The equity market has been flying too close to the sun. Sooner or later, its wings are going to melt.

So says Bank of America Merrill Lynch, which foresees the so-called “Icarus trade” spelling doom for risky assets like stocks before the end of the year.

The firm has been warning of a late-2017 meltdown since January, while also acknowledging a medium-term continuation of the “melt up” seen in stocks and commodities since early 2016.

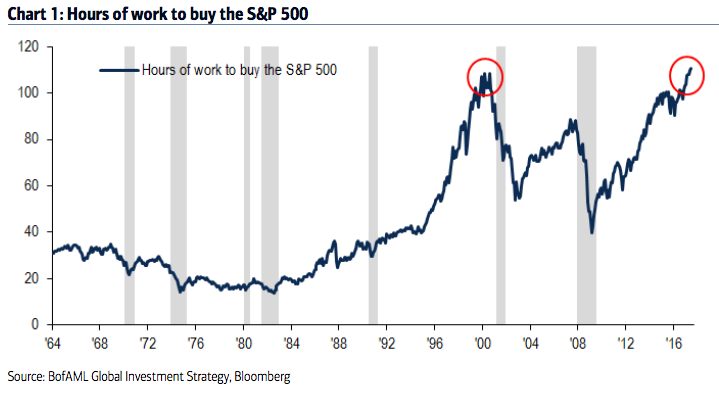

BAML sees the build-up of the Icarus trade as being enabled by central bank policy, such as the Federal Reserve’s continued insistence on a gradual pace of monetary tightening. That’s contributed to “inequality” as the grind higher in stocks has made it more expensive than ever to buy equity benchmarks.

In fact, they find that conditions have gotten so stretched that the total number of hours worked necessary to buy a unit of the S&P 500 has climbed to an all-time high.

Then, in a cruel twist of fate, BAML forecasts that those same central banks will be pushed to deflate the trade as they continue to slow accommodative asset purchases.

"Further upside in risk assets will create problems,"BAML chief investment strategist Michael Hartnett wrote in a July 12 client note. "The Icarus trade will exacerbate inequality, ultimately forcing the Fed and other central banks to pop the bubble later this year."

Hartnett's forecast for stocks is decidedly more bearish than the one held more broadly by equity experts across Wall Street. While he predicts a precipitous decline in stocks by year-end, a survey of 20 strategists calls for the S&P 500 to finish 2017 at 2,439, less than 0.2% below Wednesday's close.