- The best way to protect against a stock market downturn might be to own a basket of “out of favor” commodity stocks, says Jefferies.

- The firm argues that the impact of low inflation on outsized stock market returns has been underappreciated.

The equity strategy team at Jefferies has a novel idea for how to protect against a big stock market downturn.

Rather than simply buying exposure to the CBOE Volatility Index – or VIX, which trades inversely to the benchmark S&P 500 roughly 80% of the time – the firm says the best hedge might be to own a basket of “out of favor” commodity stocks.

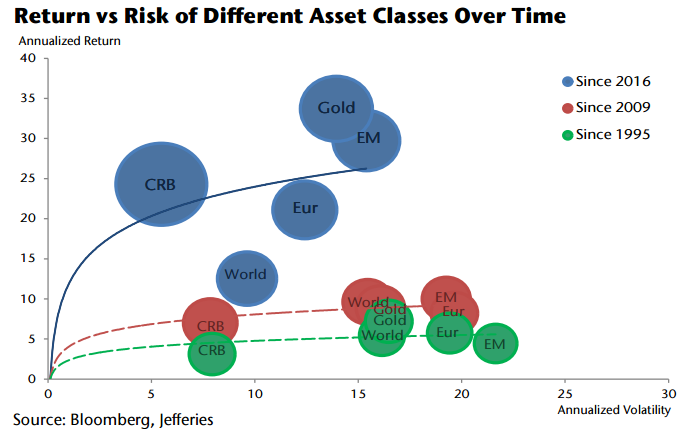

At the core of Jefferies’ reasoning is what they identify as one of the most extreme divergences in 25 years between the S&P 500 and commodity indices. The firm sees this performance gap closing, and notes that commodities will likely rally at the expense of stocks sometime soon, making the hedge effective.

Commodity stocks “at least offer operational gearing to rising commodity prices,” Jefferies Chief Global Equity Strategist Sean Darby wrote in a client note. “A hedge to global equity markets is to buy some commodity stocks including agriculture. Until the long end of the yield shifts upwards, asset prices will still be under pressure to inflate.”

The expectation of more inflation informs Jefferies' overall outlook for equities. In the firm's mind, low inflation was the true and underappreciated cause of stock market strength in 2017.

The so-called "disinflation boom" was huge for investors "with low inflation, declining real interest rates and a strong profit cycle acting as a tailwind for share prices," Darby wrote.

Now, Jefferies says, investors are at real risk of seeing inflation pick up, something that will put further downward pressure on the US dollar. However, the firm finds that over the last 18 months, commodity indices have trended sideways amid a weakening greenback, further strengthening the case for a commodity-based hedge.

"The bottom line is that the best 'hedge' for equity investors might simply be to own a basket of 'out of favor' commodity stocks rather than the VIX index," he said.