A chasm between enthusiasm and results is opening in the US economy after the election of Donald Trump.

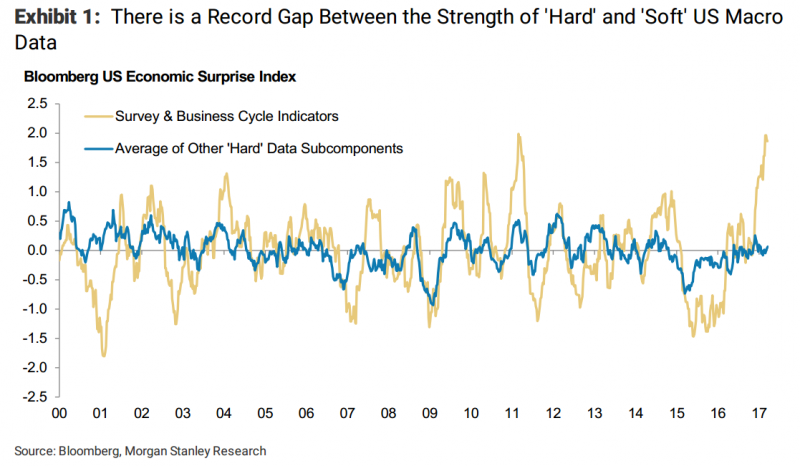

In a note to clients on Monday, Morgan Stanley economists Ellen Zentner and Robert Rosener laid out the difference between sentiment, defined by “soft data” like surveys and confidence indexes, and actual activity, defined by “hard data” like industrial production and retail sales.

We’ve noted the divergence of soft and hard data before, but it appears the gap is only growing.

“The divergence is stunning,” Zentner and Rosener wrote. “Upside surprises appear to be completely driven by the soft data while hard data are simply coming in about as expected.”

The difference was reinforced on Tuesday as the Conference Board’s consumer confidence index surged to 125.6, its highest level since 2000.

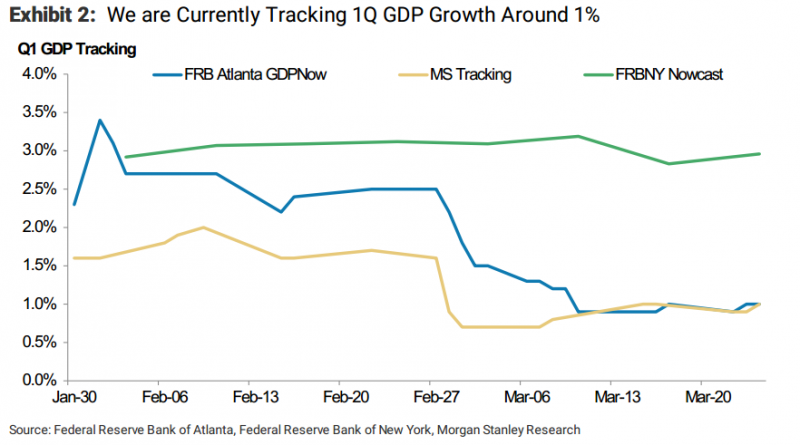

To underscore this point, Zentner and Rosener looked at a few measures of expected GDP growth for the first quarter of 2017, including the New York Federal Reserve Bank's GDP tracker and the Atlanta Fed's GDPNow. From the note:

"Compare the New York Federal Reserve Bank's current 1Q GDP tracking vs ours - FRBNY is currently tracking 1Q GDP at 3.0% versus us around 1%. The difference is larger than usual and is being driven by the fact that the New York Fed incorporates soft data into its tracking (attempting to tie it econometrically to GDP, a very hard thing to do especially in real-time). Our method translates the incoming hard data into its GDP equivalent. Note that the Atlanta Fed's GDPNow tracking also focuses on hard data and is currently tracking 1% for 1Q GDP."

Put another way, the GDP trackers that measure actual economic activity are much weaker than the NY Fed's, which incorporates soft data.

This doesn't mean the two types of data couldn't converge. Improved sentiment could lead to more spending and thus greater economic activity. Conversely, the strong soft data could be a temporary bounce and eventually fall back to earth.

Zentner and Rosener think a mix of the two is most likely - a small boost to the hard data but not enough to justify the massive leap in soft data.

"Moreover, we do expect that the breadth of the 2Q rebound in hard data will be fairly limited, with a swing in consumption as the main driver of the expected 2Q upside, followed by a slightly better net trade and inventory profile," the note said. "As a consequence, we would not necessarily expect 'hard data' surprise indices to start racing higher if the factors behind the 2Q growth rebound remain narrowly confined to a few sectors as we expect."