- In August, coworking company WeWork publicly filed its IPO paperwork. It was last privately valued at $47 billion.

- Since then, WeWork has had an exceptionally bad few months, as potential investors got their first look at WeWork’s financials and people began to dig into the past behavior and business dealings of the company’s CEO, Adam Neumann.

- In September, The Wall Street Journal reported that Neumann would be stepping down as CEO, but remain as chairman.

- Since then, the company has named new co-CEOs and shelved its IPO. Now, SoftBank is taking control of WeWork, according to The Wall Street Journal, and giving Neumann $1.7 billion to leave the board.

- With so much happening, we’ve tracked everything in one place so you can catch up.

- Visit Business Insider’s homepage for more stories.

Since August, WeWork’s original plan to go public has steadily spiraled downhill.

Since the company publicly filed its IPO paperwork, WeWork’s mounting losses, corporate governance, and the behavior and business dealings of its eccentric CEO have been increasingly criticized, eventually leading it to shelve its plan to go public indefinitely.

Top staffers continue to pour out of the company, CEO and cofounder Adam Neumann has stepped down, and the company’s valuation has plummeted. Now, SoftBank will take control of WeWork, and Neumann will leave the board, The Wall Street Journal reported.

To bring you up to speed, here’s everything that happened at WeWork since it filed its paperwork to go public.

AUGUST 14: WeWork publicly filed paperwork detailing its intent to go public.

The coworking company was last privately valued at $47 billion. Then, its filing with the Securities and Exchange Commission revealed billions in losses, a huge collection of leases, and plans to continue spending aggressively.

Filings also revealed that CEO and cofounder Adam Neumann owned several of the buildings leased by WeWork. According to documents in the filing, WeWork's' parent company, The We Company:

- Lost $429 million on $436 million in revenue in 2016.

- The following year, that loss increased to $890 million as revenue grew to $886 million.

- In 2018, WeWork lost $1.6 billion on $1.8 billion in revenue.

- For the first six months of 2019, the firm posted a loss of $690 million on $1.5 billion in revenue.

WeWork loaned millions to Neumann and other executives.

The IPO paperwork revealed that WeWork loaned CEO Adam Neumann $7 million in 2016, which he paid back in 2017.

WeWork also loaned several million each to three other executives, all of which was paid back except for a $600,000 loan to Artie Minson, which was forgiven.

WeWork also loaned millions to We Holdings LLC, of which Neumann is a managing member.

CEO Adam Neumann cashed out $700 million from the company ahead of its IPO.

The Wall Street Journal reported that Neumann cashed out $700 million in stock options before the company's IPO, an unusual move that raised eyebrows as founders typically wait until after their startup goes public if they believe the stock's value will increase.

Previous reports confirmed that Neumann made millions through leasing his buildings in New York and San Jose to WeWork.

Neumann positioned his stock in the We Company to maintain control long after the IPO.

Adam Neumann, like many startup CEOs, holds shares that will give him extra votes. His stock was worth 20 votes per share, twice as many as votes held by other CEOs.

The company faced criticism for its lack of female leadership.

According to the IPO filing, the We Company did not have a single woman on its 7-person board of directors.

AUGUST 15: Morgan Stanley backs out of WeWork's IPO.

The bank withdrew from the IPO after losing the lead underwriter role in the deal.

AUGUST 21: Presidential candidate Andrew Yang called WeWork's $47 billion valuation "utterly ridiculous" in a tweet.

For what it’s worth I agree with @profgalloway that WeWork’s valuation is utterly ridiculous https://t.co/CiqLasP5Sk if they are a tech company so is UPS. UPS trades for 1.4x revenue not 26x.

— Andrew Yang🧢⬆️🇺🇸 (@AndrewYang) August 21, 2019

Yang shared a Business Insider article in which an NYU professor called the company "WeWTF."

SEPTEMBER 4: WeWork hired a former Uber executive to handle company culture and combat accusations of discrimination.

In early September, WeWork brought Harvard Business School professor Frances Frei on board after the company was criticized for a lack of female directors.

At Uber, Frei had been charged with fixing a toxic corporate culture.

AUGUST 27: A report details that top human resources officers have left WeWork in recent months, and some blamed Neumann.

Nearly a dozen HR officials left the company in the year leading up to the S-1 filing, according to The Information's Cory Weinberg, including the department interim head, the senior director of talent acquisition, and the head of people strategy.

Before that, at least five more top HR officials left between 2015 and last year, including the chief HR officer. Several reported disagreements with Neumann. At least two former HR officials filed sexual harassment claims against the company, according to the report. One of these cases claimed the equity awards went almost exclusively to men.

SEPTEMBER 4: Neumann gives back the $5.9 million WeWork paid him to use the "We" trademark after the deal was widely criticized.

Ahead of the IPO filing, WeWork officially rebranded as The We Company, and paid CEO Neumann almost $6 million for trademark rights as managing member of We Holdings, LLC.

After this came out in the IPO paperwork , the deal was widely criticized. Soon after, WeWork released an updated filing stating the Neumann returned the money to the company, which retained its trademark on "We."

SEPTEMBER 5: WeWork considered cutting its IPO valuation by more than 50%.

The Wall Street Journal and Bloomberg reported on September 5 that The We Company was considering cutting its IPO valuation from $47 billion to $20 billion. It also began thinking about delaying the IPO.

SEPTEMBER 9: SoftBank, WeWork's biggest shareholder, asked to put the IPO on hold.

WeWork's largest outside shareholder urged the company to postpone the IPO due to the lack of investor interest even after the company halved the IPO valuation it was seeking. Softbank has invested more than $10 billion in WeWork, its latest valued the company at $47 billion.

SEPTEMBER 12: The Financial Times reported that WeWork was debating limiting the power of Adam Neumann and his wife, Rebekah.

The company was reportedly considering reducing Neumann's voting power of 20 votes per share.

The company and advisers also considered removing Rebekah Neumann from her role in naming a successor if her husband died or became unable to run the company.

SEPTEMBER 13: WeWork's board announced changes to company governance, including Neumann's authority.

In an updated S-1 filing, the company said that it would hire a lead independent director by the end of the year, and another next year. It also announced plans to list its shares on the Nasdaq index.

WeWork slashed Neumann's voting power from 20 votes per share to 10 votes per share.

Neumann agreed to a 10% limit on the amount of stock he can sell in the second and third years after the IPO, and said that he will pay back profits from real estate deals with the company.

WeWork also removed cofounder Rebekah Neumann from succession planning and banned her from the board.

Investor pushback led WeWork to remove Rebekah's Neumann's influence from the company, according to an updated September 13 SEC filing.

WeWork was rumored to now be considering an even lower IPO valuation: $10 billion.

Reuters reported on September 13 that WeWork did not feel confident that the changes in governance would convince investors concerned about its path toward profitability to reconsider.

SEPTEMBER 16: The IPO was officially delayed.

On September 16, Reuters reported that the IPO was indefinitely delayed until at least October.

"The We Company is looking forward to our upcoming IPO, which we expect to be completed by the end of the year," WeWork said in a statement.

SEPTEMBER 17: WeWork bonds fell at a record pace after the company delayed its plan to go public.

After delaying its IPO, WeWork's bonds fell as much as 7 cents on the dollar, the most since they were issued in April 2018.

SEPTEMBER 18: An exposé from The Wall Street Journal details Neumann's hard-partying behavior and management style.

The Wall Street Journal's Eliot Brown reported that Neumann asked his staff to fire 20% of employees each year as a cost-cutting measure, and his wife Rebekah Neumann asked that some employees be fired after meeting them for just a few minutes.

The Journal also reported that Neumann once announced layoffs and then sent around tequila shots before Darryl McDaniels of Run-DMC burst into the room for a surprise concert.

The piece also detailed Neumann's alleged marijuana use and how his love of flying high once resulted in a private jet being recalled in Israel after the plane's crew discovered marijuana hidden in a cereal box onboard.

SEPTEMBER 20: A Manhattan WeWork tenant found its weak cybersecurity exposed sensitive information from its tenants.

Poor WiFi security allowed one WeWork tenant to view private information including bank accounts details and drivers' licenses from other companies in the building.

A report revealed that WeWork's chief investment officer of its real-estate fund resigned.

WeWork's chief investment officer of its ARK real-estate fund, Wendy Silverstein, resigned in mid September. She told The Real Deal that she left to care for her elderly parents and that her departure did not have to do with the company's recent IPO struggles.

She was one of many high-profile exits from WeWork in the past year.

Business Insider reports that a former WeWork executive sued the company alleging discrimination, and later withdrew the suit.

The former WeWork executive, Richard Markel, described a "cultish" culture of endless alcohol and mandatory sleepovers until he was pushed out of the company. He is now in private arbitration with WeWork, Business Insider reported on September 20.

SEPTEMBER 22: The Wall Street Journal reports that some WeWork board members are considering ousting Neumann as CEO.

Some WeWork board members are now in favor of pushing out CEO Adam Neumann, according to The Wall Street Journal. The board is meeting today, and there may be a push to make Neumann WeWork's non-executive chairman and remove him as CEO.

Officials linked with WeWork's biggest backer, SoftBank, are in favor of Neumann leaving.

SEPTEMBER 23: Neumann has begun talks with WeWork's board and investors about his future role at the company.

Neumann has not yet agreed to step aside as CEO of WeWork parent We Company, and there is no certainty he will do so, sources familiar with the discussions told Reuters on Monday.

A board challenge planned by investors, including SoftBank Group Corp and Benchmark Capital, has been put on hold until these discussions produce an outcome, the sources added.

SEPTEMBER 24: Neumann has stepped down from his role as WeWork CEO.

The Wall Street Journal first reported on Tuesday that Neumann would step down as WeWork CEO, but remain chairman of the We Company.

The New York Times' Michael J. de la Merced, David Gelles, Peter Eavis, and Andrew Ross Sorkin reported that Sebastian Gunningham and Artie Minson, two current executives at the company, have been named co-chief executives.

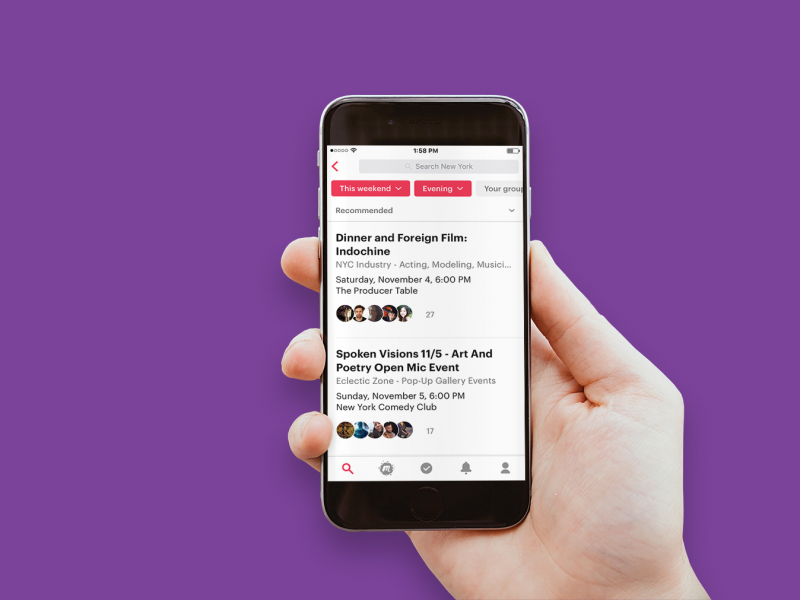

SEPTEMBER 25: WeWork puts three businesses up for sale

WeWork is trying to sell three of the companies that it has acquired since 2017, Cory Weinberg at The Information reported.

WeWork is looking to sell Managed by Q, Meetup, and Conductor, which work in office cleaning and management, group meetups, and marketing. The Information reported that the companies had revenue in the "hundreds of millions," but lost money. It also reported that WeWork has had some interest from potential buyers.

A source familiar with the matter confirmed to Business Insider that the company was looking to offload the three businesses.

SEPTEMBER 30: co-CEOs postpone IPO indefinitely.

In a statement Monday, new co-CEOs Artie Minson and Sebastian Gunningham said that they were postponing the IPO indefinitely, but they do plan to go public in the future.

"We have decided to postpone our IPO to focus on our core business, the fundamentals of which remain strong. We are as committed as ever to serving our members, enterprise customers, landlord partners, employees and shareholders. We have every intention to operate WeWork as a public company and look forward to revisiting the public equity markets in the future," the statement says.

OCTOBER 11: WeGrow, WeWork's educational arm, is closing at the end of the school year.

The school opened two years ago, and now has about 100 students. Tuition runs from $22,000 to $42,000 depending on a child's age.

A WeWork representative told Business Insider at the time: "As part of the company's efforts to focus on its core business, WeWork has informed the families of WeGrow students that we will not operate WeGrow after this school year. WeWork and the families of WeGrow students are engaging in discussions with interested parties regarding plans for WeGrow for the following school year."

OCTOBER 14: WeWork warned tenants that phone booths could have dangerous levels of formaldehyde.

WeWork said it would remove 1,600 phone booths from locations across the US and Canada after it discovered they had "potentially elevated levels of formaldehyde."

Leaked emails obtained by Business Insider showed that tenants complained about unsafe conditions in phone booths as early as July.

OCTOBER 21: WeWork reportedly plans to evaluate bailout proposals from SoftBank and JPMorgan.

The company's board will meet on Tuesday to evaluate bailout offers, both of which reportedly value WeWork at $8 billion or less, a person with knowledge of the negotiations told Business Insider.

SoftBank offered to lend $5 billion, accelerate a $1.5 billion equity investment planned for next year, and buy another $1 billion of stock from existing investors, The Wall Street Journal reported. JPMorgan's offer is expected to be more expensive for potential investors than SoftBank's, according to the Journal, and its valuation is also predicted to be lower.

Read more: WeWork is set to evaluate rescue proposals from SoftBank and JPMorgan on Tuesday

OCTOBER 22: SoftBank will take control of WeWork, and founder Adam Neumann will step down from the board, The Wall Street Journal reported.

WeWork chose SoftBank's proposal over an offer from JP Morgan, according to The Wall Street Journal. SoftBank will reportedly give Neumann $1.7 billion to step down from the board and give up his voting power. He will get $1 billion for his shares, a $185 million consulting fee, and $500 million of credit from SoftBank, according to the report.

The deal reportedly values WeWork at around $8 billion.

The Wall Street Journal reports that WeWork is expected to announce this deal, Tuesday, but it could be delayed.