- Bank of America Merrill Lynch is the latest Wall Street firm to issue a warning about a stock-market correction. The benchmark S&P 500 hasn’t seen a correction, defined as a 10% sell-off, in more than two years. BAML joins Morgan Stanley in the ranks of big firms that have sounded the alarm this week.

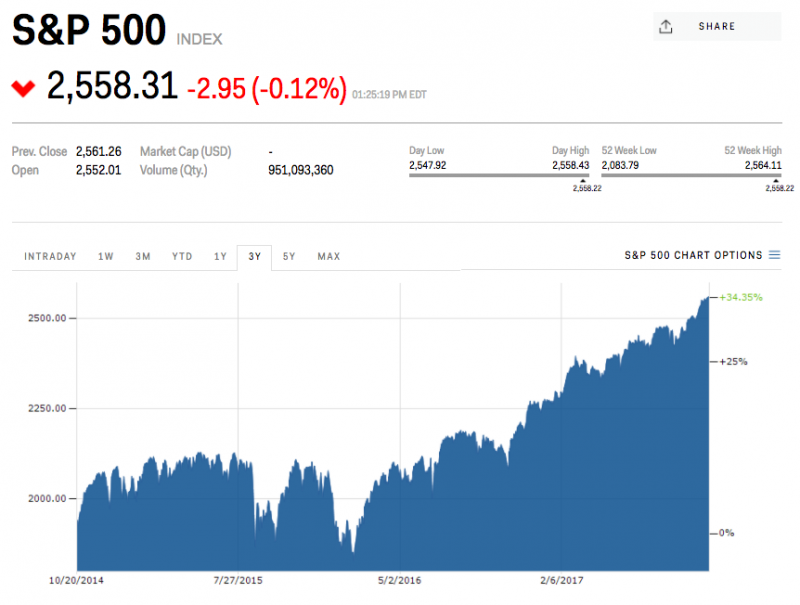

The S&P 500 hasn’t seen a correction in almost two years. But a growing chorus of Wall Street strategists says one could be right around the corner.

The most recent firm to sound the alarm is Bank of America Merrill Lynch, which forecasts a pullback of at least 10% – the historical definition of a correction – by Valentine’s Day.

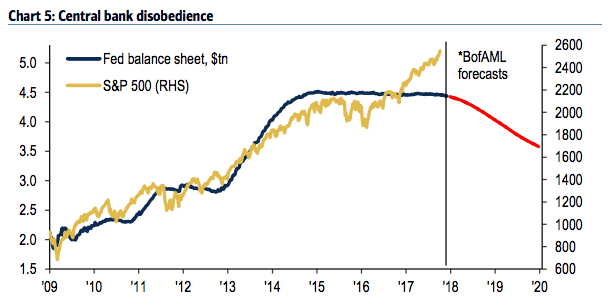

And while the firm lays out a long list of sell signals, it highlights a couple of elements as the biggest market risks right now. BAML says the “most obvious catalyst” for a correction would be a spike in wage and inflation data that brings back “fear of Fed.”

That’s a reference to the bearish sentiment that would be likely to accompany a sudden acceleration of the Federal Reserve’s rate-tightening schedule, which includes rate hikes and a shrinking of the central bank’s massive balance sheet – two measures that would boost fixed-income yields.

"In our view higher bond yields and higher bond market volatility are necessary to engender a major correction in equity and credit markets," Michael Hartnett, BAML's chief investment strategist, wrote in a client note.

Many high-profile investors interviewed by Business Insider highlighted trepidation about the Fed as the top fear. The unwinding that's about to take place is unprecedented, and there's nothing investors fear more than the unknown.

BAML is also wary of a possible bubble in tech stocks, which could be caused by what the firm describes as the two most important investment trends of the past decade: central-bank liquidity and technological disruption. The bank has long expressed worry about overstretched sentiment and trader euphoria - and those two factors may have helped bring about it.

As such, the so-called Icarus trade may soon come to an end. The term, coined by BAML, refers to the "melt up" in stocks and commodities seen since early 2016 - one it sees as unsustainable in the long term.

BAML's correction forecast isn't the first to come out of Wall Street this week. On Tuesday, Morgan Stanley warned of a sharp pullback in equities, albeit a less aggressive forecasted decline of roughly 5% by year end. Its worry stems from what it sees as a fully priced stock market - with minimal upside and a small margin for error - heading into earnings season.

Morgan Stanley also sees - wouldn't you know it - the Fed's balance-sheet unwinding as a major risk, as well as a lack of follow-through on President Donald Trump's tax plan and a potential reversal in a historically low US dollar.

But Morgan Stanley is less pessimistic than BAML about the first quarter of 2018. It forecasts that by the end of March the S&P 500 will hit 2,700, more than 5% above the index's current level.

While the two firms have differing views on the trajectory of stock-market losses, however, both can agree that whatever weakness transpires, it won't threaten the 8-1/2-year bull market. That would require a 20% pullback - a far cry from what either is expecting.

So rest easy, bull-market fans. It's not yet time to panic.