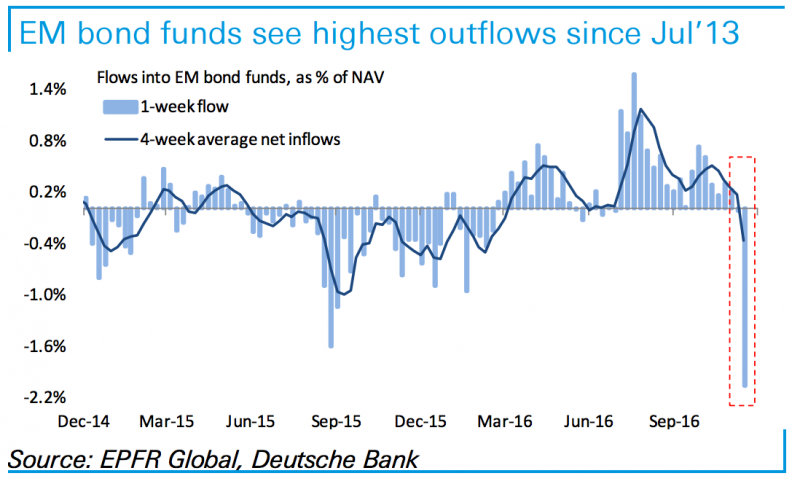

The past week has been brutal for bond funds.

Investors ditched bonds at the fastest weekly rate since 2013, according to analysts from Deutsche Bank, on fears high interest rates and inflation will make a return.

Markets expect US President-elect Donald Trump to ramp up fiscal spending, in turn boosting inflation and wiping out fixed-income investors.

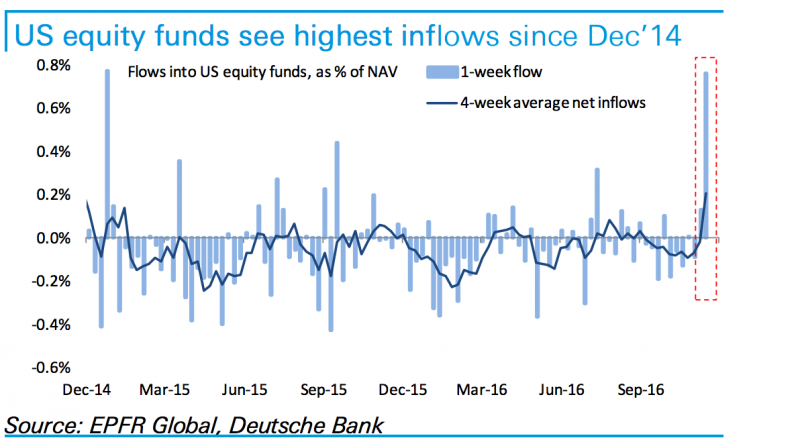

In contrast, stocks and shares have hit record highs in anticipation of a surge of economic growth from higher government spending.

“Expectations of a looser US fiscal policy added fuel to the reflationary fire, triggering a bond sell-off across regions and classes on the one hand while also arranging for a strong return of equity inflows on the other hand,” Deutsche Bank said in a note to clients.

The sell-off has been concentrated in emerging markets, which includes areas such as Latin America. Adjusting for currency movements, emerging market funds saw their biggest outflows since 2004.

Here's the chart:

And here's the move into stocks:

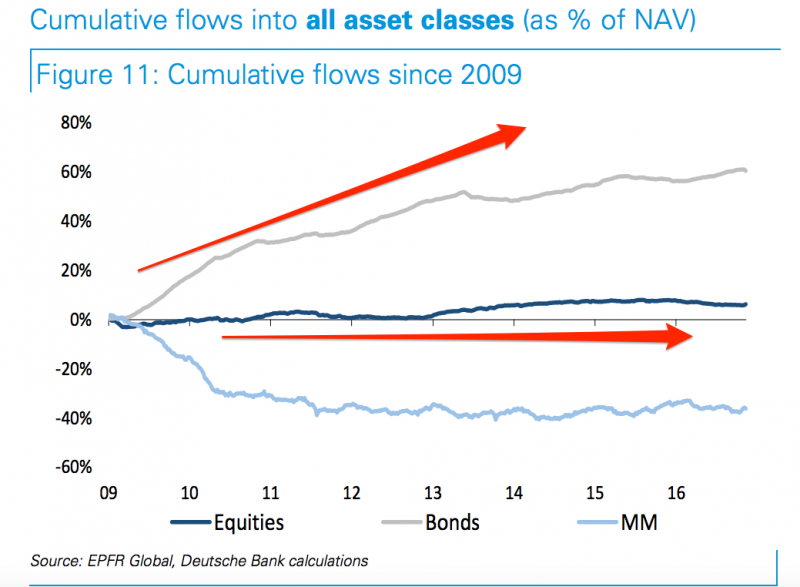

Deutsche Bank argued that there is a long way to go before this rotation away from bonds into stocks is complete.

"If such stimulus in combination with reduced business regulation were to lead US GDP growth higher (as our US economists expect), we could finally see a normalisation of flows whereby money rotates out of over-allocated bond funds ($1tn of inflows since 2009) and into DM equities ($400bn of inflows since 2009)," Deutsche Bank said.

Here's bond market surge since 2009, spurred by low interest rates and central banks' asset purchases:

This could spell trouble for emerging markets that rely on debt to fuel their economies. As investors flee bonds, the yield increases, making it more expensive to refinance existing debt.

Societe Generale on Monday argued that bonds represent the "Achilles' heel of global markets," citing a bond market collapse as one of the biggest "Black Swan" risks in global markets.

SocGen said that bond prices, which move inversely to yields, could see further drops. "Such a scenario could have very negative spillover, not least to emerging markets," the bank said.