LONDON – Every year, the Bank of England tests banks on how resilient they would be in the event of a global economic catastrophe.

The process, known as stress testing, sees how much the UK’s biggest banks would lose under different scenarios, and whether they have enough capital to survive those losses.

This year, the BOE is using two different scenarios. The first models the effect of a huge UK recession, a rise in interest rates and sterling collapse against the dollar.

The second, known as the exploratory scenario, tests how banks would cope with increased competition and a bank rate cut to zero.

Here is how it looks:

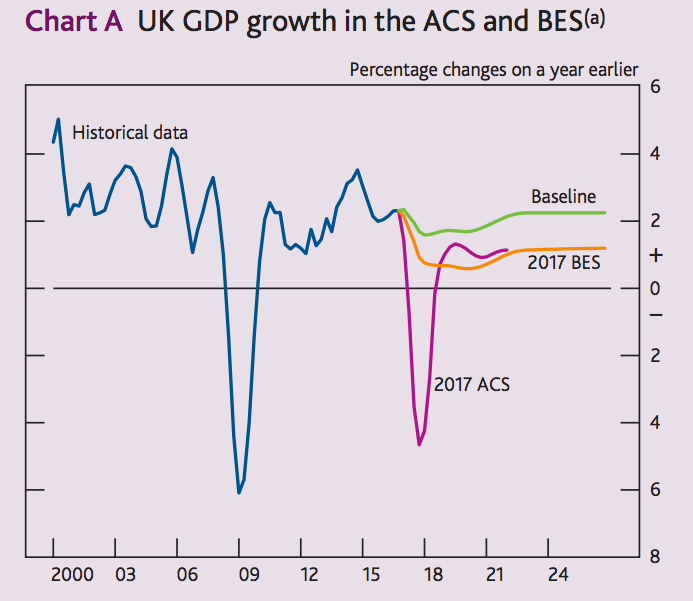

The primary UK scenario is grim. The BOE will model the effects of a sharp recession of more than -4% GDP. This is accompanied by the pound collapsing to just $0.85, a fall of about a third from current values.

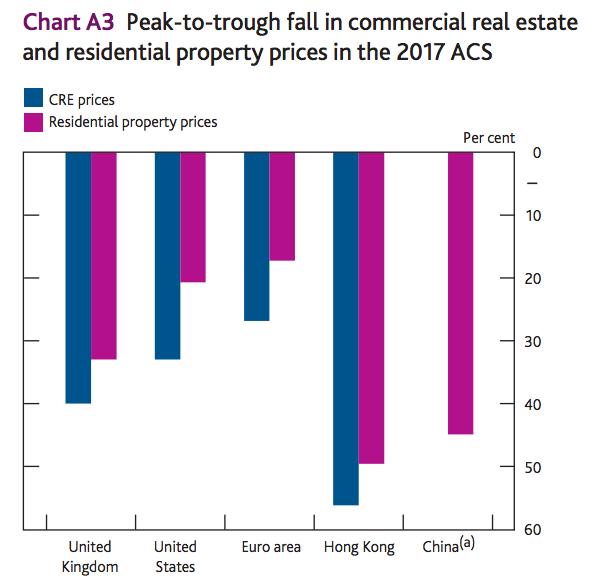

Global growth is also hit, with banks tested on how they would cope with a worldwide contraction of 2.4%. This detailed scenario also includes a collapse in Chinese commercial real estate of more than 40%.

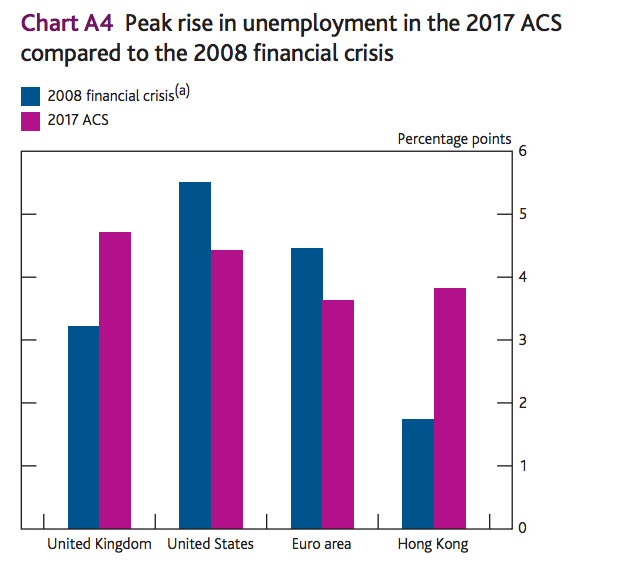

As a result unemployment spikes, higher than the 2008 financial crisis.

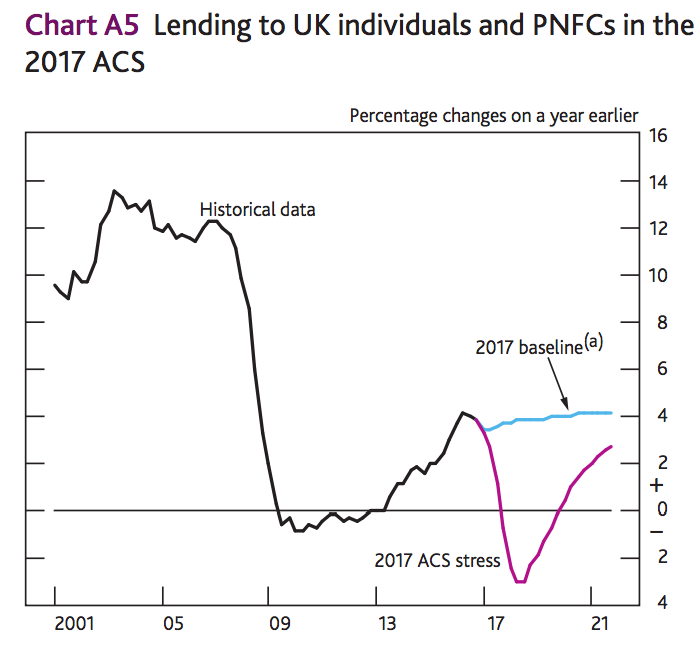

And commercial lending crumbles.

Leading to disaster in the property market. House prices fall by 33% and commercial real estate loses 40% of its value.

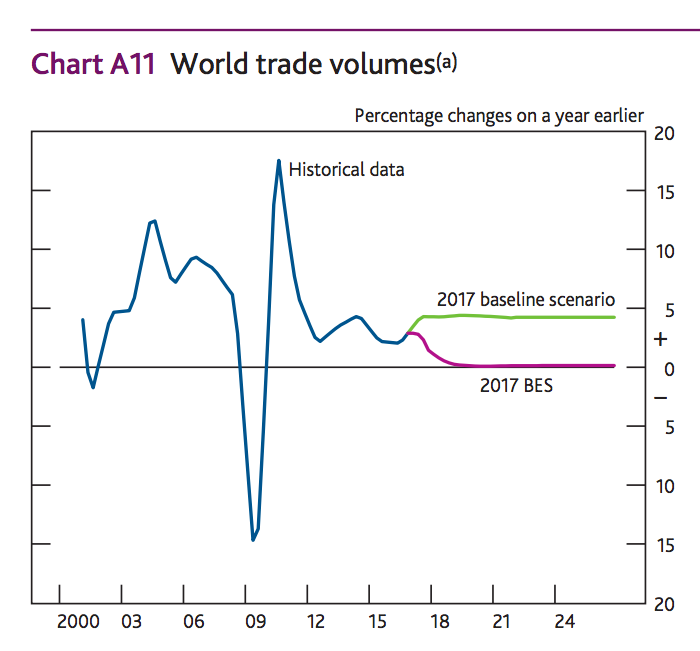

International trade falters in the wake of the economic crisis, under the second exploratory scenario, while banks will be forced to prove that their business models are flexible enough to handle the damage.

And here is the overall roundup