- Thursday’s CPI reading for May was up by 5% year-over-year, more than the 4.7% economists expected.

- Whether the surge will be temporary or inflation is here to stay is still unknown.

- If higher inflation remains it could sink stocks, which now have historically high valuations.

Jeffrey Gundlach, the billionaire investor known in the financial community as the “bond king,” made a simple prediction about inflation on Tuesday.

“June 10 is the next CPI release date. I’m guessing ‘up,'” Gundlach said in a tweet, referencing the consumer price index, a popular measure for inflation.

He was right. Thursday’s CPI reading for May was up by 5% year-over-year, more than the 4.7% economists surveyed by Bloomberg expected and the biggest jump in more than 12 years. From April, it rose 0.6%, also higher than expected.

Gundlach’s investment management firm DoubleLine, which manages $135 billion, has its own measure for inflation. And it’s telling him that inflation will continue to rise in the weeks ahead, potentially peaking in July.

But predicting inflation and how the market will react is a difficult and dangerous game. The Federal Reserve has been insisting that the current surge in inflation is a temporary result of consumer demand picking up as the economy fully reopens. The Fed has therefore said it would not tighten monetary policy to curb it.

Gundlach thinks the Fed could be wrong, however - and Gundlach warned in an interview with Yahoo Finance in May that if inflation does continue to rise as we get deeper into the summer, stocks could be in for a rude awakening.

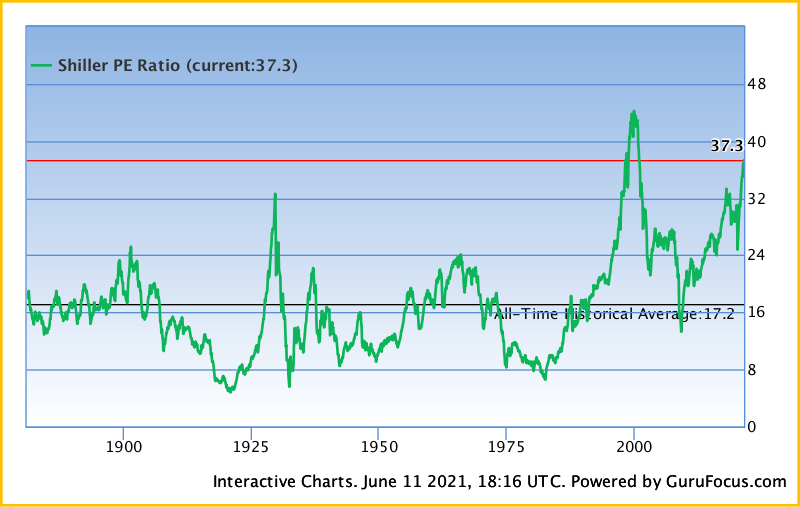

This is because stock valuations are historically high. The Shiller cost-adjusted price-to-earnings ratio for the S&P 500 currently sits at 37.3, higher than it was when stocks crashed in 1929 and approaching the level it reached during the dot-com bubble around 2000.

Valuations are so high in large part because of how low interest rates on bonds are, thanks to quantitative easing from the Federal Reserve. But rising inflation leads investors to demand higher yields from bonds, which can again make them a competing asset to stocks and trigger an investor rotation into the safe-haven assets, causing stock prices to drop due to diminished demand.

"Absorbing those bonds if inflation stays high is going to be a really big problem," Gundlach said. "And if you can't absorb those bonds and the yields are allowed to rise, well, that's going to be really trouble, problematic for the valuation of the stock market, which is depending on zero short-term interest rates and suppressed long-term interest rates via quantitative easing."

Apart from the monetary side of things, Gundlach is also worried about the implications of the amount of fiscal stimulus the government has pumped into the economy, and says this is also giving stocks, among other asset classes, a boost.

"Last month, there was another round of checks, and I don't think a lot of people are aware that about 1/3 of last month's personal disposable income was given by the government," he said. "There's a lot of distortions that are going on, but with the money that's flowing, it's helped to distort many economic series, and also the value of most asset classes."

Gundlach's views in context

Inflation is now among investors' biggest fears, largely because of how much of an unknown it is in almost every aspect.

How high could it jump? How high is high enough to spook investors? How temporary is a surge? At what point would the Federal Reserve change course from its current stance of letting inflation run hot?

There's no shortage of views on what could happen in the near future.

Allianz's chief economic advisor Mohamed El-Erian told CNBC in early May that inflation would not be transitory like the Fed has said.

On the other hand, Gargi Chaudhuri, head of iShares investment strategy, Americas, told Insider in April that inflation would not run too hot beyond a temporary period this summer, and that it does not pose a threat to markets given how prominent it is in investor's minds.

Goldman Sachs also said this week that inflation would be transitory, in part because a returning workforce would slow down wage inflation - one driver of price inflation - stemming from the labor shortage.

CPI readings have now surprised to the upside in a big way for two months straight. This still hasn't been enough to sink markets, however.

But if they surprise to the upside again in July, as Gundlach expects, and then again in August, things could indeed start to get wobbly for precariously-perched stocks.

Ryan Detrick, chief market strategist at LPL Financial, said in a statement on Thursday that markets are entering a crucial time as the transitory debate becomes tangible.

"We believe the Federal Reserve (Fed) will view today's inflation data generally as confirmation of its preexisting stance that the majority of excess inflationary pressures will be transitory," he said. "The coming months will be telling, though, as we are now entering the "show me" phase of the inflation debate where market participants will be increasingly anxious for the Fed to prove its assertion that higher inflation will be transitory."