- Bets against Tesla’s stock price are at their highest point this year as the company gears up to report its first-quarter earnings.

- Tesla has long been one of the most heavily shorted stocks in the world.

- CEO Elon Musk has long derided short-sellers who bet against Tesla’s stock price.

As Tesla gears up to report its first-quarter earnings, investors appear to be ratcheting up their bets against the company.

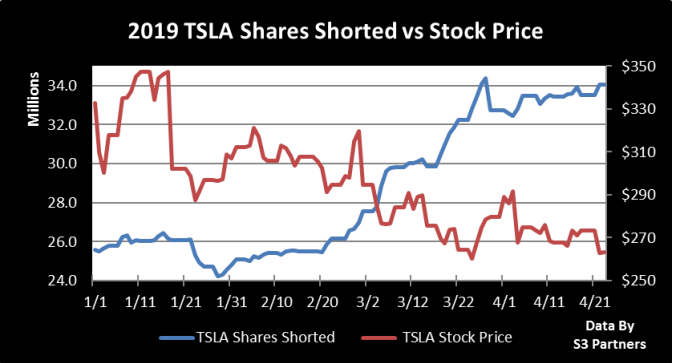

Data from the financial-analytics firm S3 Partners indicates that as of Tuesday’s close, short bets against Tesla, or bets that its stock would decline, were at their highest level of the year. At $8.9 billion, the stock is the largest automotive short worldwide, the firm said.

Tesla’s stock has fallen nearly 15% this year as store closings, a disappointing first-quarter deliveries report, and fears about the company’s ongoing financial stability weigh on investors’ minds.

According to S3 Partners' data, short investors seemed particularly energized by CEO Elon Musk's announcement at the end of February that he expected Tesla to slip into the red in the first quarter of this year.

Tesla stock's 3.6% decline since Monday alone has made short-sellers $334 million in profits, according to S3, and the investors stand to make even more if Wednesday's earnings report matches investors' fears.

"We should see short sellers topping off their bets tomorrow, if they feel TSLA will report a quarterly loss following a delivery shortfall in its first quarter," Ihor Dusaniwsky, a managing director of predictive analytics at S3, said Tuesday.

Tesla is the most popular short target not only for professional investors but also amateur traders who can mimic their directional bets through options contracts on retail brokerages. On Twitter, an army of Tesla skeptics who call themselves $TSLAQ has gained a massive following in recent months, much to Musk's chagrin.

The billionaire has spoken many times of his hatred of short-sellers. "They want us to die so badly they can taste it," he tweeted in June 2017.

"When CEOs criticize short-selling, it's usually because they're looking to deflect blame for their own failings and obscure the uncomfortable truth that their long-holders are losing confidence and are selling," the short-seller Carson Block, who founded Muddy Waters Capital, told Business Insider last year.

Tesla's first-quarter earnings are expected shortly after markets close Wednesday.

Now read:

- Tesla announced improved battery ranges for the Model S and Model X and brought back the lower-cost version of both cars

- Elon Musk says Tesla will have 1 million robo-taxis on the road next year, and some people think the claim is so unrealistic that he's being compared to PT Barnum

- Nvidia fires back at Tesla's claim that it created the world's best chip for self-driving cars

- Elon Musk slams rivals' self-driving-car tech, says 'anyone relying on lidar is doomed'

- Tesla claims it has made the 'best chip in the world' for self-driving cars at its autonomy day event