The Russian ruble dropped after the United States launched a missile strike on Syria, despite rising oil prices.

The petro-currency is down by 1.1% at 57.0019 per dollar as of 7:39 a.m. ET.

Russian equities dropped as well. The MICEX is down by 1.9% as of 8:06 a.m. ET.

The US launched 59 cruise missiles on Shayrat airfield and nearby military infrastructure controlled by Syrian President Bashar al-Assad, in response to a chemical attack that killed at least 80 people in the northwestern part of the country on Monday.

The FX and equity drops reflect “fading hopes that US-Russia relations will normalize and that sanctions might be lifted,” William Jackson, senior emerging markets economist at Capital Economics, said.

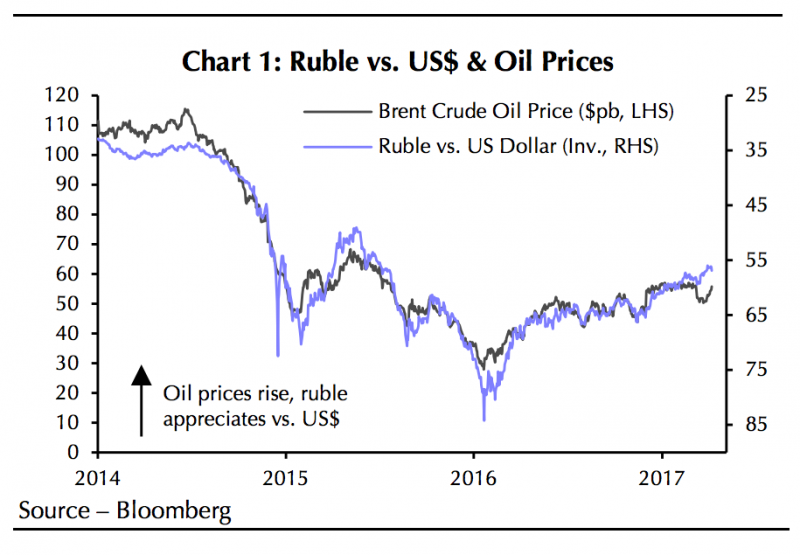

"Moreover, barring a dramatic escalation of the conflict in Syria, it seems likely that global oil prices will remain the most important driver of moves in the ruble."

Oil prices, meanwhile, spiked. West Text Intermediate crude oil, the domestic benchmark, rose to a high of $52.94 per barrel in overnight trade, a one-month high. WTI is up by 0.9% at $52.18, while Brent crude oil, the international benchmark, is up by 0.7% at $55.26 as of 8:13 a.m. ET.

Earlier this year, the ruble was among the best performing currencies, and Russian equities climbed amid hopes of improving relations between Russia and the US following Donald Trump's election win in November and rising oil prices. At the time, analysts believed that there was possibility that the sanctions imposed on Russia over Ukraine could be lifted, which theoretically would have major implications for energy.

Looking at the ruble's moves over the last few years with respect to political developments, Jackson noted that the "impact has tended to be brief."

"For instance, the central bank sold significant amounts of foreign exchange at various points in March 2014 amid Russia's moves to annex Crimea. But it only did so for a period of a few days. And the currency remained relatively stable against the dollar," he wrote.

The US strikes "are likely to revive tensions between the US and Russia, potentially hampering the two great powers' cooperation over reaching a political settlement to the Syria conflict," analysts at BMI Research said in a note. "Over the coming weeks, we will be watching the evolution of US strategy in Syria, relations between US and Russia, and the next round of talks in Geneva."

"Meanwhile, the US airstrikes on Syria also demonstrate Trump's highly unpredictable behavior on the international stage. This will work to Washington's advantage, because it serves as a sobering reminder to US adversaries and rivals worldwide that the US can move to an aggressive position very quickly," they added. "This in turn will pressure Tehran, Pyongyang, Moscow, and Beijing not to act too recklessly, as such behaviour could prompt a sudden US response."