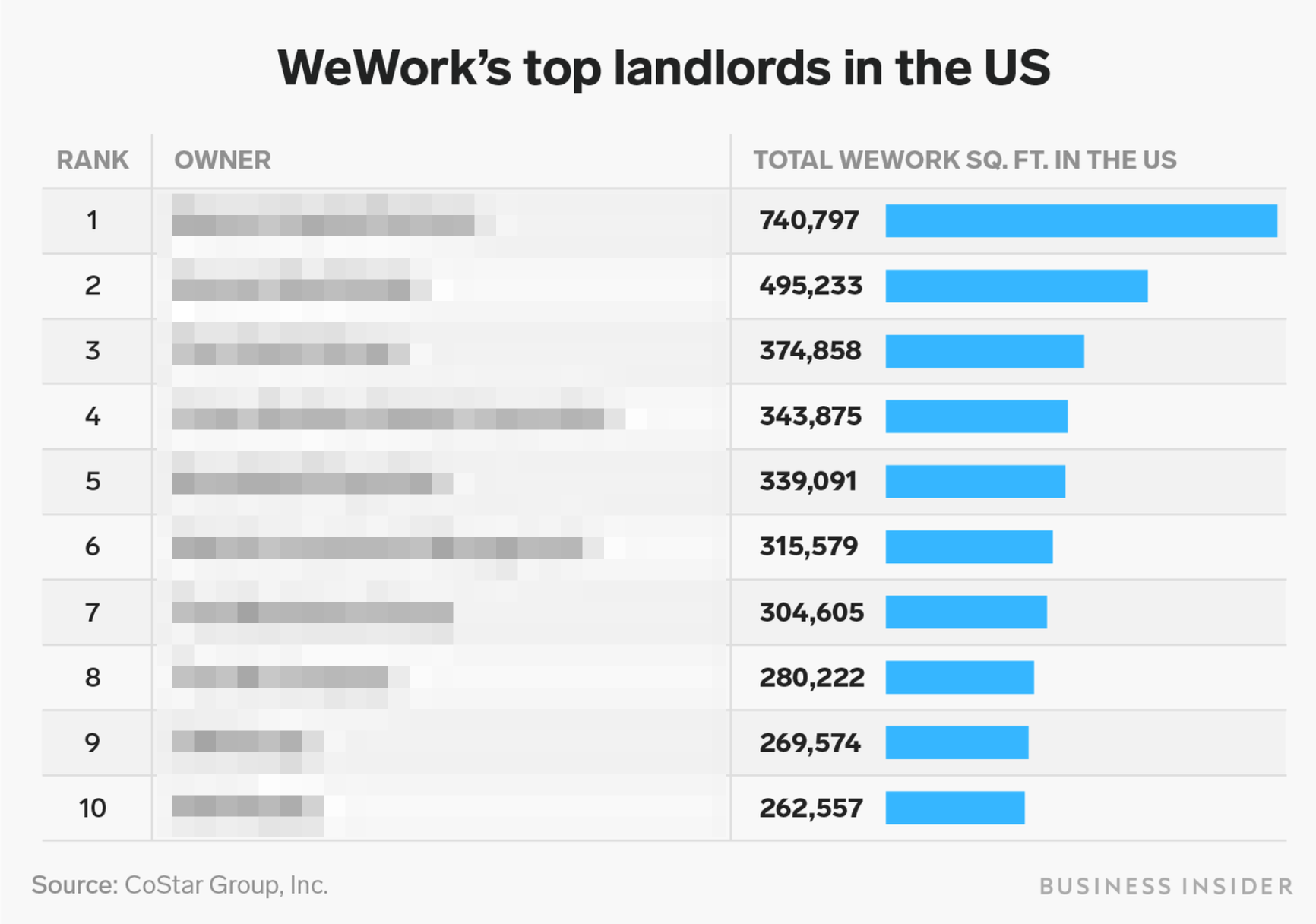

- Business Insider analyzed who WeWork’s biggest landlords are, according to data from CoStar group and a list provided by the company itself.

- The list provides one of the most comprehensive looks so far at who’s leasing to the coworking company as it prepares to go public.

- With a hotly anticipated IPO on the horizon and details of WeWork’s financials – and wide losses – emerging, more attention is being paid to the company and those that touch it.

- You can read the full list here.

WeWork’s landlords have, so far, avoided much of the media coverage swarming around the startup.

Business Insider took a look at who’s leased out the most square footage to the fast-growing, but money-losing, coworking company.

We analyzed June numbers from real estate data provider CoStar Group to understand who’s renting to flexible office provider WeWork in the United States. Since its 2010 founding, WeWork has upended the staid real estate industry, shot to the top of tenant lists in cities like New York, and its valuation has ballooned to $47 billion. It’s now laying the groundwork to go public.

With a hotly anticipated IPO on the horizon and details of WeWork’s financials – and wide losses – emerging, more attention is being paid to the company and those that touch it.

To be sure, WeWork's landlords are keeping their total exposure to the company relatively small, though they work with competing coworking firms as well. Coworking is seen as primed for explosive growth, and large real estate companies will have to decide how much they want to work with young flex-space firms that haven't been tested through a downturn.

WeWork said there were inaccuracies in the CoStar data, but declined to provide a list of its US landlords. It did give Business Insider a list of its top 20 global landlords, but did not include square footage. That global list from WeWork contained six of the 10 names listed in CoStar's US data.