Sentiment on the US stock market may be too positive for its own good.

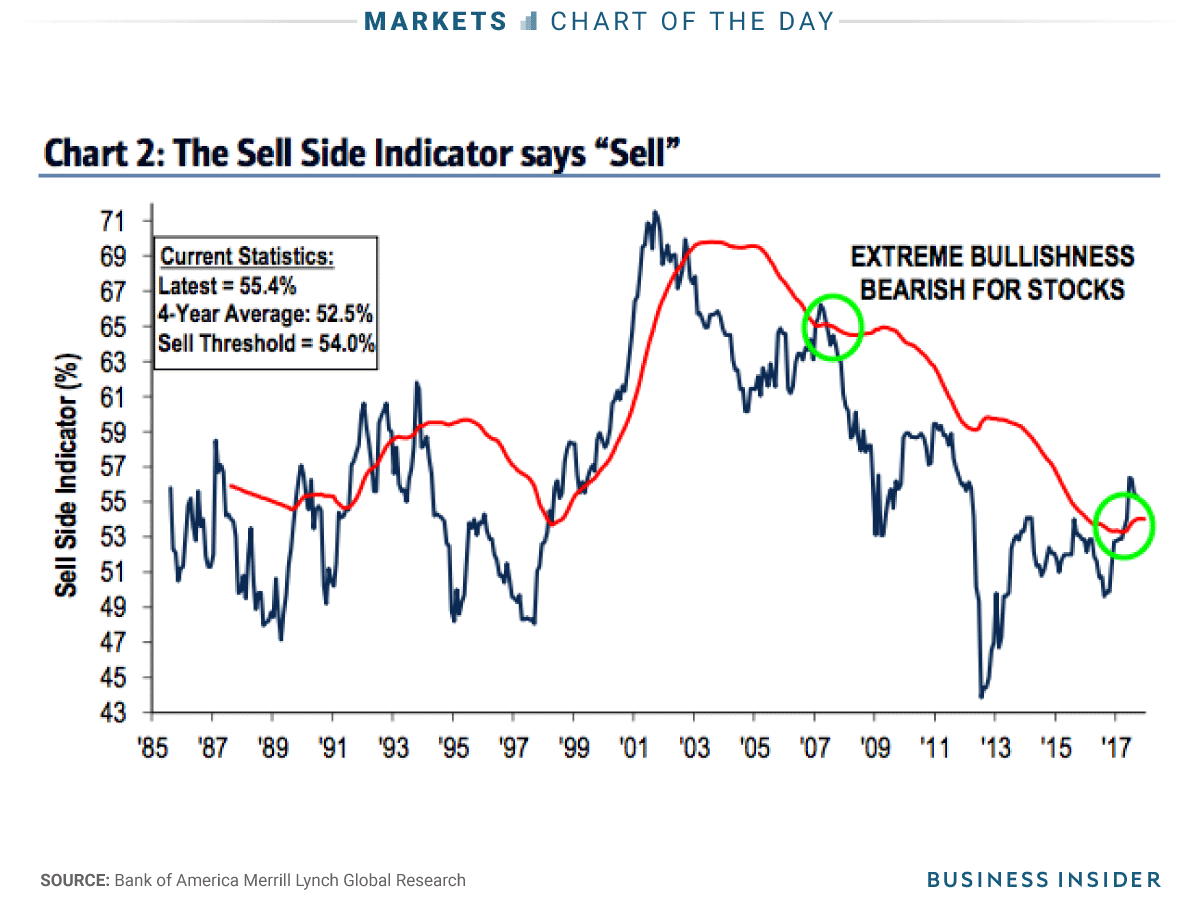

Wall Street analysts showed “extreme bullishness” on stocks at the end of September, based on a monthly survey conducted by Bank of America Merrill Lynch. As such, the firm’s proprietary “Sell Side Indicator” – which monitors investor exuberance – is now nearly two standard deviations above its four-year average.

BAML points out that it’s historically been a bearish signal when Wall Street gets extremely bullish. Described by the firm as a “reliable contrarian indicator,” the sell-side gauge helps bolster the long-standing argument from stock market pessimists that US stocks are overheating.

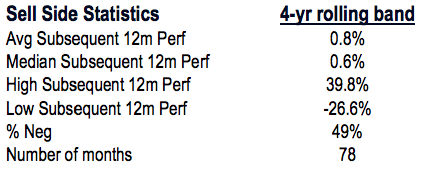

On prior occasions in which the indicator has been one standard deviation above the four-year rolling average, the S&P 500 has returned less than 1% over the following 12 months, and it has actually declined almost half of the time.

The chart shows that the last time the BAML indicator (blue line) has been that far above its four-year rolling average (red line) was the financial crisis.

"Relative to the last four years, sentiment levels are now at relative levels that have historically indicated weak returns over the next 12 months," a group of BAML equity and quantitative strategists led by Savita Subramanian wrote in a client note. "It has historically been a bullish signal when Wall Street was extremely bearish, and vice versa."

BAML's contrarian indicator is certainly living up to its name, bucking bullish signs that have suggested the 8-1/2-year equity bull market will stay alive and well.

Take, for instance, the S&P 500's recent resilience in the face of weakness in tech stocks - previously viewed as an indispensable pillar of continued stock gains. Instead of selling off, the benchmark index hit a series of new highs as investors rotated into previously unfavored energy and telecom stocks.

More than anything, these conflicting signals show that no one truly knows what's ahead for the US stock market. There's ample evidence on either side of the bull/bear debate. So in the meantime, the best possible advice is probably just to keep buying, but stay hedged against an unexpected shock.