- StockX is a sneaker and collectible resale platform that uses historical data to help buyers and sellers find out what items are really worth.

- The company recently nabbed a $1 billion valuation based on investors’ confidence in the business’ ability to grow globally and the end of fixed pricing.

- Its next ambition is moving behind resales into what it calls “IPOs” – or initial product offerings – to help brands find out what their goods are really worth.

- Visit Business Insider’s homepage for more stories.

Gas lanterns, horse-drawn carriages, and paying a fixed price at retail could all be considered antiquated concepts.

Well, paying fixed prices isn’t quite passé yet, but StockX – the sneaker and collectibles resale platform that connects buyers and sellers in a way similar to the stock market – is betting it will be soon.

And, it’s playing a major part in getting there.

“We don’t look at ourselves as a resale marketplace,” StockX CEO Scott Cutler said to Business Insider.

"The market size and opportunity in the things that we're going after are as big as the market itself."

The company recently attained a $1 billion valuation after securing a $110 million Series C investment, with firms like DST Global, General Atlantic, and GGV Capital participating. It's this fixed-pricing revolution, as well as the potential for overseas expansion, that is fueling the investor excitement around the platform, according to the company's leaders.

That's not to mention a rapidly expanding sneaker resale market, which a recent report from Cowen & Co. estimated would grow to $6 billion globally by 2025.

"We're going to leverage that infusion of capital to grow and expand internationally," Cutler said. "We see a tremendous amount of growth this year coming from Europe - both supply as well as buyer. And then we see a tremendous opportunity already, from a demand perspective, coming from China and from Asia."

The StockX difference

The company differentiates itself from other reselling sites by leaning on its vast array of data to help figure out what other people are paying for examples of the same exact model, listing a pricing history going all the way back to the first time the model was ever sold on the site. It's even broken down by variations like sizing or colorway and displayed to users.

From there, users can see trends, historical highs and lows, trade ranges, and price volatility.

"The answer to what any single thing is worth is what one single person is willing to pay," Josh Luber, StockX's former CEO, said. Luber cofounded the company but stepped down in June to allow Cutler, a seasoned e-commerce vet, to take the reins.

Luber added: "But if you have a commodity, if you have an asset, if you have a product that you have many of, well then the answer is: What is the market willing to pay for it? What is everybody willing to pay for all of these?"

With StockX, there's an element of fairness that cannot exist without the data to back it up, Luber says.

It's that transparency and standardization that has made StockX one of the most trusted sources for reselling high-priced sneakers. All of StockX's sneakers are unworn and guaranteed authentic, each with their own official StockX landing page.

Though StockX has grown into handbags, streetwear, and watches - and will soon start listing collectibles - the sneaker category still accounts for about 75% of sales on the site.

StockX does most of its business online, where buyers or sellers set bids, which are basically what they're willing to either buy or sell the item for.

"In the long run, the real revolutionary part of this is for sellers to be able to literally sell something without ever listing it for sale, without ever taking pictures," Luber said. "Our best sellers never list anything, ever. All they do is just go and accept bids."

The company does also have a New York City location. It's not for buyers - sellers can walk in off the street to list items, get them verified, or get paid.

"We're seeing a tremendous amount of foot traffic there," Cutler said. "We're trying to figure out what type of buying experience we want to have in the store."

Chasing a new customer

The idea of actually getting the best possible price has appeal for more than just the most hardcore sneaker collectors.

One of the fastest growing segments of sneaker sales on the website is now sneakers under $100, which are more likely to be worn than the more expensive sneakers on the site.

Sometimes, when it comes to sneakers that are not quite that rare, the fair market price determined by StockX sales is actually less than a customer could find at a store. Roughly 25% of sneaker sales on StockX now happen for less than the retail price, according to Luber.

"It's sort of the next customer on StockX," Greg Schwartz, StockX's COO and cofounder, said.

"More and more today on StockX, you see someone like me that bought their last pair at Finish Line ... [StockX has] this massive catalog of product that's available, that's not available at traditional retail."

That means customers can choose from every color ever released for a particular sneaker, which could be dozens instead of just the few on a traditional store shelf.

"You go into Finish Line, Foot Locker, there's 300 pairs of shoes on the wall, 400 pairs of shoes," Luber said.

"There's 26,000 different shoes on StockX. It's not just the Yeezys and thousand-dollar Jordans. It literally could just be a colorway that came out last season that's just not on the wall anymore at Foot Locker, and that product might be ten bucks less than retail, 20 bucks less than retail."

New customers need new sellers

As StockX works to reinvent the traditional online auction model, it can also work to change the way it works with the brands that actually make the products being sold.

One of the ways StockX is looking to grow in terms of both sales and importance is in partnering with brands to release new, limited products. In another nod to the stock market, the company calls them "IPOs," or initial product offerings.

"Today we're a better secondary market," Luber said. "We already start to service that customer who just buys a different pair of shoes than is available at Foot Locker. And the next step is then you work with the brands to release products directly, to literally IPO products into existence."

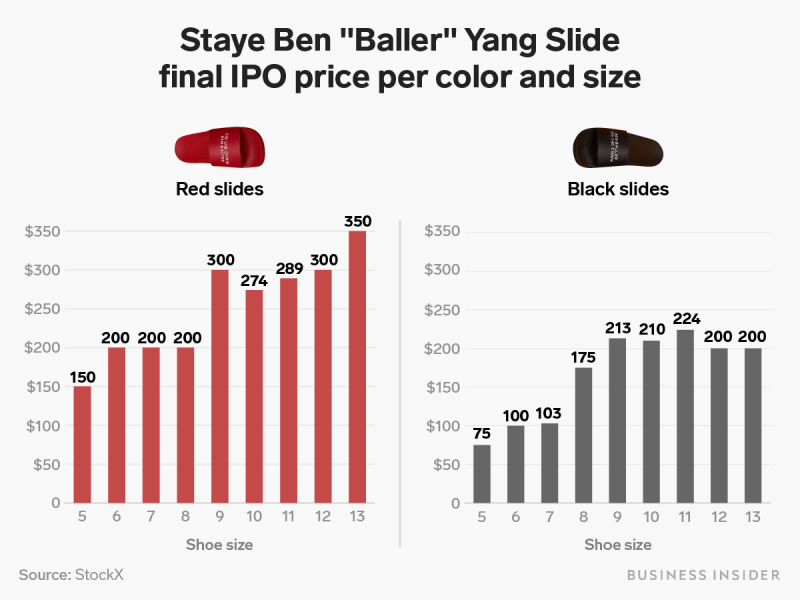

It's already had one successful IPO so far. In January, the company partnered with celebrity jeweler Ben "Baller" Yang and footwear brand Straye to offer a limited number of shoes in a style of sandals known as a slide.

It was a blind Dutch auction, meaning buyers put in anonymous bids for the size and color they wanted, without knowing what the other bids would be.

Top bidders won the chance to buy the shoes but were only charged the lowest winning bid - also called the clearing price - so that every buyer paid the same price for each discrete variation.

Over the three days of the IPO, users placed 10,439 bids on the 800 pairs of shoes, with amounts ranging from $50 to over $1 million. On average, people paid about $210 for the sandal, with the price varying by the color and size.

"The idea that says, 'Listen, this product would have had a retail price of $70.' That's an antiquated concept. Why should it retail for $70?" Luber said.

"'Because slides always retail for $70, that's about what we expect to pay for it.' But no, if you took the actual demand around this person that people follow, the demand for that product says that this thing is worth $210."

According to Luber, 97% of winning bidders paid less for the shoe than they had stated in their bid.

Now, StockX is planning on pitching other, bigger brands for their own IPOs of limited-release goods on the platform, to try to convince them to cash in on demand for these scarce products in a meaningful way.

"A lot of [brands] stood up after [the Ben Baller IPO] and went, 'Oh I get it. I get it, we want to sell our stuff like this,'" Luber said. "So we'll see. Hopefully over the next four months, we probably have about a half a dozen IPOs coming, including, knock on wood, some really big sneaker companies."

"It could be a lot sooner than you think," he added.

- Read more in our Sneaker World series:

- Sneaker resale could be a $6 billion market by 2025 as the shoes cement their place among the most popular footwear in America

- Photos show the rise and fall of Nike's iconic Air Jordan sneakers - and how the shoes are making a comeback 15 years after Michael Jordan's retirement

- Here are the most expensive Air Jordans to sell on StockX and Stadium Goods, where rare pairs have gone for as much as $20,000