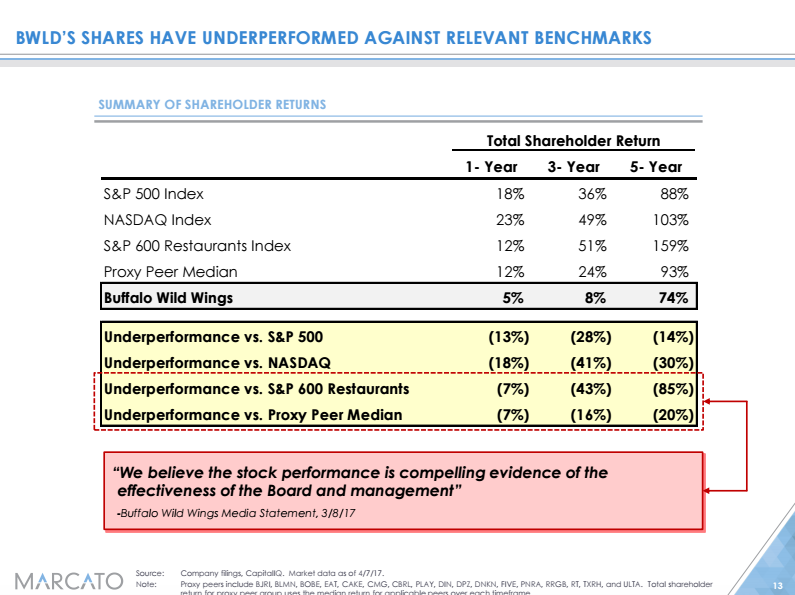

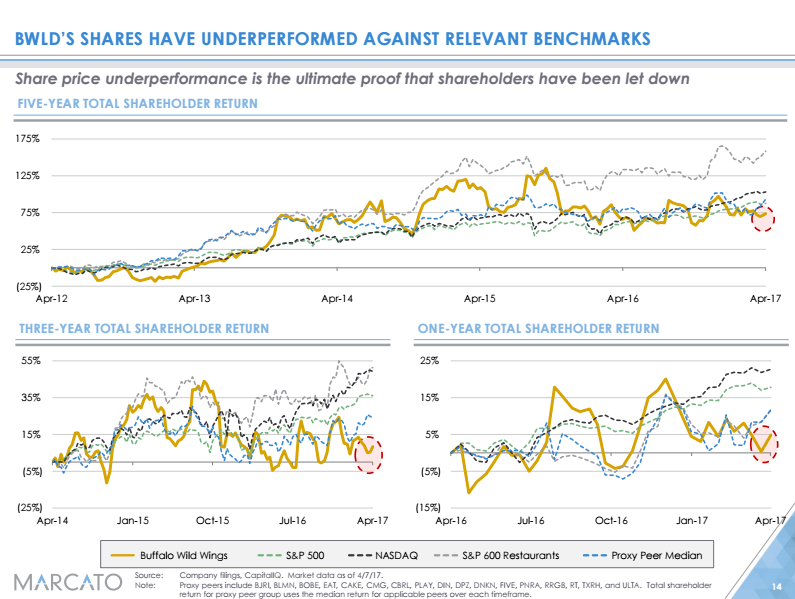

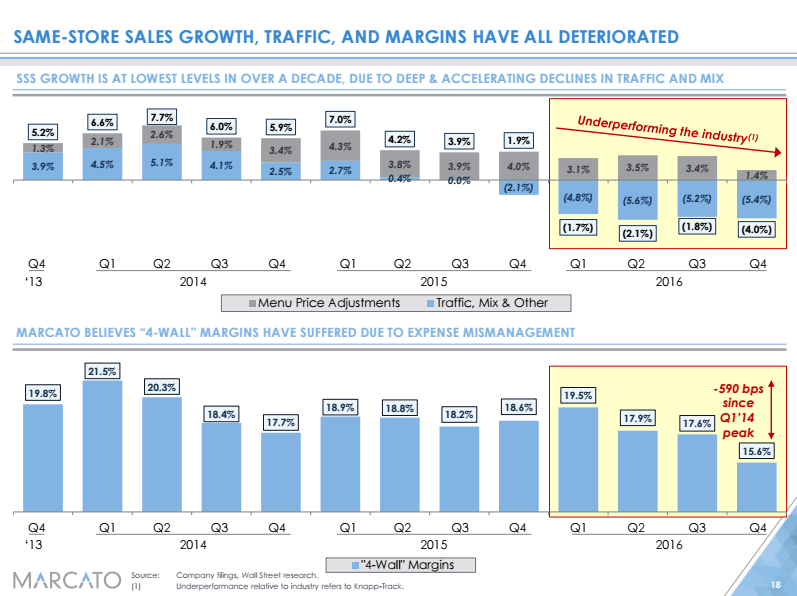

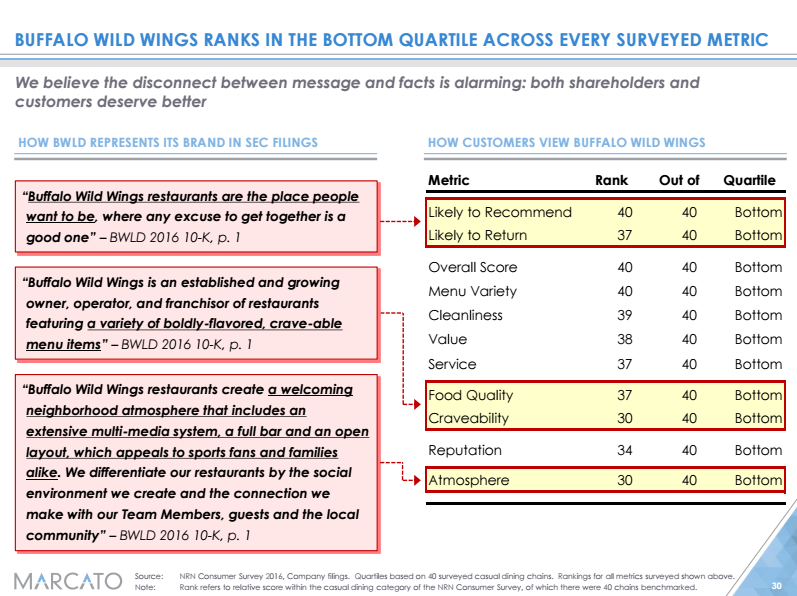

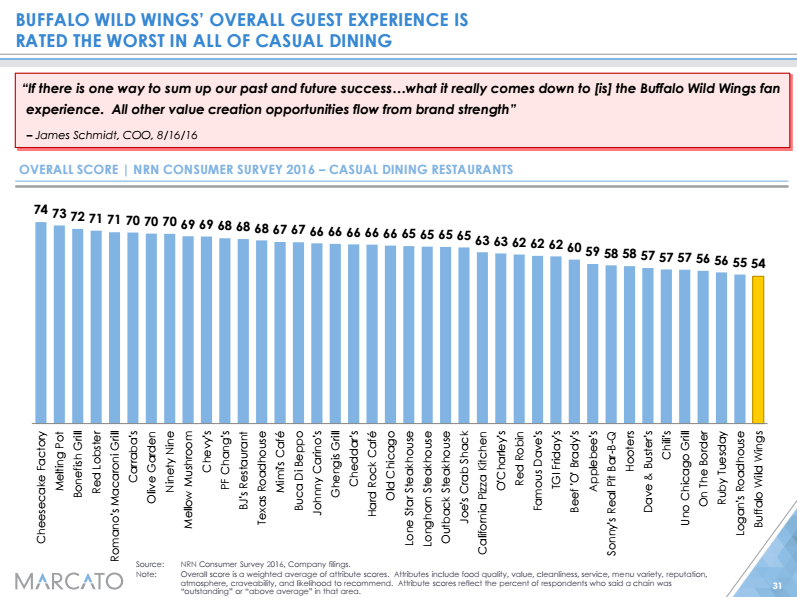

Marcato Capital, a hedge fund that owns 6.1% of Buffalo Wild Wings, has released yet another presentation outlining the company’s failures and ways to improve it.

Marcato’s presentations criticizing the casual-dining chain are not new. This battle has been going on for months – which on Wall Street means slide decks on slide decks.

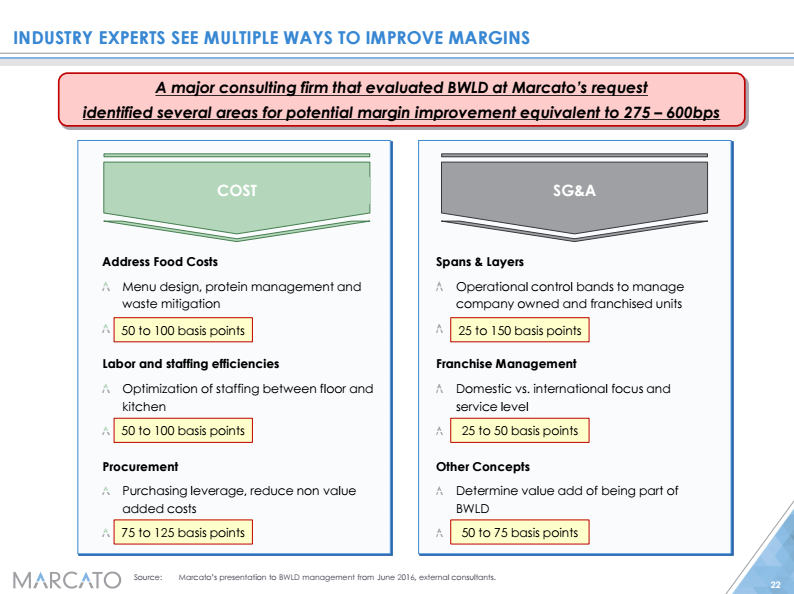

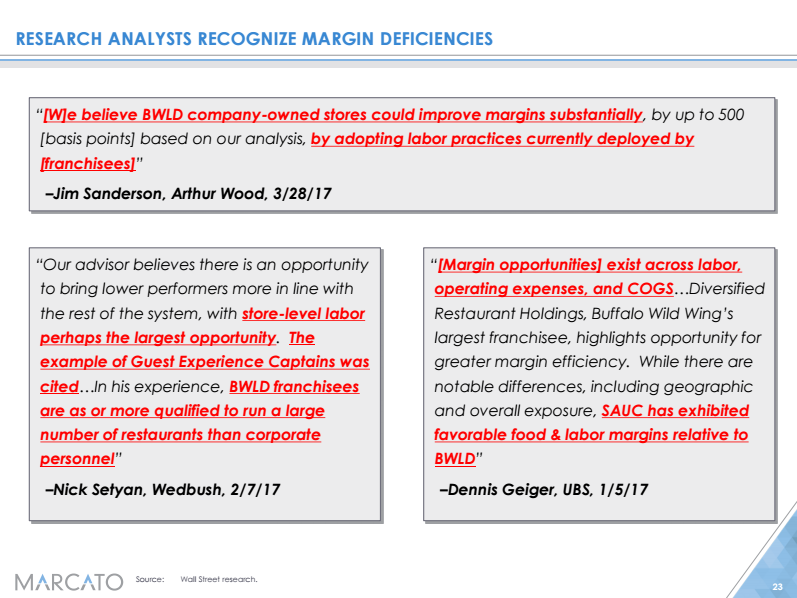

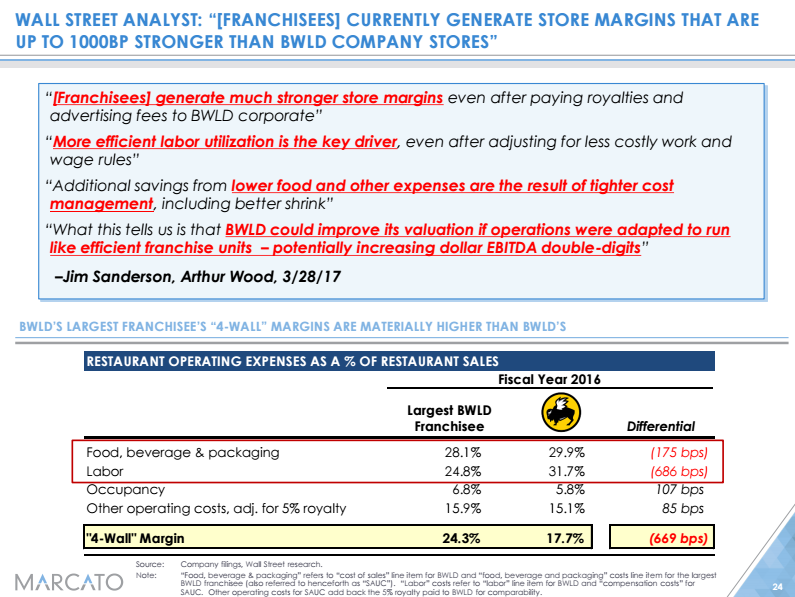

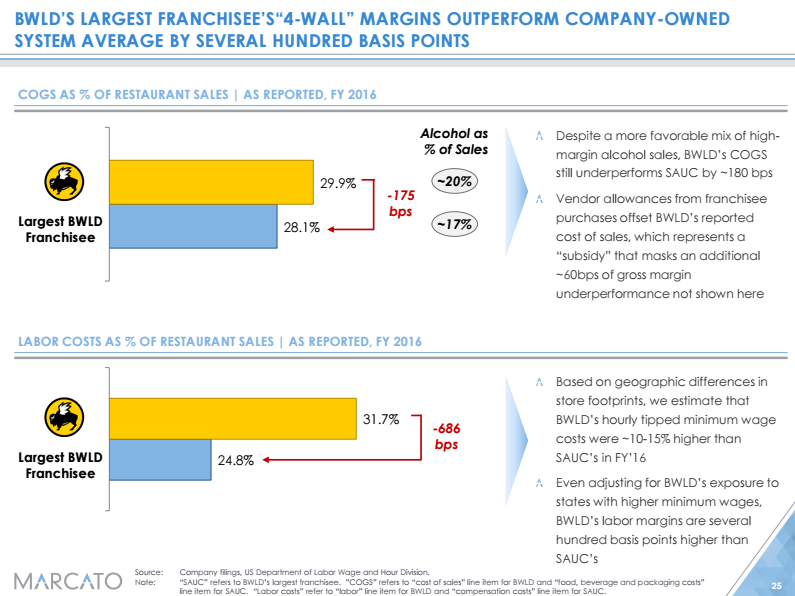

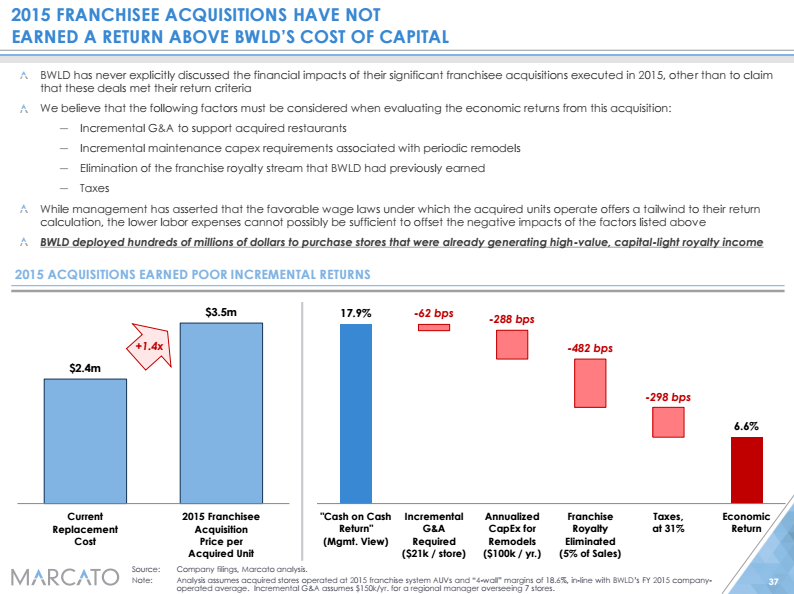

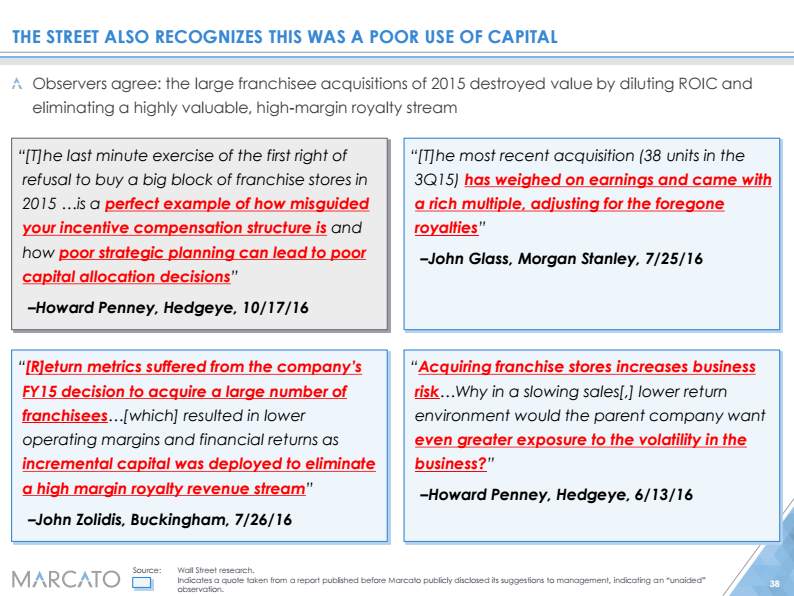

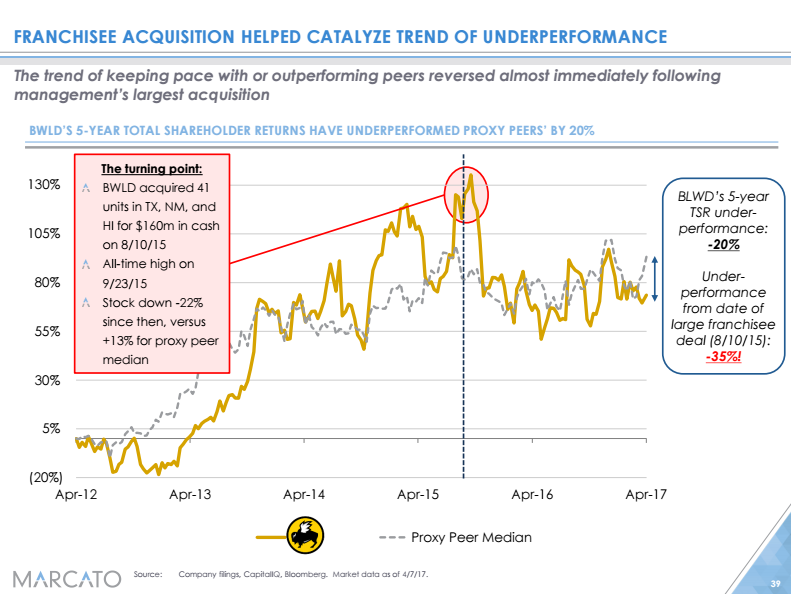

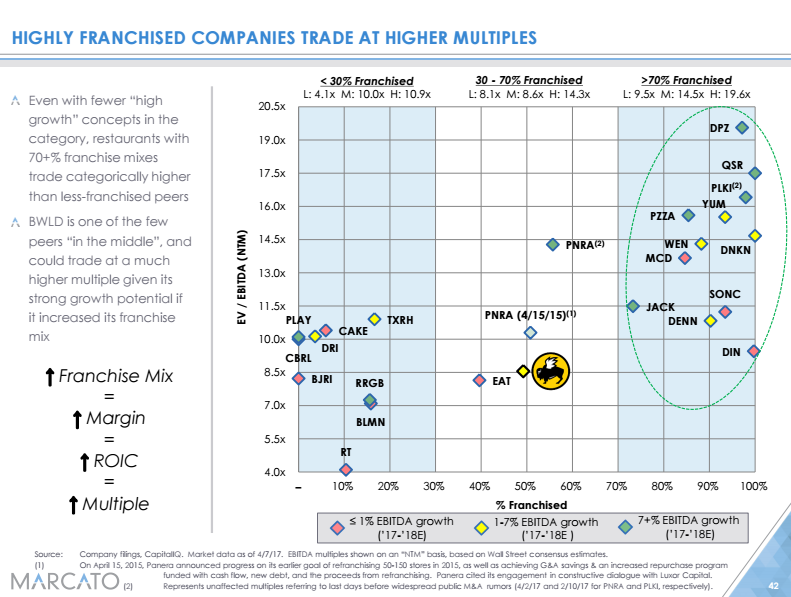

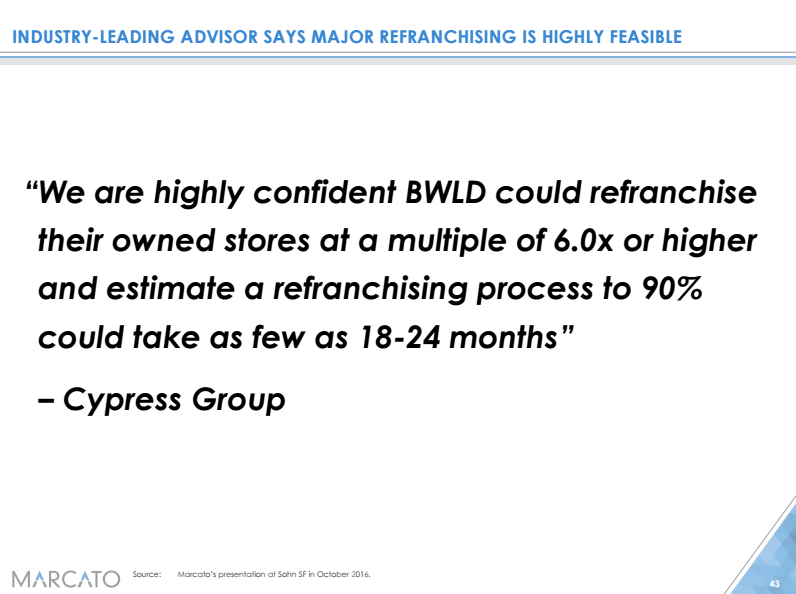

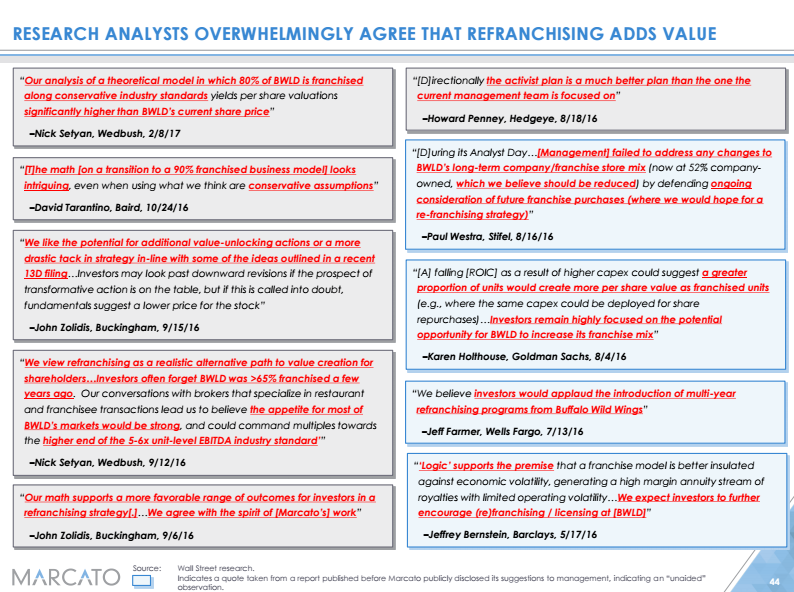

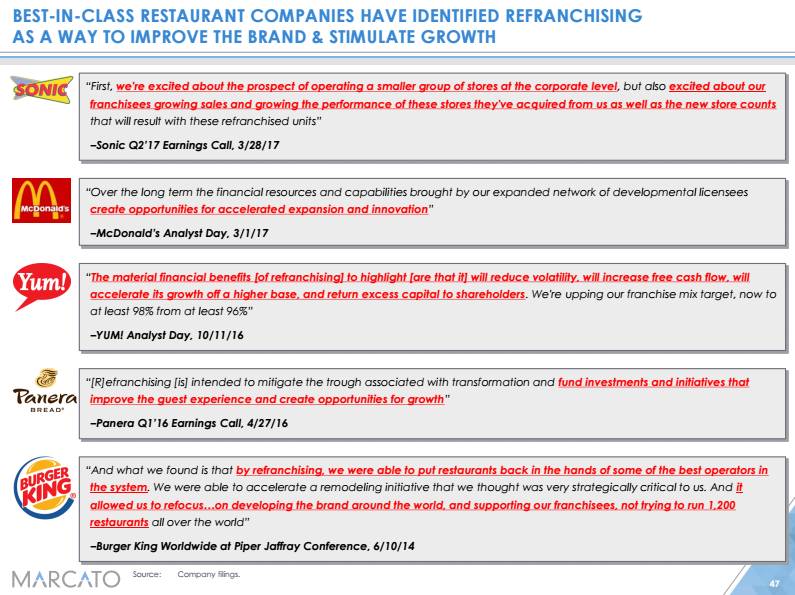

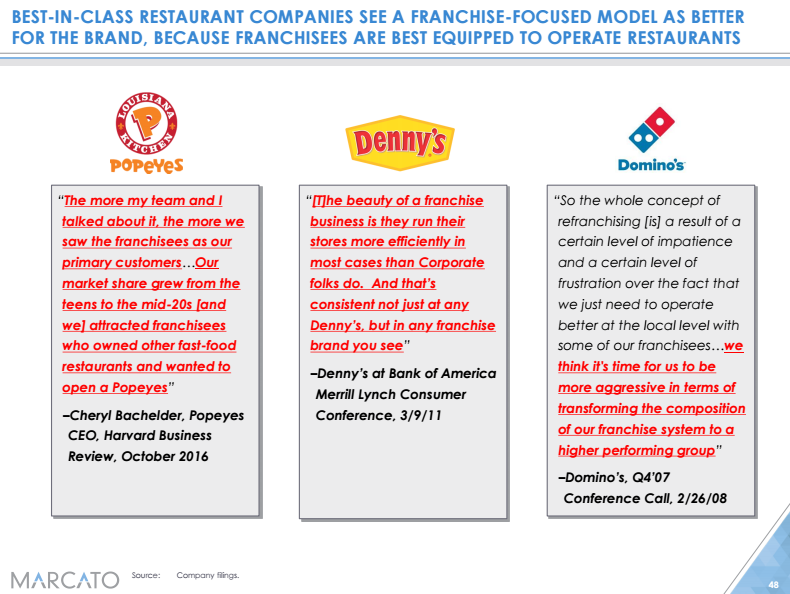

What is new this time, though, is that Marcato is now asking fellow shareholders to vote for a board shake-up at the company on Thursday. Marcato’s aim is to transition the company more toward franchise ownership, which it claims leads to more efficient management.

Buffalo Wild Wings doesn’t seem like it’s budging.

“Over the past decade, Buffalo Wild Wings’ performance has consistently led the casual dining industry, delivering superior results to our shareholders while providing a differentiated guest experience to our customers,” a representative told Business Insider.

"Under CEO Sally Smith's leadership since its IPO in 2003, the company has generated total returns for shareholders of 1697%. In fact, $10,000 invested in Buffalo Wild Wings stock at the IPO was worth more than $175,000 on March 31, 2017. The company has continued to innovate and pursue cost savings initiatives amid difficult market conditions for the sector and remains focused on creating sustainable value for our shareholders."

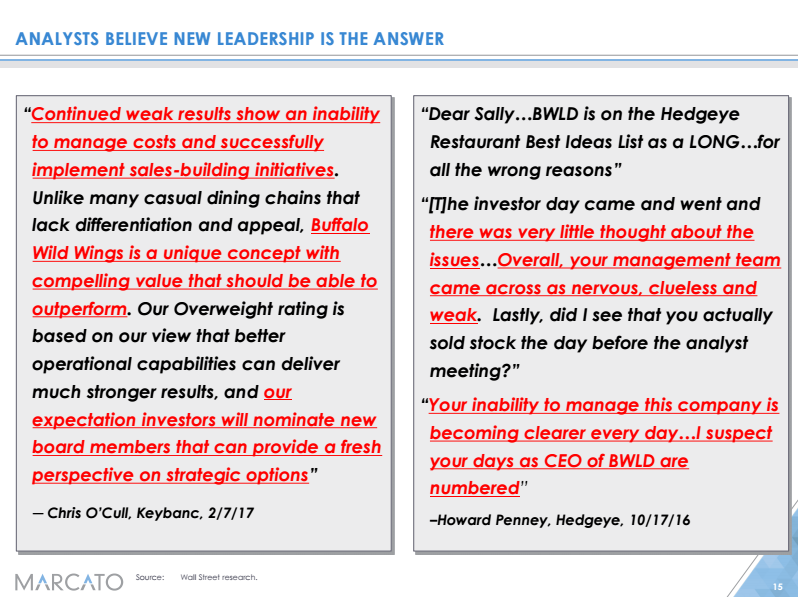

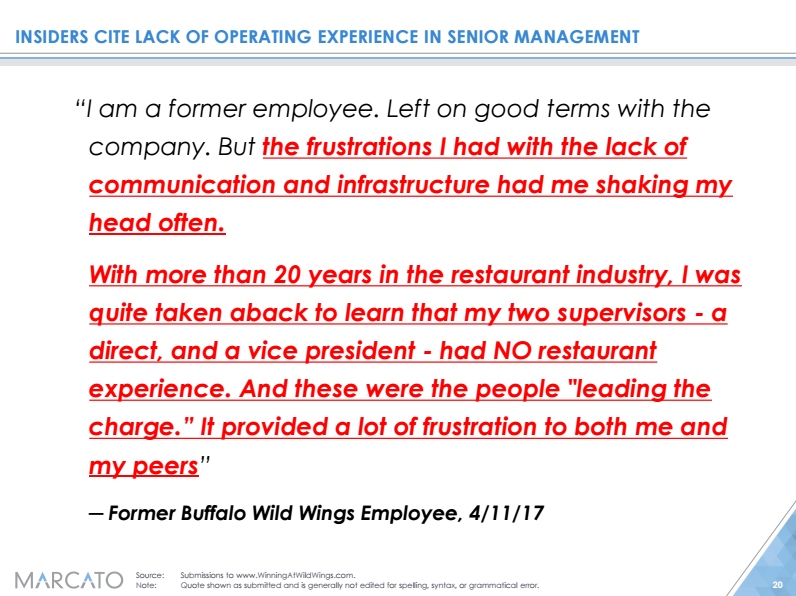

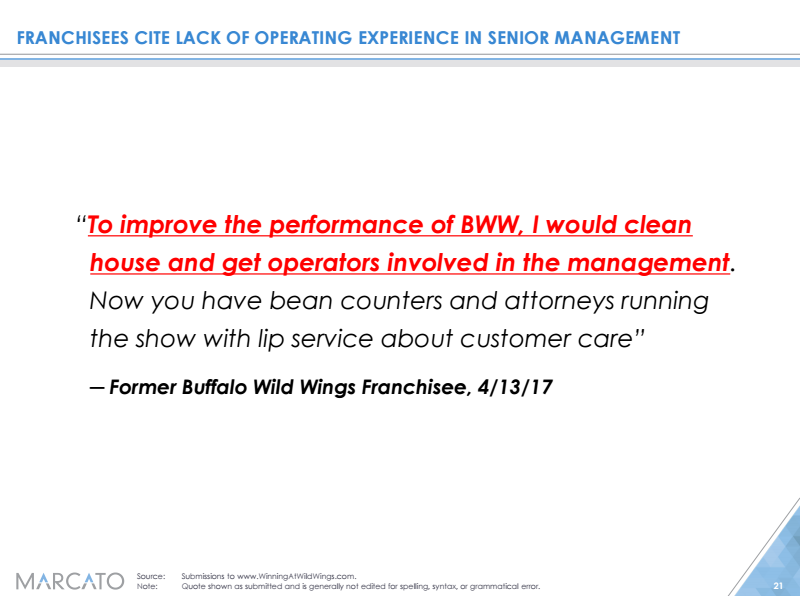

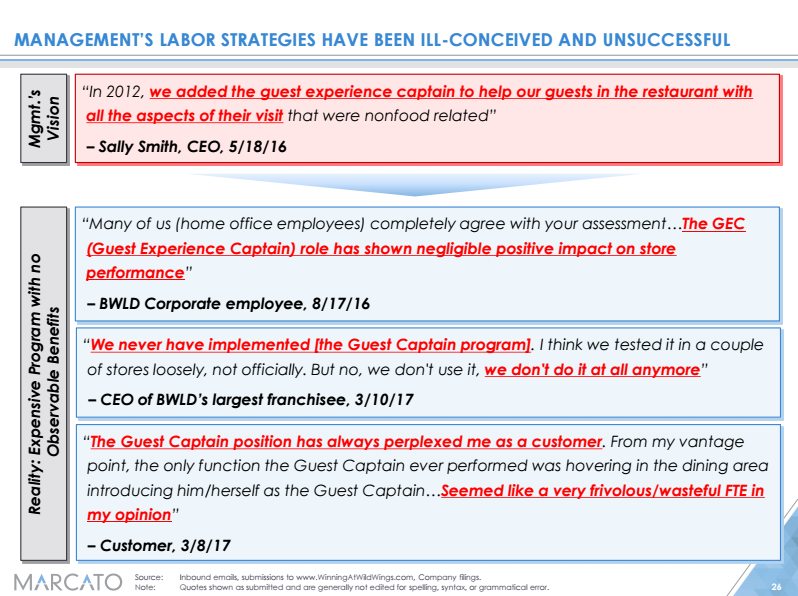

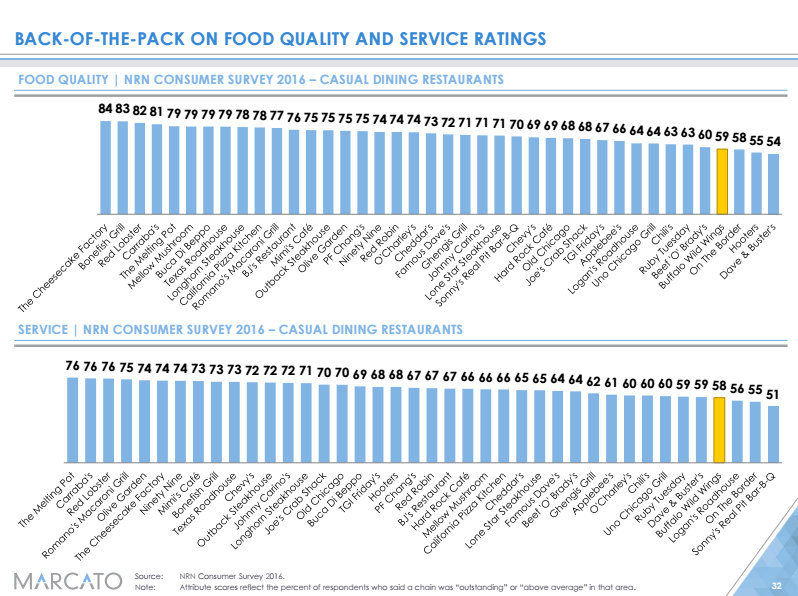

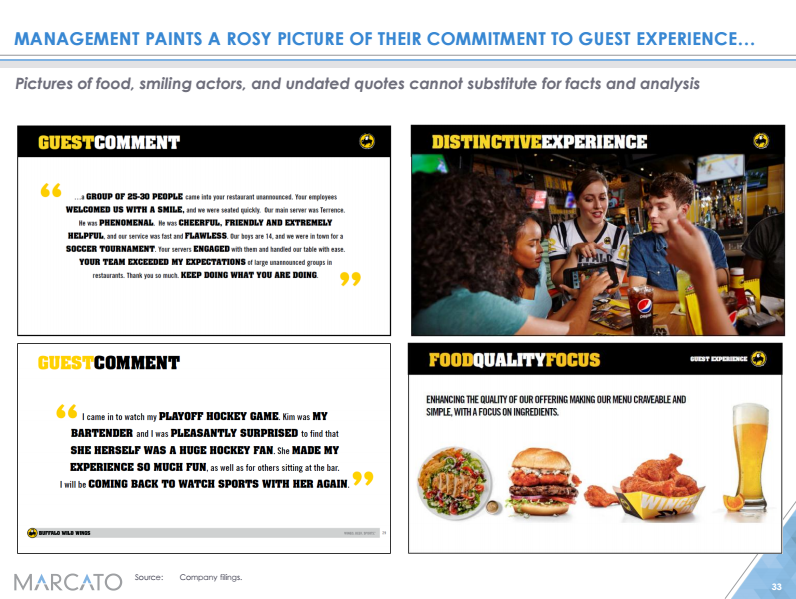

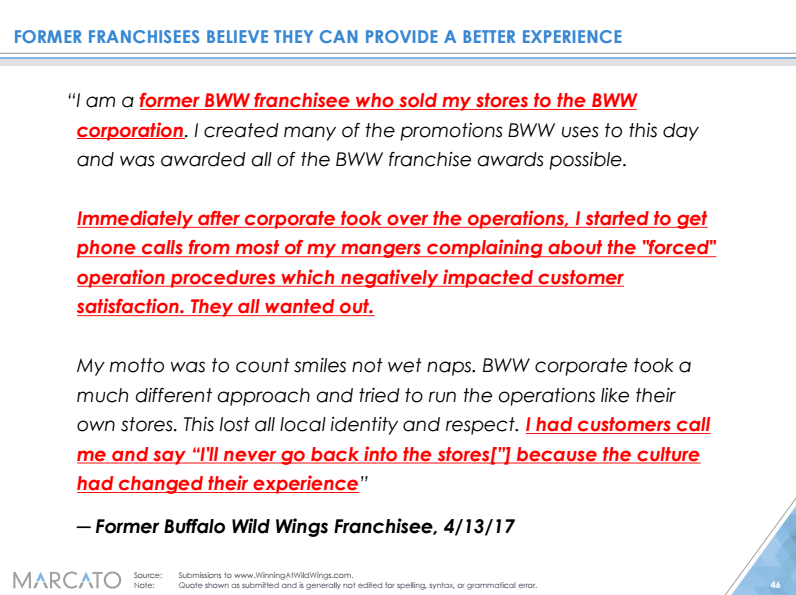

What's also interesting here is that this presentation doesn't just include your run-of-the-mill hedge fund number-crunching. It's full of quotes from former Buffalo Wild Wings employees and customers bashing the company.

Some gems:

"Several of the BWW expats have had communication over the last couple of days. Just wanted to let you know that the assessment of you and your team, as it relates to the challenges with Buffalo Wild Wings, are spot-on and things that literally we have been talking about and trying to change for years." - a former Buffalo Wild Wings executive, August 19, 2016

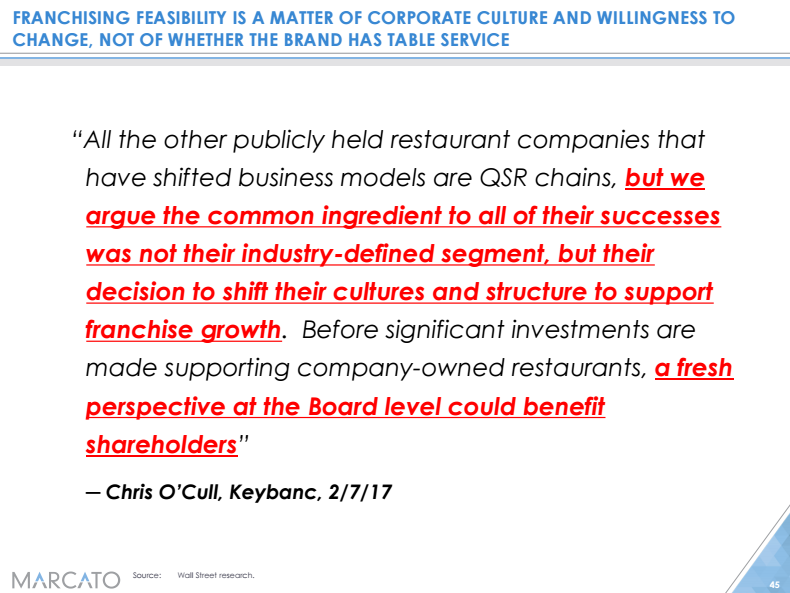

"We are surprised the company's investor presentations continue to center on tactical efforts, like FastBreak Lunch and Wing Tuesday, and secondary strategic priorities, like international development and new concepts, rather than full explanations for why traffic is declining, how costs will be reduced or why the business model is appropriate. It is not clear to us the issues and alternatives are fully understood." - Chris O'Cull, Keybanc, February 7, 2017

And from one not-so-happy customer:

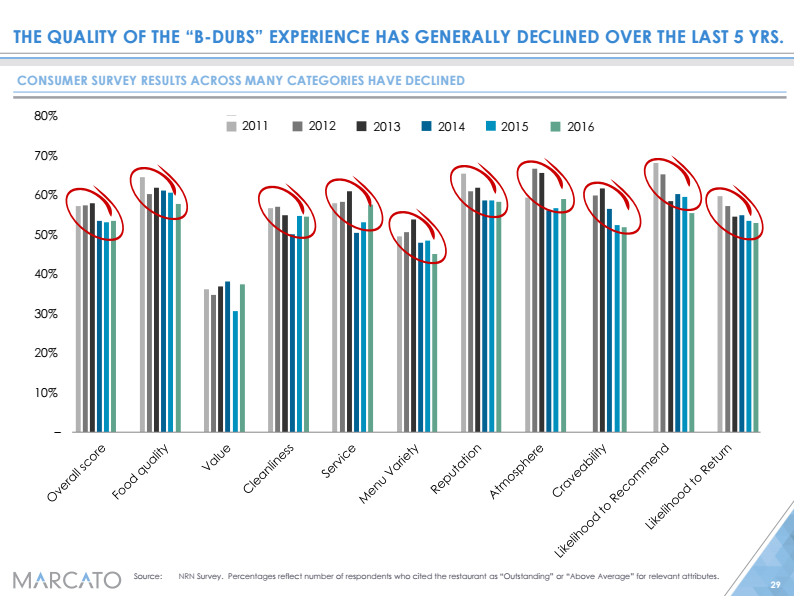

"The service is atrocious. ... This is a common complaint among others that I have discussed my frustrations with regarding BWW." - February 22, 2017

More in the deck - the good stuff starts around slide eight. Enjoy!