Netflix

- In 2021, the total amount of debt that South Koreans ran up exceeded the country's GDP by 5%.

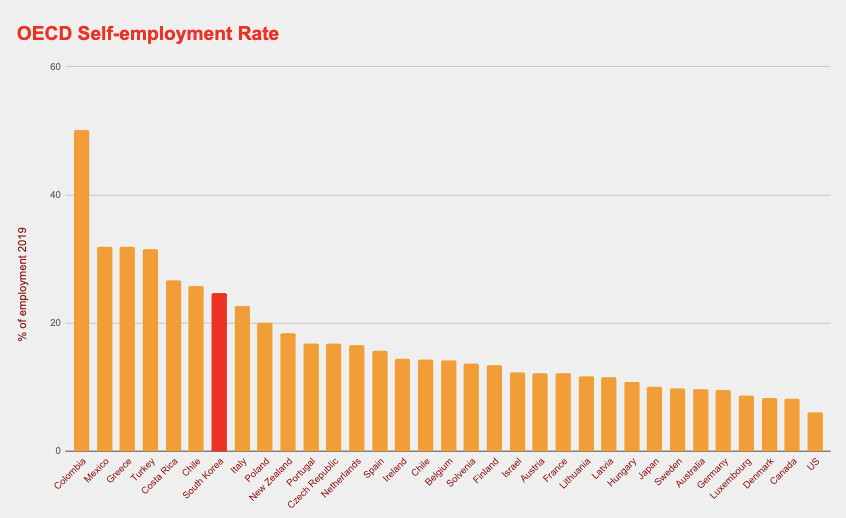

- About one in four South Koreans is self-employed, making them vulnerable to economic downturns.

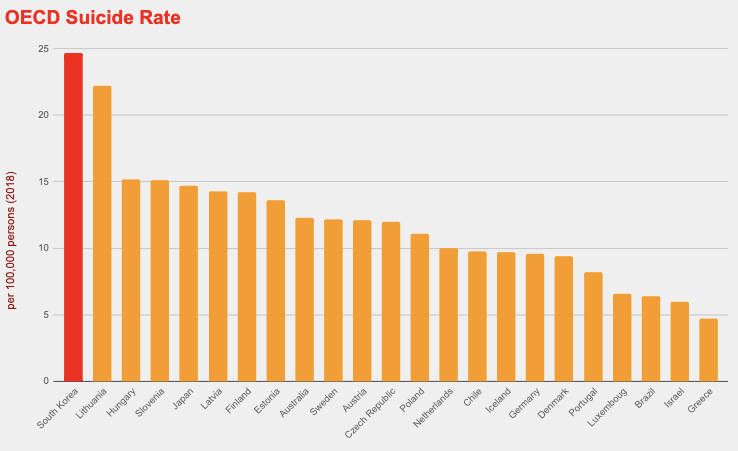

- South Korea has the highest suicide rate among OECD countries.

In the South Korean Netflix hit "Squid Game," 456 people are in so much financial strain that they are driven to join a deadly survival game. While the show has become an international sensation, many South Koreans are less than entertained by what they say is an accurate portrayal of an unforgiving society.

"At the heart of the show's dark story is the frustration felt by the average Korean, and particularly Korean youth, who struggle to find employment, marriage, or upward mobility – proving that grim economic prospects are indeed at the center of Korean society's woes," the State Department reported in a diplomatic cable, per Foreign Policy.

Now, with the next South Korean presidential elections coming up in March, presidential hopefuls are pledging to even out economic inequality in the country.

We've put together six charts that show just how badly the numbers are stacked against the average South Korean.

The average South Korean couldn't pay off all their debt even if they saved every cent for a year

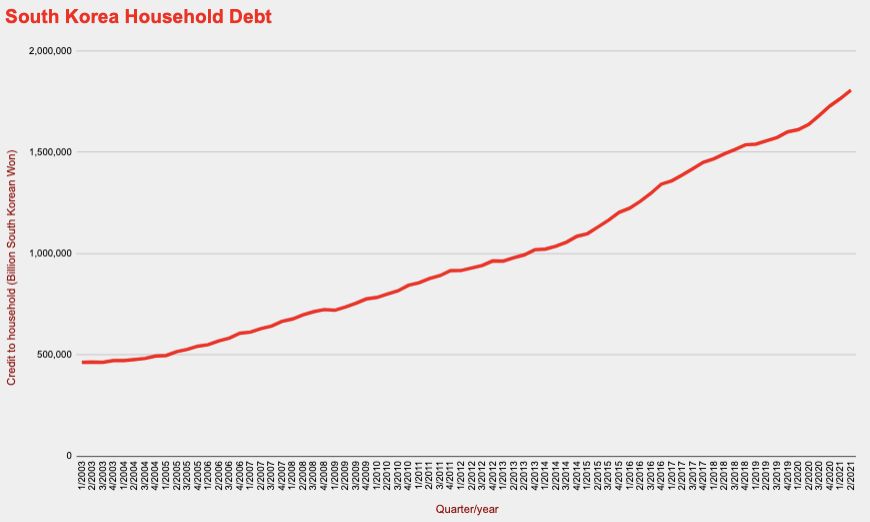

Household debt levels in South Korea are among the highest in the world. At the end of June, debt levels stood at 1,805 trillion South Korean won ($1.5 trillion), according to the Bank of Korea.

In 2021, the total amount of debt that South Koreans ran up exceeded the country's GDP by 5%. This means that even if a person saved every dollar they earned for an entire year, they would still be unable to pay off what they owed. The US, for comparison, has a much lower debt-to-GDP ratio, which was below 80% in the first quarter of the year.

South Korea's household debt levels have been steadily climbing since the 2000s:

Bank of Korea

Property price gains in South Korea have outpaced wage gains

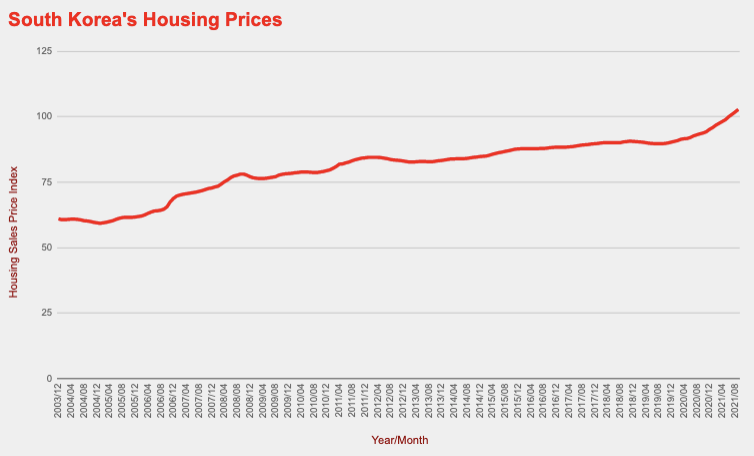

Soaring household debt levels are partially tied to soaring property prices. In particular, real-estate prices in the capital city Seoul - where about half the population lives - saw a spike of 22% in 2020, real-estate consultancy Knight Frank estimates.

Bank of Korea

"High levels of household debt and rapidly rising real estate prices driven by very low interest rates create significant potential economic risks," Raji Biswas, chief economist for IHS Markit's Asia-Pacific, told Insider. "A key concern is that a significant increase in interest rates due to rising inflation pressures could result in rising financial stress on households, as well as potentially triggering the potential bursting of a property sector bubble."

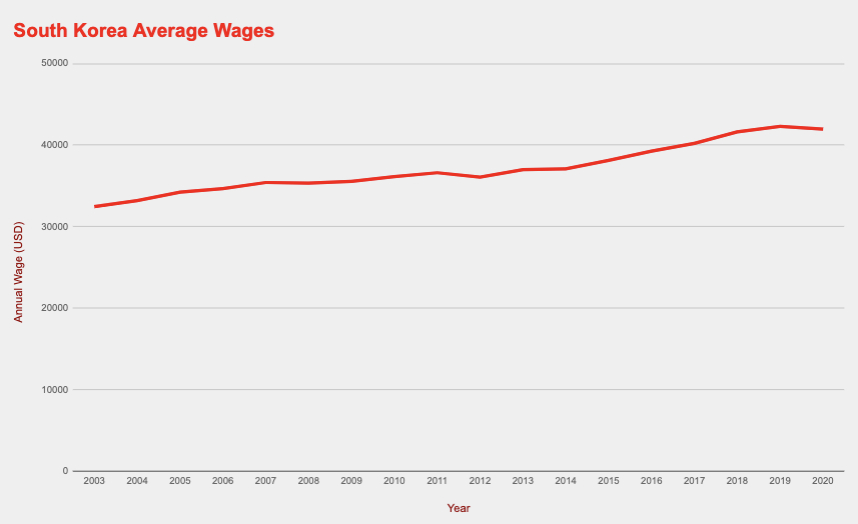

While prices of newly built and existing homes have been rising relentlessly over the years, average wages have not climbed as steeply in the same period.

The average wage in South Korea fell by 0.8% in 2020 amid the pandemic, according to Organization for Economic Cooperation and Development (OECD) data.

OECD

South Korea has a high-self employment rate, which means many workers are vulnerable to economic downturns

South Korea's economy grew spectacularly from the late 1970s through to the 1990s, creating a wealthy middle class and stable job-for-life career paths. But the 1997 Asian Financial Crisis triggered a massive wave of job losses. Many of those who lost their jobs had no other options than starting their own businesses.

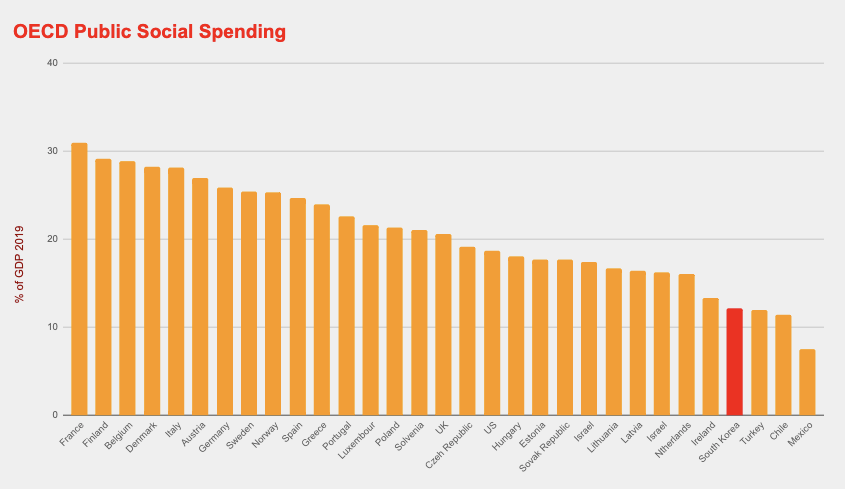

"As Korea's social safety net is not strong enough yet, the unemployed cannot remain jobless for long. They must do whatever they can," Ha Joon-kyung, a professor in the Department of Economics at Hanyang University, explained to the Korea Times earlier this month.

As the chart below shows, South Korea ranks at the very bottom of OECD countries when it comes to public spending, with only Turkey, Chile, and Mexico devoting less of their respective GDPs to social causes in 2019.

OECD

Today, South Korea's self-employment rate is one of the highest among OECD nations. The self-employed are particularly vulnerable to economic downturns, and using personal borrowings to fund business needs is part of the reason why South Korea's household debt level is the highest in Asia.

OECD

South Korea has the highest suicide rate among all OECD countries

In 2018, Korea had the highest suicide rate - 24.7 per 100,000 people - of all OECD member countries. This rose to 25.7 per 100,000 people in 2020, according to data service Statista. Although the figure has come down from a high of 33.8 per 100,000 people in 2009, it's still far higher than the average 11 per 100,000 among OECD countries in 2018.

The top reason for suicide among South Koreans is financial stress, according to Nodutdol, a New York-based organization of diasporic South Koreans. Last year, South Korea's personal bankruptcies hit a five-year high of 50,379, court filings show, per the Korea Herald.

In September, a memorial was held for at least 22 small-business owners in South Korea who died by suicide during the pandemic, highlighting the financial stress faced by the self-employed during this time, the UPI reported.

OECD

The government has had little success curbing debt

The day of reckoning may have come, as authorities are concerned about high household debt levels and risk to the economy.

In August, South Korea's central bank was the first Asian economy to raise benchmark interest rates, a significant move since the pandemic is ongoing. But household debt levels still pushed higher in September from a month earlier.

Earlier this month, authorities said they will implement stricter income-based lending rules going into effect next year to rein in household debt earlier than planned, reported the Korea Herald.

"Borrowing within your means and paying your loans back little by little would be the starting point of household debt management," Financial Services Commission Chairman Koh Seung-beom said in a statement, per The Investor from the Korea Herald.

Dit artikel is oorspronkelijk verschenen op z24.nl