- At least 360 senior staffers working on Capitol Hill in 2020 and 2021 have student-loan debt.

- Congressional staffers say living with student-loan debt gives them "daily anxiety."

- Democratic lawmakers are pursuing multiple bills to provide student-loan-debt relief.

Lawmakers can't agree on how to save college students from years of stifling loan debt. It's an ideological tug-of-war that can't end soon enough for millions of Americans.

It's also a fight that's personal for many congressional staffers who work under those members, and who are still paying off the bills for their own educations — with some having paid over decades.

An Insider analysis of congressional financial disclosures for 2020 and 2021 found that Congress itself was profoundly affected: About 360 high-ranking staffers owed money on student loans. Dozens of these staffers either work for House or Senate leadership, on committees with jurisdiction over student-debt relief, or both.

Together, these congressional staffers are juggling more than 500 outstanding student loans. Even for those earning good salaries by national standards, such loans can sap available resources in the ever-expensive Washington, DC, area, and even prompt some staff to consider leaving public service for more lucrative jobs in the private sector and lobbying industry.

Some of these influential aides have the ears of leaders on both sides of the debt-cancellation effort.

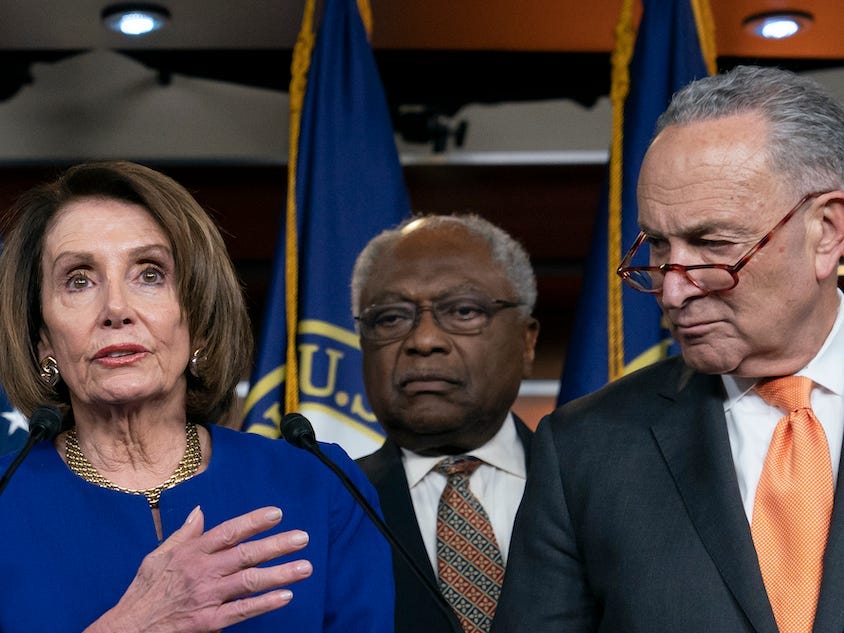

Debt-burdened staffers tied to Democratic supporters of wiping the slate clean include those who work for Senate Majority Leader Chuck Schumer of New York; three lawyers who work for House Democratic Whip Jim Clyburn of South Carolina; and an education-policy wonk who works for Rep. Ayanna Pressley of Massachusetts.

Debt-burdened staffers tied to anti-loan-forgiveness GOP bosses include two lawyers who work for Sen. Richard Burr of North Carolina, the ranking member of the Senate Committee on Health, Education, Labor, and Pensions; a policy director and a tax lawyer who works for Senate Republican Whip John Thune of South Dakota; and a lawyer, a senior advisor, and an operations manager who works for House Republican Whip Steve Scalise of Louisiana.

There's also a handful of senior advisors who separately assist House Speaker Nancy Pelosi and House Minority Leader Kevin McCarthy, opposing California-delegation members, neither of whom has commented much on debt-cancellation plans.

Insider isn't naming specific staffers with education-related loans because seeking such financial aid is commonplace among students who lack the funds to pay for college outright. But highlighting certain segments of the congressional borrowers helps illustrate the scope of student-loan indebtedness on Capitol Hill at a time when the issue is a contentious political topic.

Almost four dozen of the affected staffers have amassed more than $250,000 in student-loan debt. More than 230 owe up to $100,000 in loans. More than 160 owe up to $50,000 — all of which would be wiped away by the debt-forgiveness proposals that progressives in both chambers are imploring President Joe Biden to enact by executive order. Their pleas to date haven't been granted, with White House press secretary Jen Psaki telling reporters that the Biden administration won't be extending its student loan payment relief program beyond the end of January 2022.

Researchers calculated that the total student-loan debt stood at $1.7 trillion in the United States and affected almost 45 million Americans. While Democrats seem to agree that something must be done on the debt-forgiveness front, they remain far apart on how much pain relief is doable.

Biden campaigned on erasing up to $10,000 per borrower. Progressives, such as Sen. Elizabeth Warren of Massachusetts and Rep. Ilhan Omar of Minnesota, want more and are angling for school-loan relief of up to $50,000.

Considering the looming specter of next fall's midterm elections, which could flip power in Congress, supporters of debt forgiveness insist that now is the time to strike.

At least four dozen student-debt-related bills have been introduced so far in the 117th Congress, not counting student-loan-centric pet projects that seek special treatment for niche constituencies, including frontline healthcare workers, terrorism survivors, and military spouses.

Pending student-loan legislation runs the gamut. There are plans that offer blanket forgiveness. Others slash associated interest rates or bolster corresponding tax breaks. Several bills aim to expand the Public Service Loan Forgiveness program — a debt-retirement plan that absolves full-time federal workers of any remaining obligations after making qualifying monthly payments for 10 years.

One Hill staffer has spent 32 years paying off student loans

Insider analyzed the annual financial-disclosure documents filed by congressional staffers who earn at least $132,552 a year. Those who earn less aren't required to file such financial disclosures, which means there could easily be thousands of additional student-debt-laden staffers toiling on Capitol Hill.

The almost 360 staffers Insider found provide a cross section of financial difficulties in the legislative branch.

Some staffers have spent decades — 32 years in one case — chipping away at student loans that have piled up over the course of their careers, despite an education loan-reduction program available especially for congressional staffers.

One serial borrower racked up seven loans in a matter of months. Another took out 11 loans within two years. Over three dozen disclosed taking multiple loans within a 12-month period, and more than 30 took out multiple loans two-plus years in a row.

The issue is personal for staffers who've worked in recent years to advance languishing student-debt legislation though a deadlocked Congress. It's also been a source of anxiety or even embarrassment.

A former Democratic senior congressional aide who previously worked on student-debt legislation said her almost $150,000 in student-loan debt was a constant source of anxiety. Even though she'd been dealing with it for more than 17 years, she still hadn't told her parents how much it was.

"It's been a part of my life since 2004," said the staffer, who didn't want to be identified because of the sensitivity of this issue. "It's often easier to manage that monthly payment as a chief of staff than it was when you're a first-year Hill staffer. But I can tell you, you think about it every single day."

The former aide said she had to bartend and live with a roommate while working on Capitol Hill in order to make rent and pay her monthly student-loan installments on time.

The mental-health toll that student debt takes on staffers and student-loan borrowers nationwide is hardly ever talked about, said Brendan Rooks, a government-affairs coordinator at the Student Debt Crisis Center.

"A lot of people go to college to start building generational wealth and get off on the right foot for their life and in their careers," Rooks said. "When debt is holding them back so much, it just kind of feels like a waste."

Still, some staff carrying student loans said they didn't think debt forgiveness was the answer.

A senior Republican congressional staffer said he'd had to wrestle with $70,000 in student-loan debt since graduating from law school in 2010.

"It's like a stray dog. It just doesn't go away," said the staffer, who spoke on the condition of anonymity over fear of retribution. "It's a constant annoyance."

The GOP staffer said his student debt had put off plans to have kids, buy a house, and get married. But despite those delays, he still thought it was "unfair" to cancel student-loan debt for everyone.

"It's a really bad idea," said the aide, who doesn't work on education policy.

Some Democratic congressional staffers who spoke with Insider were torn about how to fix this issue.

"I don't think Congress is doing enough," a senior Democratic congressional staffer said about passing any type of forgiveness bill. "They really need to focus on long-term fixes."

He said some amount of forgiveness could help a lot of people, but he wasn't "sure if paying off everyone's debt makes a lot of sense."

"It's a little unfair to folks who have paid off all of their debt," said the Democratic aide, who has been paying his student debt since 2010.

Low expectations on Capitol Hill

The student-debt crisis acutely hinders college graduates of color who want to work on Capitol Hill and affect crucial issues, such as student-debt forgiveness, Rooks said.

"If we know that congressional staffers don't get paid very well, and if we know that they're one of the biggest groups facing the student-debt crisis, then we know that communities of color and low-income communities will likely be excluded from even being able to pursue this career path," he said.

Entering 2022, lawmakers remain divided on how to move forward, which could mean that they don't move forward at all.

As Insider found, Capitol Hill does have a small army of student-debt-laden congressional staffers well positioned to retool lending laws for all.

And while their bosses continue to hash it out, the former Senate Democratic aide who had almost $150,000 in student debt said she remained hopeful that Congress could get something done in the upcoming months.

"Is it disappointing? Yes. Is it surprising for a Capitol Hill staffer? No," the former aide said. "Does it advance the conversation and hopefully lead to policy change? We'll see."