Dania Maxwell / Los Angeles Times/Getty Images

- Weaker-than-expected global economic growth could hinder the US recovery, Fed researchers said.

- The CBO expects US GDP to grow 4.6% in 2021, but the chances of that fade on slower global growth.

- The Fed simulated 2021 growth 1 million times and found weak global growth almost guarantees US underperformance.

- Visit the Business section of Insider for more stories.

The US economic recovery hinges a great deal on how the rest of the world rebounds, according to researchers at the Federal Reserve Bank of Dallas.

For the moment, the US is expected to fully recover from its virus-induced downturn by the end of the year. The nonpartisan Congressional Budget Office projects gross domestic product will expand by 4.6% in 2021, offsetting the 3.4% contraction seen in 2020.

Yet global risks could drag US growth below the baseline forecast, Fed researchers Jarod Coulter and Enrique Martínez-Garćia said in a study published Tuesday. A model of cross-country growth dependencies shows significant downside risks, and even that outlook is a relatively conservative scenario, according to the team. The data doesn’t reflect cross-country events linked to the pandemic.

Accordingly, the Fed’s estimates suggest a greater likelihood of weaker-than-expected global growth. And further modeling suggests a weaker global rebound would cut into growth in the US.

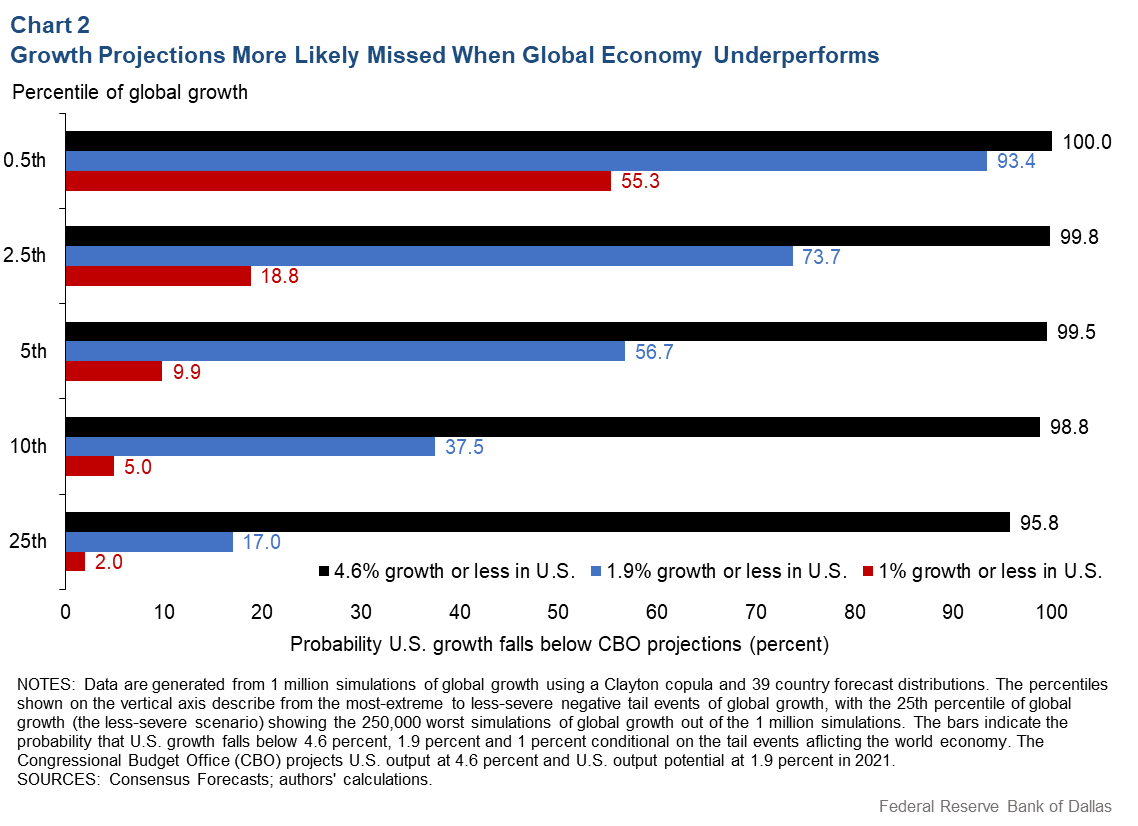

By simulating 2021 growth 1 million times, the team found that disappointing outcomes practically guaranteed the US would miss the CBO’s estimate.

Federal Reserve Bank of Dallas

In the worst-case outcomes - 0.5th percentile - global growth coming in below 2.7% equated to a near statistical certainty the US would grow by less than 4.6%. There was also a 55.3% chance that US growth would come in below 1%, essentially relegating the country to another year of bleak economic performance.

Even the bottom 25th percentile of scenarios, in which global growth is less than 5%, show a sizeable impact on the US recovery. Such outcomes set a 95.8% chance that US growth would land below the CBO's projection, and a 17% chance it would come in below 1.9%.

The study suggests that, in "not particularly severe" tail events, poor global growth often coincides with US GDP growth that's below the baseline estimate.

"The more extreme the negative global growth outcome becomes, the more likely that the US recovery would falter in 2021," the team said.

Such global spillover can also erode the US' long-term economic potential, the researchers added. The CBO revised its projection for potential real GDP slightly lower from January 2020 to February 2021, implying that, even after the virus subsides, the economy's maximum possible output has been dented.

The central bank's modeling signals the US' path forward is notably vulnerable to a slowdown in the global recovery, and that growth through 2021 is critical to the country's ability to return to pre-pandemic output.

"The longer the recession drags on, the more significant the impact on the U.S. economy's potential can become - mostly through its impact driving up long-run unemployment - and the longer it may take for real GDP to return to its prerecession path," the Fed researchers said.