- Apple says it will no longer report iPhone sales numbers.

- The move can only be interpreted negatively.

- “Some people may fear that this now means that the iPhone units are going to start going negative year over year because it’s easier to talk about great things and not show the details of things that aren’t so great,” the Citi analyst Jim Suva said.

- Global data shows smartphone sales declining, and CEO Tim Cook has previously said he is comfortable with that.

Apple announced Thursday night that it would no longer be reporting iPhone sales numbers – or sales numbers for any of its products – on future earnings calls. Investors hated it: AAPL stock tanked 7% on the news in after-hours trading and was still down 5% in premarket trading before the New York exchanges opened Friday.

The disclosure can only be interpreted negatively. The Citi analyst Jim Suva summed it up perfectly on the earnings call Thursday night. He told CEO Tim Cook and CFO Luca Maestri:

“Some people may fear that this now means that the iPhone units are going to start going negative year-over-year because it’s easier to talk about great things and not show the details of things that aren’t so great.”

In a later note to clients, Suva said that the move “left investors speechless” and that “some investors will view this as a negative that the company is trying to hide information that in the past was so important to assess the company’s strength.”

Friday morning, Walt Piecyk, the respected tech analyst at BTIG Research, agreed. He told the Financial Times, “It’s certainly not a good look for Apple in the eyes of consumers when analysts are quoting ASPs,” the average sales prices, “that are rising by double digits.”

"By not reporting units," he added, "it effectively removes the discussion of rising prices from mainstream media stories."

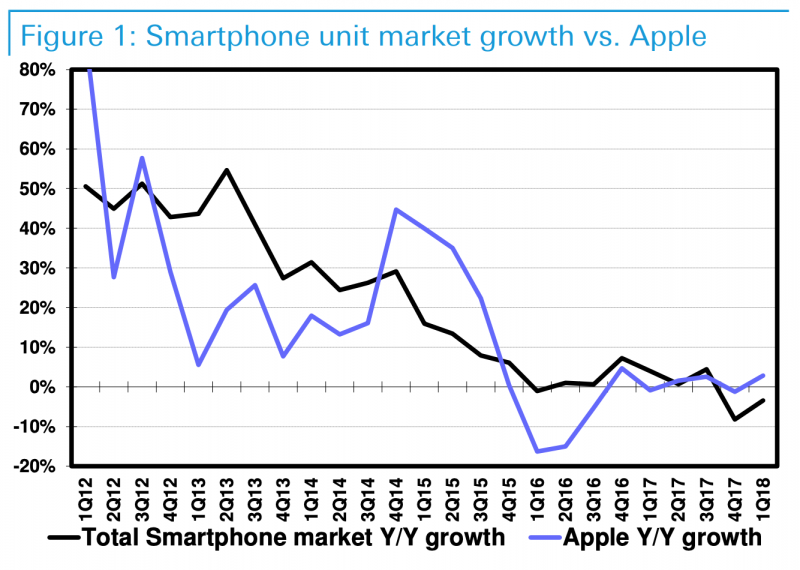

If Apple is worried the iPhone is entering a decline, then not reporting its sales numbers helps it avoid that negative PR. On Friday, many analysts openly worried in notes to clients that the move was an indicator that iPhone growth was over and that negative unit sales growth lay ahead.

There is almost no other way to interpret the move

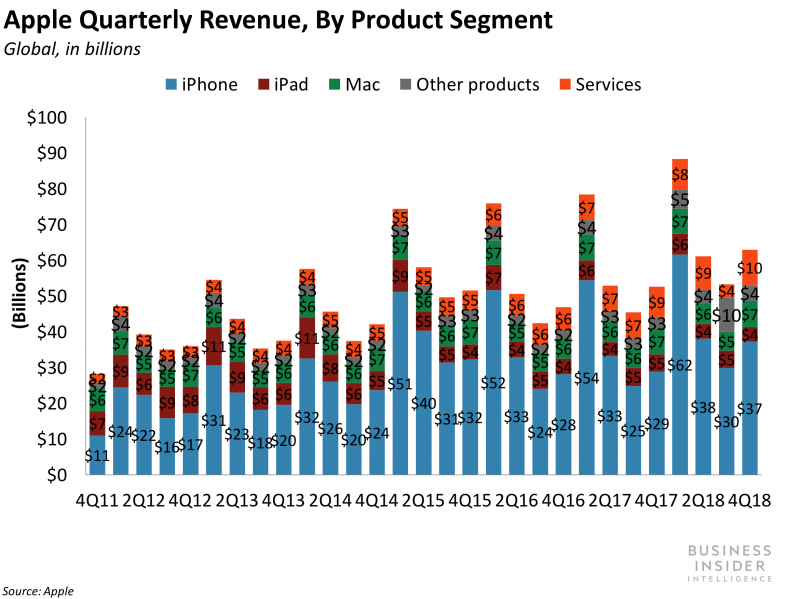

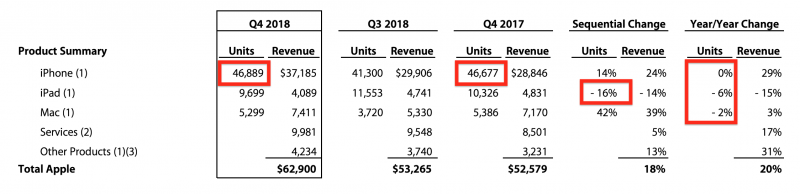

On the call, Cook and Maestri tried to explain that they believed unit sales had become less important than total dollar revenue. There is some logic to this. In recent years, especially since the iPhone X was introduced, Apple has increased its revenue largely by raising the price of the iPhone, not by selling more phones. Actual sales have barely moved. This set of numbers from Thursday night's earnings tells the tale: dollars going up but actual products flat or in decline:

Cook and Maestri tried to convince analysts that Apple's other lines of business were increasingly important. Sales of "Services" - the App Store and other paid software downloads - increased by 17%, for instance. And, Cook said, the "installed base" of existing iPhones had become so big that it was more important for sales than the much smaller number of new units they sell every 90 days. The installed base is what is driving Services sales. People own an iPhone for years, and they continually pay to download music and apps. That is Apple's growth business now.

"Our installed base is growing at double digits," Cook said. "And that's probably a much more significant metric for us from an ecosystem point of view and the customer loyalty, etc."

Notably, Cook did not promise to replace the unit-sales stat with a new stat on the size of the total installed base.

So, that's Apple's case.

Cook has all but acknowledged the iPhone is in decline

But here is the grim reality Cook did not talk about: The iPhone is most likely entering a decline. We know this because Cook came close to saying it on his previous earnings call, when he said of the smartphone market: "It's an enormous sized market and whether it grows, from our point of view, whether it grows 1% or 2% or 5% or 6% or 10% or shrinks 1% or 2%, it's a great market because it's just huge. And so that's kind of the way that I view that."

More objectively, smartphone sales data has been signalling the decline of the iPhone for years. The global context is that the iPhone rarely gets better sales than the smartphone market as a whole, and the smartphone market as whole is slowing down - implying that the iPhone will too.

Analysts hate it

Analysts will hate this. Like it or not, the iPhone accounts for 59% of Apple's revenue. Apple is the iPhone company, by definition. So when the company moves to conceal how the iPhone is doing, that's bad.

On Friday morning, the Wedbush analysts Daniel Ives and Strecker Backe called the pullback a "jaw dropper" and "frustrating." "The Street will find this a tough pill to swallow this morning as the transparency of the Cupertino story takes a major dent," they said, adding, "The skeptics will point to Apple doing this right at the critical juncture where higher ASPs are making up for slower unit sales."

Similarly, Nomura's Jeffrey Kvaal and his team stuck the knife in. "We do not find Apple's rationale for the reduced disclosure well considered," they said. "We disagree with Apple's view that a unit of sale is less relevant; on the contrary, we consider it an indicator of the health and growth of the ecosystem."

They added: "Consumers are not choosing a range of different iPhones at different price points like items in a shopping cart. Consumers are choosing only one iPhone; we care how much they pay."

Guggenheim's Robert Cihra and Amil Patel said, "We think investors will dislike it as it could foreshadow trying to hide unit declines."

And Ben Schachter of Macquarie added, "Long time AAPL watchers will clearly be disappointed by this and the assumption is that units are very likely to turn negative for the near-mid-term and that is why AAPL is making the disclosure change."

Some analysts have already hinted they no longer trust Apple

Some analysts have signaled in the past that they no longer trust Apple's numbers. In 2016, Ben Thompson of Stratechery and the Pacific Crest analysts Andy Hargreaves and Evan Wingren all said they thought Apple's description of some iPhone sales metrics were misleading.

And in 2014, Barclays' Ben Reitzes had the temerity to ask Cook, "Are you still a growth company?" - implying that Apple had lost the ability to increase the market for iPhone.

Now we may have an answer to that question. The iPhone has reached a peak, and Apple wants to leave it at that.