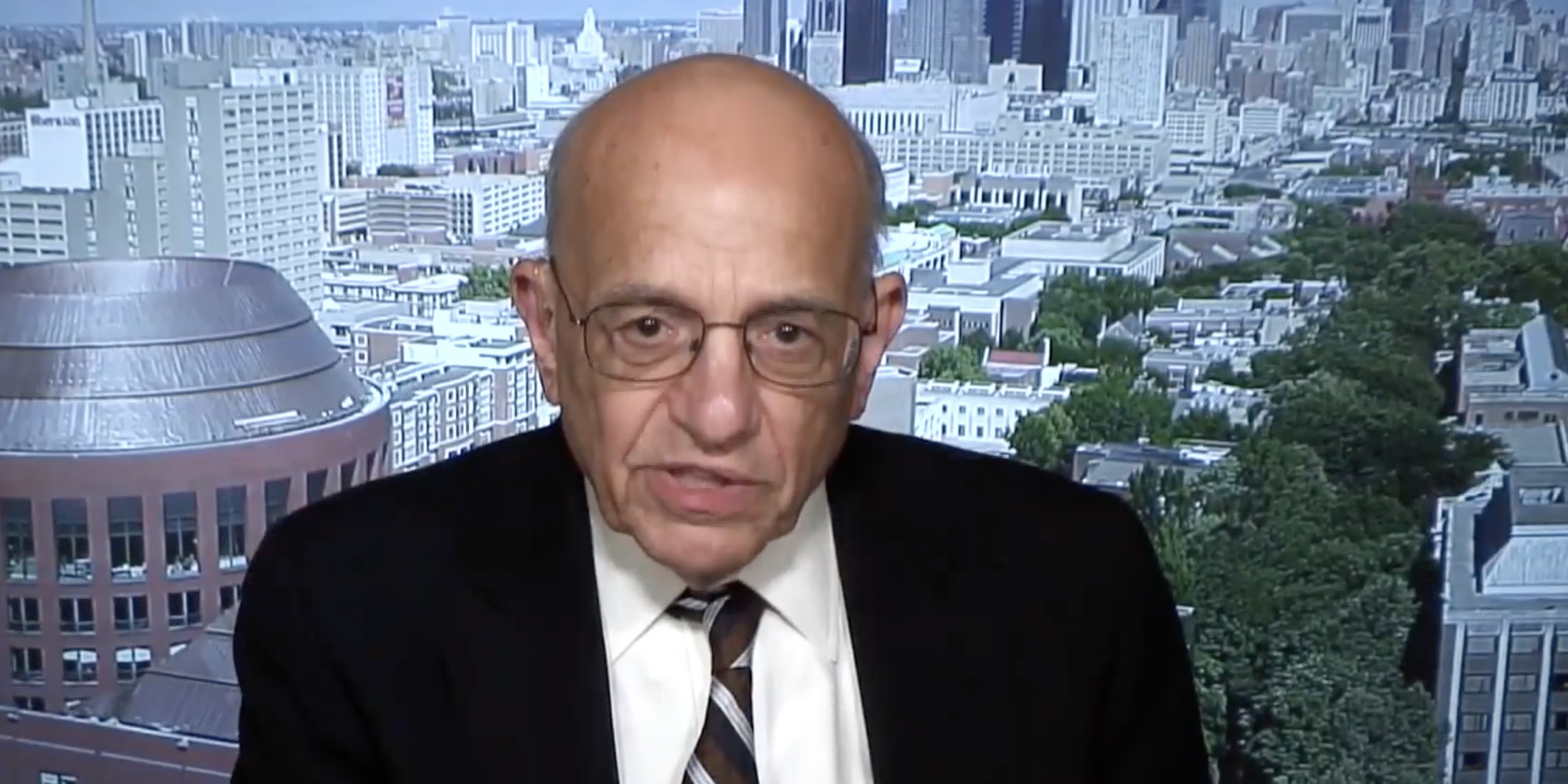

- Wharton professor of finance Jeremey Siegel told CNBC that the stock market would not lose upward momentum if the US were to experience a second wave of COVID-19.

- Siegel said that because stocks are so forward looking, a short-term lapse in the economy will not stop long-term moves higher.

- The professor also said he believes both tech stocks and cyclical stocks will go higher in 2021 as the US begins to fully re-open.

Professor Jeremy Siegel told CNBC on Tuesday that it’s unlikely a second wave of the coronavirus would derail the stock market’s march upward. “We’re not anywhere getting near down those March lows. A little pause if we get that wave, but I don’t think it’s going to really stop the longer-term momentum,” the Wharton School of Business professor of finance said.

The S&P 500 has rallied more than 55% since its March 23 low. It traded 0.07% higher on Tuesday.

Siegel stressed that the forward-looking nature of stocks and the continued liquidity provided by the Fed will be a “really powerful force” for the market’s drive upward. The professor said that even if an effective coronavirus vaccine takes another six months or more, stocks will still move upward in a V-shaped recovery.

"That's why you could have a U-economy, a W-economy, and you can still have a V-stock market. Because of that forward looking component," the professor said. According to Siegel, 90% of the value of a stock depends on its earnings more than 12 months in the future.

He also discussed the popular debate about whether investors should buy more tech stocks or pivot into cyclical stocks as the US begins to recover. "I think there's room for both groups to go up in 2021," Siegel said.

Siegel said he believes that even if cyclical stocks outperform the market next year, it doesn't mean that tech stocks have to go down. The coronavirus pandemic has demonstrated to the economy how important tech is, and Siegel does not think that's going to go away.