- US jobless claims for the week that ended on Saturday totaled 2.1 million, the Labor Department said Thursday. The matched the median economist estimate.

- That brought the 10-week total to 40.7 million. But Thursday’s report also marked the eighth straight week of declining claims.

- Continuing claims were 21 million for the week ending May 16, down from the previous report’s record of more than 25 million.

- Visit Business Insider’s homepage for more stories.

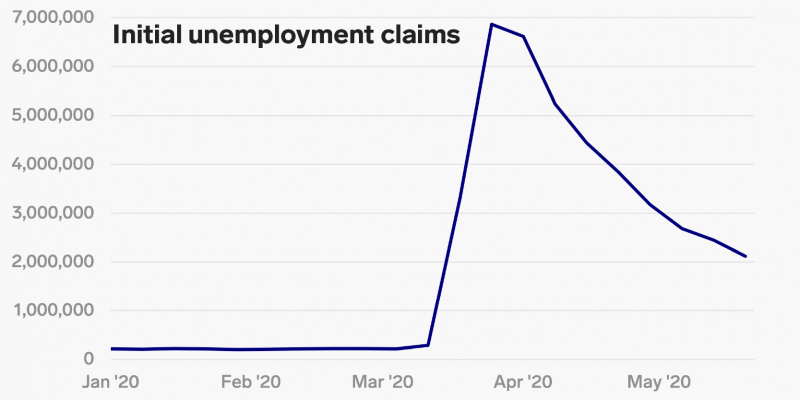

Millions more Americans filed for unemployment insurance last week as the coronavirus pandemic continued to spur layoffs.

US jobless claims totaled 2.1 million for the week that ended on Saturday, the Labor Department said Thursday. That matched the median economist estimate.

The figure raised the nine-week total to 40.7 million. That’s more than the roughly 37 million people who filed unemployment-insurance claims during the year and a half of the Great Recession.

Still, unemployment filings last week fell from nearly 2.4 million in the previous week. The number of new filings has now declined for eight straight weeks.

Continuing claims, which represent the aggregate total of people actually receiving unemployment benefits, were 21 million for the week ending May 16, suggesting a slow labor-market recovery, despite signs of economic reopening. Still, it was down from the previous week's record of 25 million.

In addition, filings under the separate Pandemic Unemployment Assistance program fell to an unadjusted 1.19 million from 1.25 million, representing 32 states reporting. Last week's number was revised down by about 1 million following an error by Massachusetts.

The PUA program expands unemployment benefits to people not previously eligible, such as the self-employed or gig workers. Including PUA, the total number of inital claims under federal and state programs to 3.1 million for the week ending May 23.

"At this pace, claims won't be back below 1 million until September, though we expect the gradual reopening will start soon to push claims down more quickly," Ian Shepherdson, the chief economist at Pantheon Macroeconomics, said in a Thursday note.

Thursday's report was the latest picture of the US labor market as economies reopen from lockdowns put in place in mid-March to contain the spread of COVID-19. Mass layoffs since then have been devastating. April's jobs report showed that employers slashed a record 20.5 million jobs in the month and that the unemployment rate surged to 14.7%, the highest since the Great Depression.

Recovery on the way?

There's hope that the worst is over the in the labor market. As of Memorial Day weekend, all 50 states had relaxed at least some coronavirus-related restrictions. That means some of the millions of Americans who were furloughed or laid off because of the pandemic should be able to return to work soon.

Economists will continue to monitor both initial jobless claims and continuing claims for signs of a rebound or further deterioration in the labor market. So far, the pace of decline has been more "glacial" than expected, James Knightley, the chief international economist at ING, wrote in a Thursday note.

"It is possible that some businesses that had continued paying staff in the hope of a swift re-opening process now recognise that social distancing constraints mean that business will not return to 'normal' quickly," Knightley wrote.

That would mean that they're now adjusting their workforce for the new environment and that jobless claims may see "only modest declines for a good few more weeks," he said.

Still, claims remaining elevated longer throws more cold water on hopes of a swift economic recovery. High unemployment can weigh on consumer sentiment and spending, a cornerstone of the US economy.

"As workers remain unemployed, concerns will grow regarding temporary unemployment becoming permanent, employee networks drying up and skills getting rusty," Jason Reed, a professor of finance at the University of Notre Dame's college of business, told Business Insider. "Although it's too soon to know now, the concern is that unemployment will continue to be an issue even after we begin the recovery."

The upcoming May jobs report

Economists and industry watchers are also awaiting the May nonfarm-payrolls report on June 5. Job losses are expected to decline from April's record 20.5 million but remain elevated.

The unemployment rate, however, could surge even higher from 14.7%, as nearly 16 million Americans have filed for unemployment insurance since the measurement period for the April report.

Economists expect that will translate to an unemployment rate of about 20%, a jump that would threaten the all-time record estimate of roughly 25% unemployment during the Great Depression.

In addition, Knightley said he expected the May report to show that only 47% of working-age Americans are earning a wage.

"It is clear that because of social distancing constraints, consumer anxiety relating to the virus and household incomes feeling the strain with tens of millions of Americans out of work, unemployment will not drop anywhere as quickly as it spiked," Knightley said.