Hello and welcome back to Insider Advertising, your weekly look at the biggest stories and trends affecting Madison Avenue and beyond. I'm Lara O'Reilly, Insider's media and advertising editor. If this was forwarded to you, sign up here.

As we gear up for the big holiday quarter, Facebook advertisers are already experiencing their nightmare before Christmas as Apple's recent privacy changes take effect. In a blog post Wednesday, Facebook said some advertisers' post-iOS 14 difficulties were hitting harder than they had expected. Some of those issues could be attributed to Facebook underreporting conversions on iOS devices by about 15%, the company said. Direct-to-consumer and so-called performance advertisers in particular are bracing for a bumpy Q4.

Let's get you caught up on this week's other big advertising news:

- Marketers are pushing their ad agencies to be eco-friendly

- Supply-chain shortages are affecting ad plans

- Facebook is embarking on a more defensive comms approach

It's not easy being green

Frank Bienewald/LightRocket via Getty Images

It's been a little over five years since big brands like General Mills and HP made headlines by setting out requirements for their ad agencies to diversify their workforces.

Now, an increasing number of advertisers are also asking agencies pitching for their business to lay out their sustainability commitments, the Insider correspondent Patrick Coffee reports, quoting one agency exec who said it's now part of every pitch.

But while sustainability metrics are now front and center of many RFPs, I'd wager that few advertisers are at the point where they can audit compliance with the promises being made.

"It's an important part of any process, but many of the areas can be quite challenging on an ongoing basis," Ryan Kangisser, the managing partner of strategy at the media-advisory firm MediaSense, told me.

What's more, as the coronavirus pandemic forced nearly all businesses to significantly rev up their e-commerce operations, some advertisers could do well with turning the mirror back on themselves. Global delivery volume records that were set last year are likely to be smashed once again in the holiday quarter.

"As e-commerce gets bigger, we all have to recognize the fact that the energy and power required to fuel all the e-commerce sites and clicks and transactions that are exponentially exploding at the moment," said Richard Robinson, a managing director of the pitch consultancy Oystercatchers.

Yet, Robinson said, when brands are leaned on to ask who is ultimately responsible for sustainable e-commerce within their companies - The CMO? CDO? IT? Supply chain? - many execs still don't have a solid answer.

"The e-commerce kahuna is everyone's inconvenient secret at the moment," Robinson added.

Hey big spender

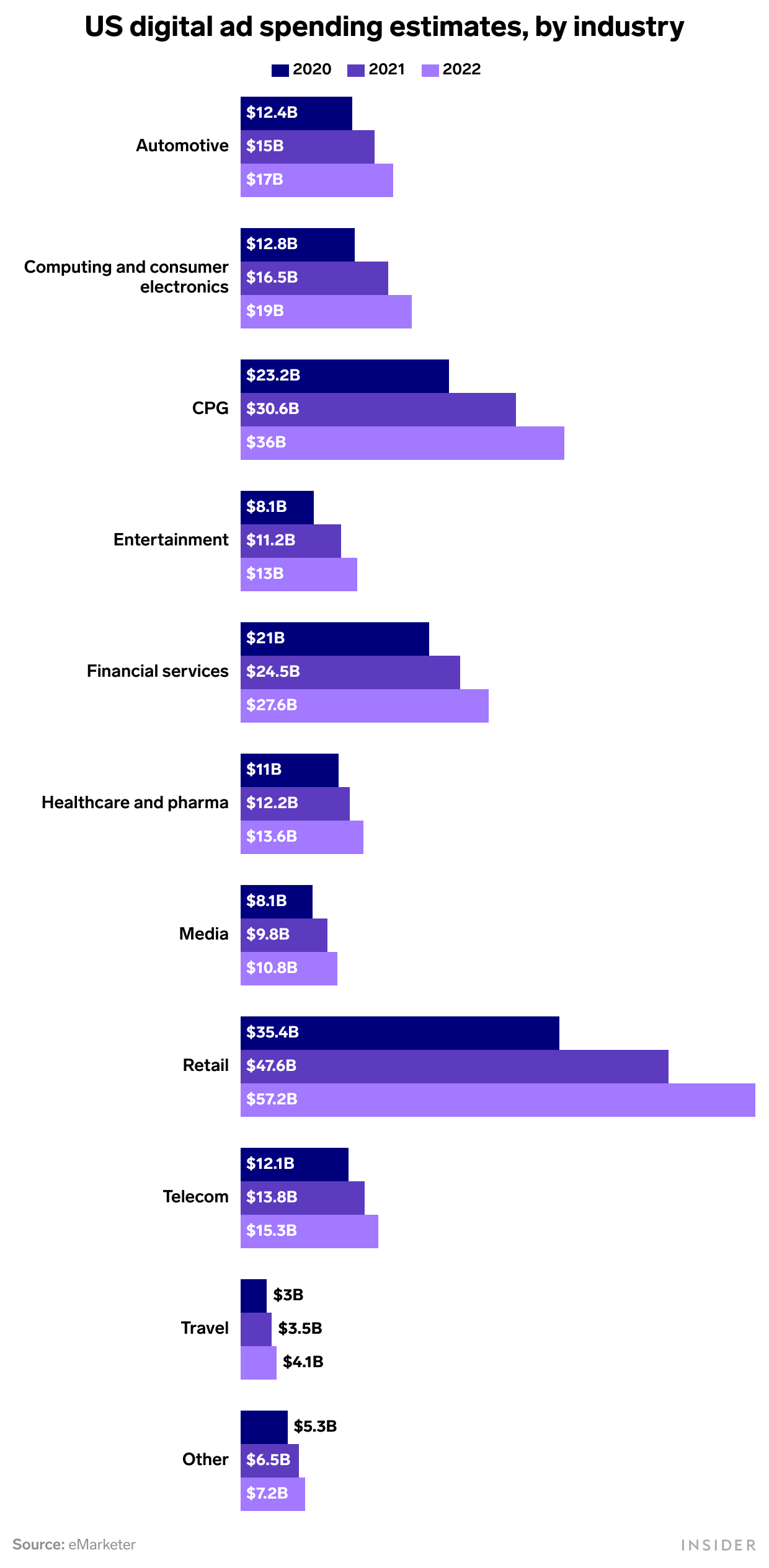

As e-commerce spending continues to soar through 2021 and beyond, so too is retailer spending on digital ads.

Retail has long been the biggest-spending sector on digital ads in the US - which makes sense, as it's the category with the clearest visibility about whether the ads drove a sale.

Insider Intelligence predicts US retailer digital ad spending will blast through the $50 billion mark - "a mark that no other industry will approach in the next couple of years," the Insider-owned research company's analysts wrote. In fact, Insider Intelligence doesn't predict any other single category will spend more than $20 billion in digital ads a year until 2023.

In the meantime, retailers and e-commerce companies like Walmart, Target, and Instacart are busily building their own ad businesses and taking on the market leader Amazon by using their valuable first-party data to help advertisers target the shoppers most likely to buy their products. Insider Intelligence estimates that US retail media ad spending will grow almost 28% to reach $24 billion this year.

You can't always get what you want

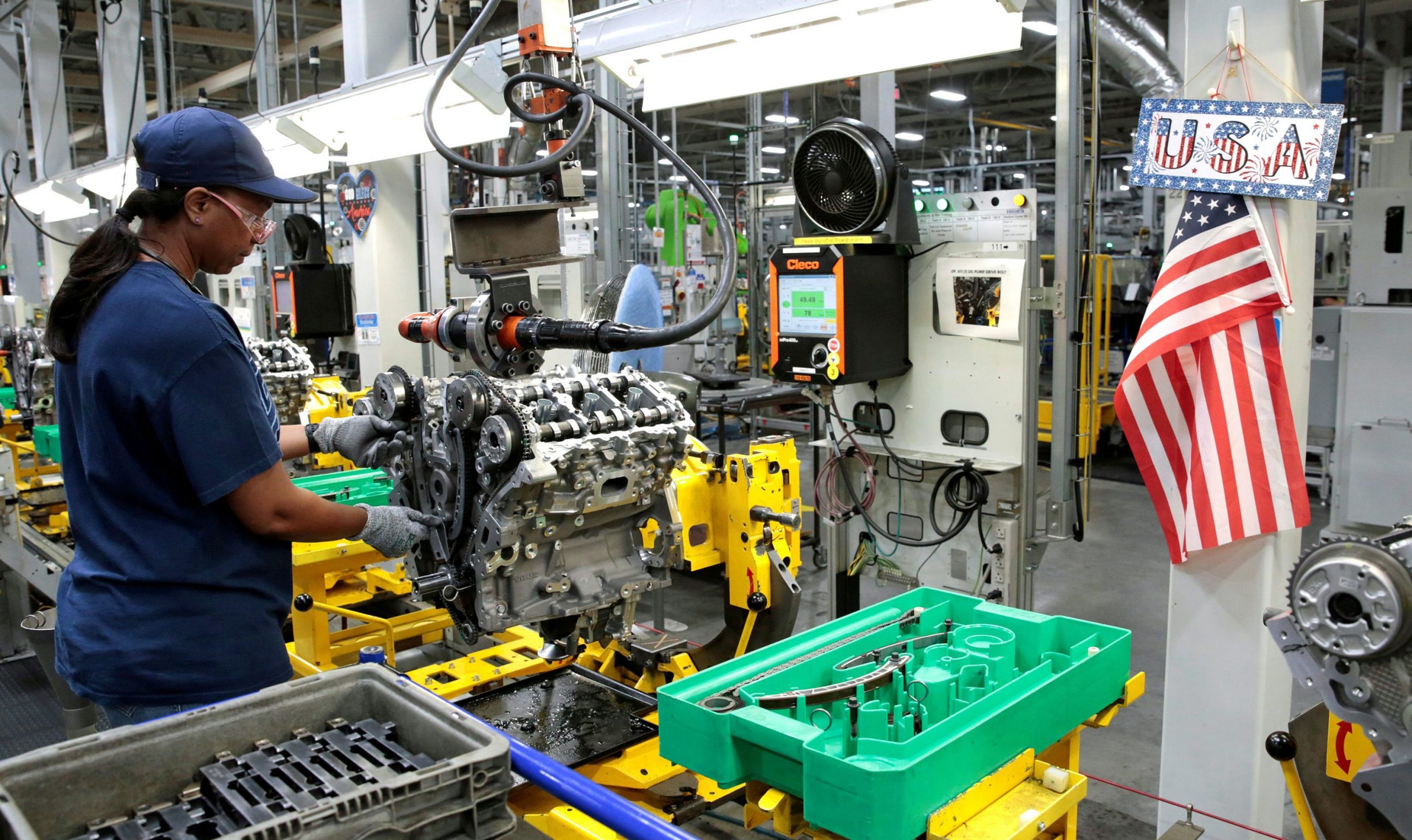

Rebecca Cook/File Photo

Insider's senior reporter Lauren Johnson reports: Supply-chain issues are affecting ad spend, Ad Age reported, and it's not just mom and pops grappling to stock their shelves.

Automakers like GM are also contending with big issues that make it hard to get their products to people, and big names are cutting advertising spend as a result, according to four agency sources who handle ad buying for the auto industry.

One ad buyer said GM brands like Ford and Chevy, as well as the Dutch automaker Stellantis, cut ad spend earlier this year in response to computer-chip shortages that slashed production cycles, adding that car brands shifted their messaging from selling new vehicles to encouraging people to buy used cars at local dealerships. Representatives for Ford, Chevy, and Stellantis did not respond to requests for comment.

Agency sources said that such cuts had hit mostly TV advertising and that in cases in which only some of a brand's products were unavailable, advertisers redirected digital ad spend to promote in-stock items with performance tactics like programmatic advertising that can track sales of products.

Sorry seems to be the hardest word

AP Photo/Mark Lennihan

A few years ago, as sure as spring would turn to summer and summer to fall, it felt as if the latest Facebook mea culpa was only ever a few months away. (The Washington Post even made a handy timeline.) Yet while Facebook has been significantly ramping up its own ad spend of late, don't expect to see any more full-page apology ads from the social network in your favorite newspaper anytime soon.

As The New York Times reported, amid the weight of negative scrutiny on the company, Facebook's communications execs are pressing on with a different strategy: No more apologies.

That attack-dog approach has been in plain view following The Wall Street Journal's explosive "Facebook Files" investigative series, which uncovered a litany of serious issues on that platform that the company appears to be aware of but has failed to fully address.

Facebook's vice president of global affairs, Nick Clegg, fired back with his "What the Wall Street Journal Got Wrong" blog post. Mark Zuckerberg, who personally hasn't responded to The Journal's reporting, instead wagged his finger at The Times for implying he had posted a video of himself riding an "electric surfboard" instead of a hydrofoil. Over on Twitter, a Facebook representative sought to play down The Times' reporting of "Project Amplify," the social network's initiative to show people positive stories about the company on the platform.

Meanwhile, the heat on Facebook shows no sign of petering out:

- Another Facebook ad boycott could be around the corner

- Senators said they'd investigate Facebook's internal research into Instagram's effects on the mental health of young users

- One of Wall Street's top internet analysts says Facebook and Instagram user satisfaction just dropped to all-time lows

Recommended reading

Waze CMO Erin Clift has left amid leadership shake-up at the Google-owned company - Insider

Roku is rolling out a new tool to compete with Facebook and Google for the $16 billion local advertising market - Insider

AT&T CEO John Stankey says he's unhappy with the company's brand and is planning a more future-facing refresh - CNBC

VideoAmp has begun testing its cross-platform TV- and video-measurement ratings alternative with five major ad holding companies - Campaign

Audi is looking for a new ad agency to handle its $185 million ad business - Insider

TikTok insiders describe how parent company ByteDance's culture principles, called 'ByteStyles,' are used to reward and reprimand - Insider

See you next week - and in the meantime please do continue sending your feedback and news tips for this newsletter to [email protected]