- It’s no longer safe to simply “buy the dip,” says Mike Wilson, Morgan Stanley’s CIO.

- Slowing growth and rising interest rates are a dangerous combination for markets.

- Stocks in the financials, healthcare, and consumer staples sectors should hold up better than peers.

Stocks have been whipsawed in September as a debate rages between bulls and bears over whether the latest market dip is worth buying.

Eighteen months of equities routinely rising has had a numbing effect on many investors, who now seem to reflexively swoop in and add to their portfolio positions when stocks slip. That ‘buying just to buy’ sentiment has flipped in recent weeks, and many market participants now appear to be itching to sell in the face of any perceived threat – legitimate or not.

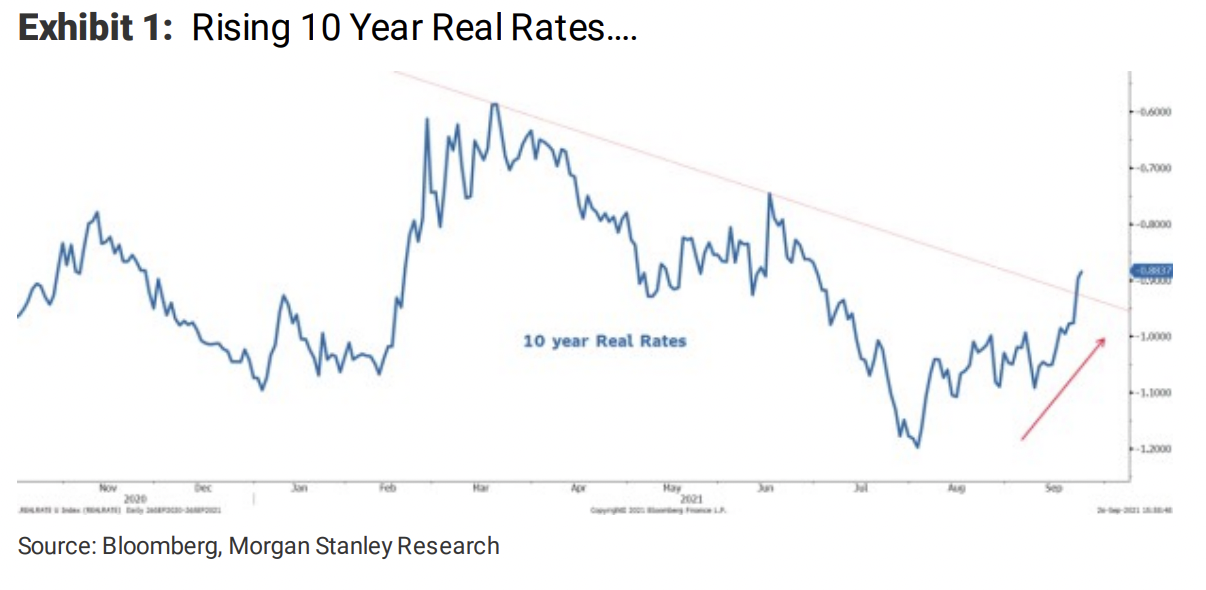

Two weeks ago, a concern was seasonal weakness, given that stocks have historically fallen in September. Last week, some investors panic-sold as Evergrande, one of China’s largest property developers, appeared poised for collapse. This week, rapidly rising bond yields are seen as lowering the equity risk premium for stocks and making them relatively less attractive.

A chorus of market experts - from the BlackRock Investment Institute and JP Morgan to others Insider has spoken with - has called the recent weakness in stocks a big buying opportunity. Mike Wilson, chief US equity strategist and CIO for Morgan Stanley, firmly disagrees.

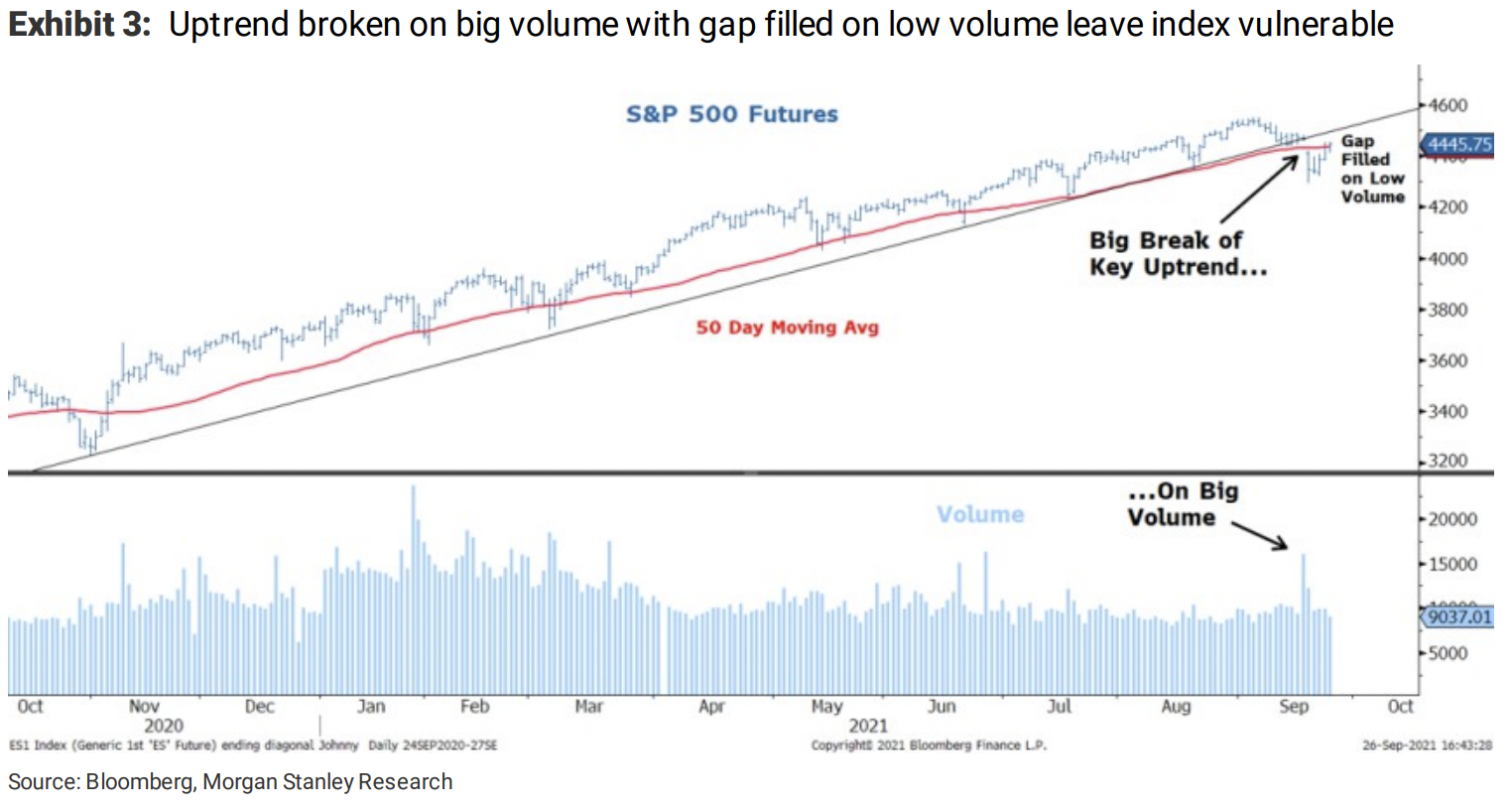

Slowing growth and rising interest rates are poised to be a two-part gut punch for the S&P 500, Wilson wrote in a September 27 note, adding that the 500-component index appears to have broken out of an uptrend last week. That could mean that stocks are in serious trouble.

"With the technical picture murky, that's a time to trust the fundamental and cycle analyses which suggest lower equity prices ahead," Wilson wrote. "As growth decelerates and financial conditions tighten, valuations are likely to fall from their lofty levels."

Wilson acknowledged that recent swings in the stock market "can be interpreted bullishly or bearishly," suggesting that significant confirmation bias exists among investors. In other words, bulls and bears can both be criticized for seeing what they want to see.

"Don't underestimate the power of price to determine how investors interpret the facts," Wilson wrote. "Just like negative price action can get people to sell the lows, positive price action can force people to buy. … We think this may be a time when the markets are playing tricks on investors and even setting a bit of a trap."

Morgan Stanley's bearish convictions stem from a hunch that Q3 earnings will return to earth after a record-breaking Q2 season. Last quarter, earnings beat expectations by between 14% and 22%, which Wilson noted is far above the 5% median since 2005. Analysts have already trimmed estimates for the upcoming season by 0.77% in the past month, the note read.

"We do not think companies will continue to beat at such an unprecedented rate and believe 3Q could see a material change in the more recent trend as supply chain issues and labor shortages pose a risk to both top line and margins," Wilson wrote.

Analysts may be souring a bit on Q3 estimates, but they're maintaining margin estimates for 2022 that are "historically lofty," Wilson wrote, adding that his team expects profit margins to contract - not expand. Morgan Stanley's contrarian take is formed from a view that wage growth will be higher relative to GDP growth, which the note said often ties to tighter margins.

Corporations have shown an uncanny ability to pass on price hikes to consumers to insulate their bottom lines, but these higher consumer-facing prices may erode demand from households that have already "over-consumed" in many areas in recent months, Wilson wrote.

"Corporate transcript mentions of 'cost pressures' and related terms are historically elevated," Wilson wrote. "When this has happened in the past, margins have consolidated."

Investors can brace for broader market downside and "unfavorable" risk-reward prospects by owning financials stocks and those in defensive sectors like healthcare and consumer staples, Wilson wrote.

Wilson has consistently advocated for financials as interest rates rise, given that higher borrowing rates should boost banks' profitability. The Federal Reserve, which indicated last week that it will soon be scaling back its ultra-easy monetary policy, may facilitate the move quicker than expected. Investors have taken note, as the Financial Select Sector SPDR Fund (XLF), an exchange-traded fund that tracks the sector, is up 3.5% since the latest Fed meeting.

Healthcare and Consumer Staples names have long been among Wilson's favorites, given that these "defensive quality sectors" should hold up well if growth disappoints. Those sectors consist of companies that have a knack for succeeding in any environment, given the relatively low elasticity of demand for their products. In other words, consumers will need their products - even if growth disappoints.

Investors can add exposure to those two sectors through a pair of ETFs: the Health Care Select Sector SPDR Fund (XLV) and the Consumer Staples Select Sector SPDR Fund (XLP).