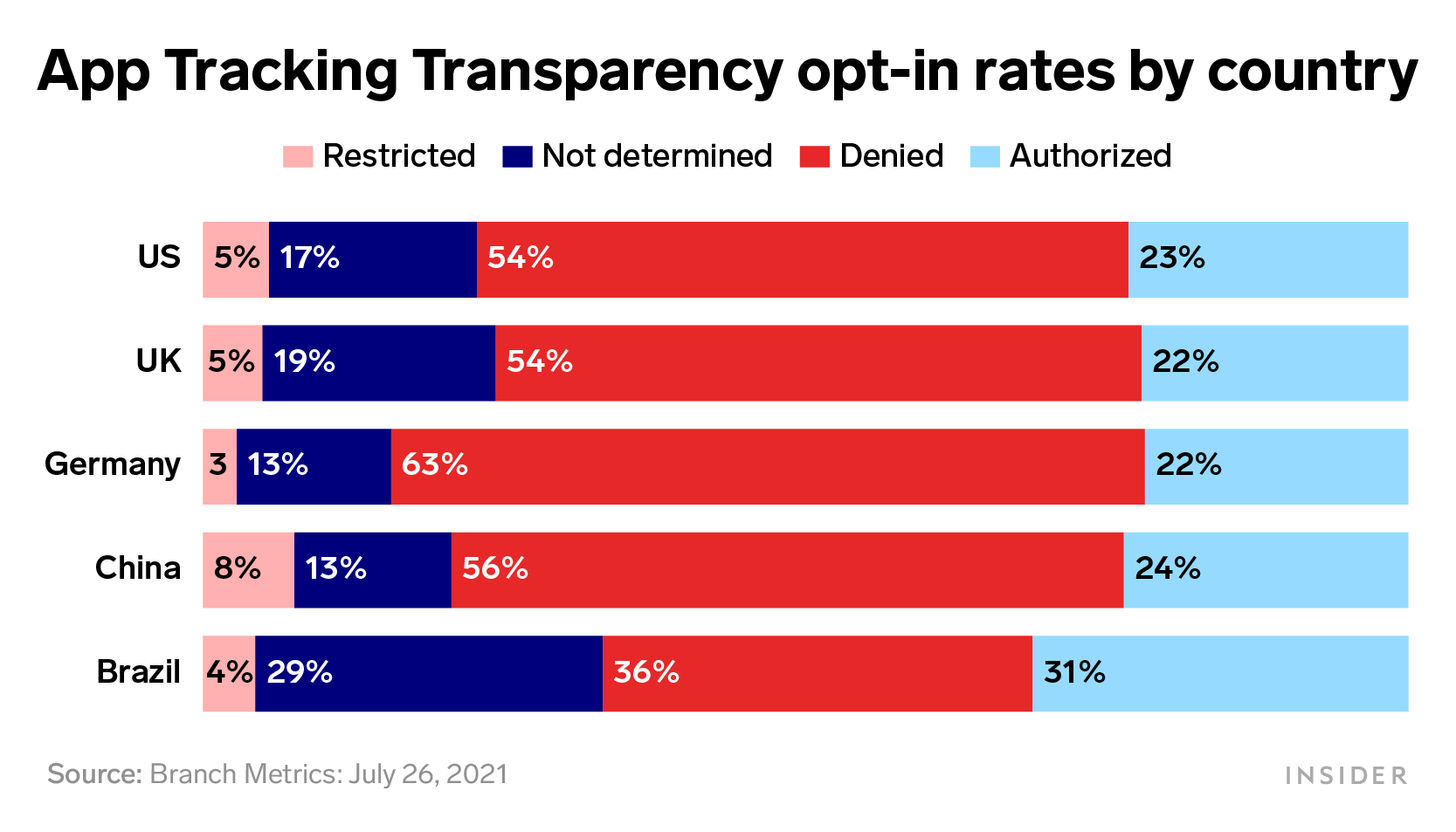

Hold on a minute, wasn't the sky meant to be falling for digital ads hawkers this quarter after Apple rolled out its App Tracking Transparency privacy update in April?

The simple, boring, and noncommittal answer is that it's too early to tell how it'll shake out. Yes, the ATT change immediately made it more tricky for many advertisers to precision-target and measure the effectiveness of their mobile ads. And there's some data showing that some advertisers have even upped their spend on Android, which hasn't yet rolled out a similar anti-tracking measure for apps.

But in spite of all of this, the big trends favoring digital ad platforms - the rise in digital content consumption and spending on e-commerce - were so buoyant that they cushioned any early underlying turbulence.

"While some were expecting major fireworks when App Tracking Transparency went into effect, ATT was never going to dramatically hurt the walled gardens in the short term," said Alex Bauer, the head of product marketing at the mobile measurement platform Branch.

"Longer term, the full impact is still to be seen: Walled gardens have a huge trove of incredibly valuable first-party data, but ATT means Apple is planning to enforce an equal playing field for everyone," he added.

So, there may be trouble ahead. Facebook's CFO, Dave Wehner, warned investors of a significant slowdown in growth and said the company expected "increasing ad-targeting headwinds in 2021" from regulatory and platform changes, which it expects to have "a more significant impact in the third quarter." Alphabet, too, faces several antitrust inquiries, both in Europe and stateside, and it isn't immune to Apple's tracking changes, either. Plus, Alphabet in particular will have tougher comparable year-ago quarter.

There's light at the end of the funnel

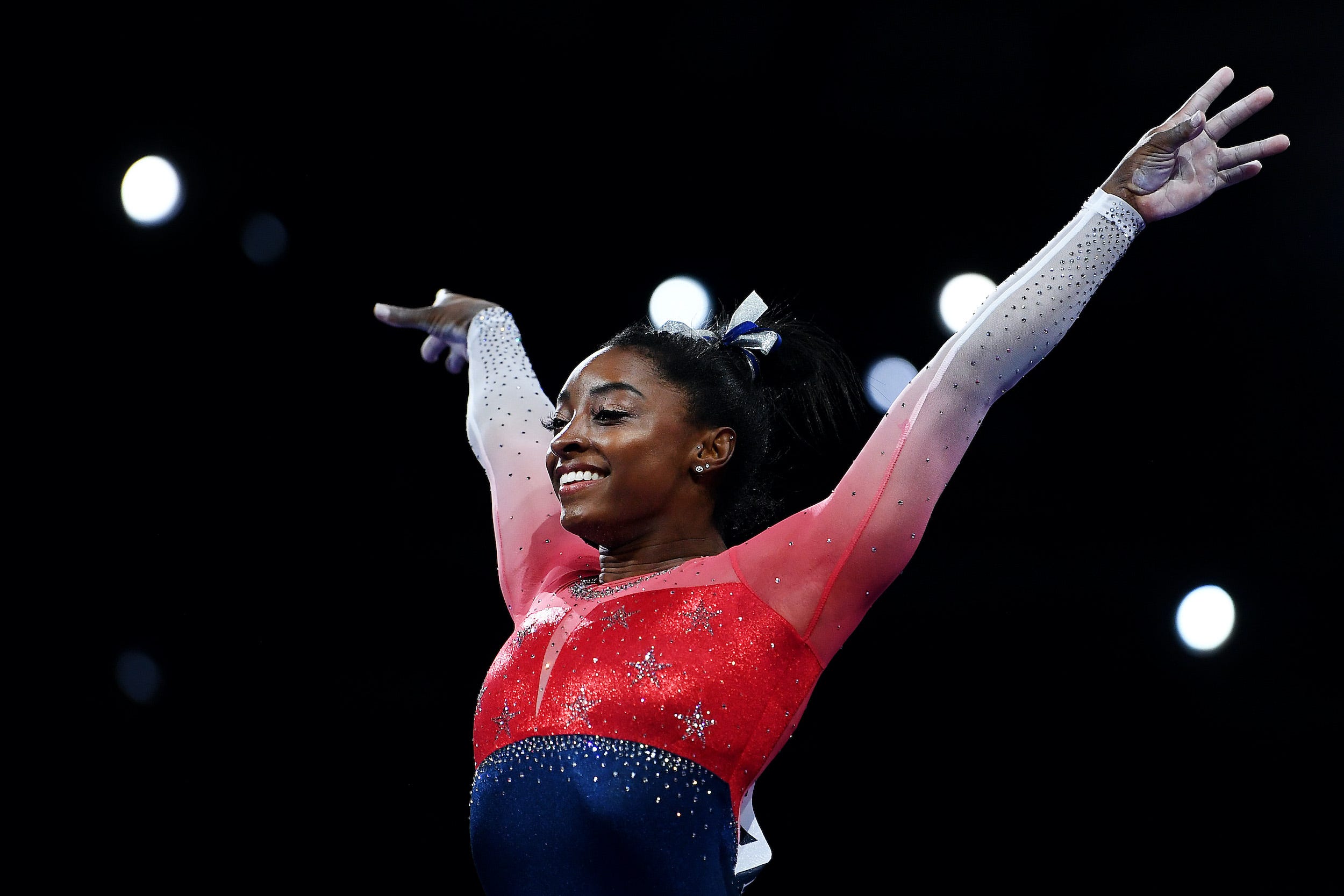

Ad agencies are already having the awkward "make goods" talk with the Olympic broadcaster NBCUniversal, Variety's Brian Steinberg reports. The negotiations come amid shaky ratings and advertiser anxiety following the decision of the star US gymnast Simone Biles to pull out of her first two events at the games. Elsewhere, the tennis champ Naomi Osaka also exited early.

"Don't worry, it's all under control," is essentially the narrative coming out of NBCU, where execs are trying to convince impatient ad buyers that events like the Olympics often deliver results over a longer period of time.

Ultimately the real test for NBCU won't be its ability to peddle multi-mix modeling reports and charts demonstrating "top of the funnel" awareness but its ability to spin up compelling storylines for viewers - against the odds.

There's precedent for it. As told by Disney's executive chairman, Bob Iger, in his book, "The Ride of a Lifetime," the 1988 Winter Olympics in Calgary, Alberta, were a mess on the face of it too. High winds, fog, and warm weather meant many of the alpine events had to be called off.

ABC, the broadcaster for those games, pivoted to human-interest stories: the Jamaican bobsled team and the unlikely British ski-jump hopeful, Eddie "The Eagle" Edwards.

"Somehow it all worked," wrote Iger, who was ABC's senior vice president of programming at the time. "The ratings were historically high."

Recommended reading

WPP's GroupM pulled out of Facebook's media agency review. People familiar with the matter pointed toward Facebook's request for strict contractual terms as one of the reasons - WSJ

The TV seller Vizio is cutting off some adtech companies from ad targeting data as it tries to build a TV ad business to compete with the likes of Roku and Samsung - Insider

Brands including Nike, AB InBev, and Red Bull have set up or are building in-house teams for esports and gaming - Digiday

Kuaishou, a Tencent-backed Chinese TikTok competitor, is on a US hiring spree as it prepares a big marketing push to launch "a new global brand" - Insider

The basketball star Kyrie Irving alleged on social media that Nike was set to release a "trash" sneaker collaboration carrying his name without his permission. Nike hasn't responded - Bloomberg

Weddings are back! But this time it's different. Brands like Zola and David's Bridal are trying to cash in with new ad campaigns, digital services, and perks - Insider

And finally: Apple's long-running "Shot on iPhone" ad series is back, and this time it's teaching us how to take the sorts of portraits of our pets that Annie Leibovitz would be proud of. It is your duty as Insider Advertising subscribers to send me your results: [email protected] - Adweek

That's all for this week. See you next Thursday. - Lara