- Morgan Stanley, Wall Street’s most bullish firm on stocks in 2017, is taking a more moderate view of the year ahead.

- Equity strategists led by Mike Wilson forecast that low stock-market volatility combined with low volatility in interest rates, FX, credit, and economic data are set to turn around in 2018.

- They pegged a year-end target on the S&P 500 of 2,750 that should be achieved – as a peak – in the first half of the year.

Morgan Stanley was the most bullish major Wall Street firm on the stock market in 2017. It’s not trying to retain the title next year.

The volatility that has escaped markets this year will be back in 2018, the firm’s equity analysts forecast.

This year is on track to go down as one of the most peaceful in market history. The CBOE Volatility Index fell to a record low of 8.56 on Black Friday’s short day of trading.

Traders have bet on low volatility this year because many economies are growing simultaneously and earnings forecasts are strong across sectors, said Mike Wilson, the chief US equity strategist at Morgan Stanley.

"We cited low interest rate, currency, credit and economic data volatility combined with very low earnings estimate dispersion as good reason for low equity volatility, and we implored clients to embrace it rather than fear it," Wilson said in a note Monday.

He added: "We stand by that claim and call today, but acknowledge several of these factors are likely to change in 2018."

First, interest rates should get more volatile as the Federal Reserve continues to raise them, the European Central Bank starts to reduce its stimulus, and governments are willing to issue more sovereign debt.

Credit volatility is likely to rise next year as more sectors like retail, healthcare, and telecommunications struggle with their debt loads. Morgan Stanley's US credit strategists led by Adam Richmond forecast on Monday that this cycle of the credit market could turn sooner than many think.

Wilson further forecast that economic data would get more volatile, as periods of simultaneous growth around the world rarely last when various economies are at different stages of recovery. The bigger variations in data should, in turn, lead to more currency volatility, Wilson said.

"The conclusion for us is that after a very painful slide in volatility for many traders looking for a rise the past several years, we have finally reached a point where betting on higher volatility will pay off," Wilson said.

2,750 price target

Wilson's team pegged a year-end target on the S&P 500 of 2,750 and said it wouldn't be surprised if that were achieved in the first half of the year.

With a 2,700 target, Morgan Stanley was the most bullish major firm coming into 2017. The index closed at an all-time high of 2,602.42 on Friday.

But 2,750 could also be the peak for next year, Wilson said. That's based on the expectation that S&P 500 earnings growth will peak and financial conditions will tighten as the Fed continues to hike rates.

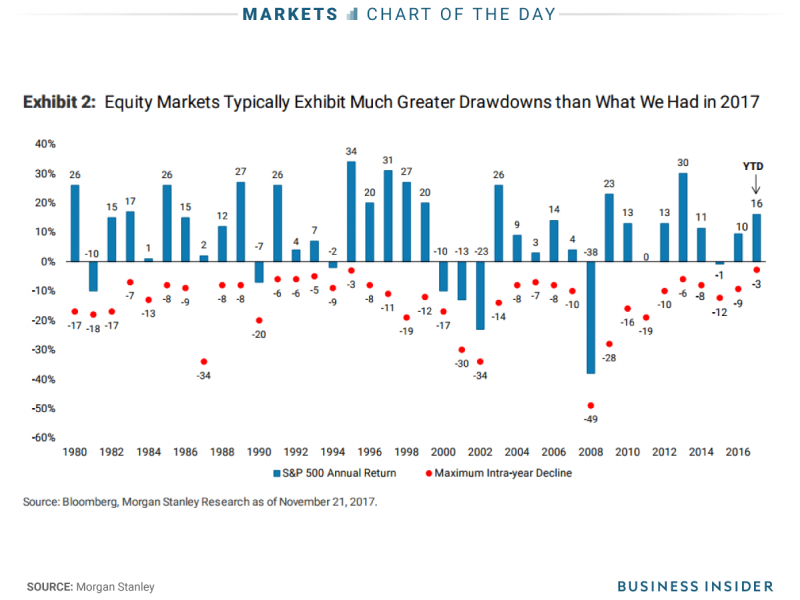

"We would be very surprised if we don't return to a more normal environment and witness at least one if not several 10 percent plus drawdowns next year," he said.

Investors have already priced in the higher earnings growth that could come if the GOP passes legislation that cuts corporate taxes, Wilson said. He forecast that the S&P 500's earnings per share would be $145.90, up from an estimated $131.60 this year.

"We do not think EPS growth in 2019 will be that exciting and could even be negative if our bear case plays out," Wilson said. "Undoubtedly, that will matter for stock prices next year."

Earnings will continue to drive stock prices, but the economy will also play a role as it extends into its 10th year of recovery, Wilsons said. He noted that some of the best equity returns come late during the economic cycle - like now - but said it was time to start thinking about what happens when the tide turns.

"While it's way too early to call a recession, nor do we see one in 2018, the equity market may start to discount its arrival in the next year," Wilson said.