It’s hard getting funding for a startup, but it’s even harder when the product doesn’t exist yet, still requires regulatory approval, and is being launched during a recession.

But after 75 investor pitches, the founders of a commission-free stock-trading app, Robinhood, found a few willing venture capitalists. Now the easy-to-use app has over 2 million users and is valued at about $1.3 billion.

“There were a lot of people who didn’t believe in it, and we had to bang down a ton of doors. We were really relentless,” Vlad Tenev, the cofounder and co-CEO of Robinhood, told Business Insider US Editor-in-Chief Alyson Shontell on the “Success! How I Did It” podcast. “We probably knocked on 75 doors before we actually made it work.”

In the wide-ranging conversation, Tenev and Shontell discussed:

- His move to the United States from Bulgaria as a young boy, and how his upbringing affected his career. What it was like having about 75 venture-capital doors slammed in his face. How he and his cofounder, Baiju Bhatt, got nearly 1 million people to sign up for Robinhood before the app even existed. How they met Snoop Dogg, one of Robinhood's investors. What it took to build a $1.3 billion company by the age of 30. What millennials are investing in (the average age of Robinhood's users is 30).

You can listen to the full interview here:

Subscribe to "Success! How I Did It" on Acast or iTunes. Check out previous episodes with:

- ClassPass founder Payal Kadakia. NBA star LeBron James. Dropbox founder and CEO Drew Houston. AOL CEO Tim Armstrong. BuzzFeed founder Jonah Peretti. Facebook COO Sheryl Sandberg.

If you'd rather read the interview, here's a transcript of the podcast that has been lightly edited for clarity and length:

Alyson Shontell: Vlad, thanks so much for joining us today.

Vlad Tenev: It's a pleasure to be here.

Shontell: To get started, I want to learn about you and your background, and how you grew into the CEO of a $1.3 billion company before you even hit age 30 - I think maybe you're 30 years old now?

Tenev: I am 30 now, yeah.

How emigrating from Bulgaria affected his career

Shontell: But take me back. You moved here to the States when you were 5 years old from Bulgaria?

Tenev: Yeah, that's right.

Shontell: So what was growing up like for you?

Tenev: Communist Bulgaria is where I grew up, and my father was actually a professor of economics. He tells me the story about how when he was in school, he would sneak into the basement - he had a friend there who was, like, keeping track of access, and she would let him in and let him read all of the banned literature, which was Western economic thought from the US, and that stuff wasn't well accepted at the time.

My father had an opportunity to come to this country to study - this was in 1991, when I was four. So he went, moved over by himself. My mom moved over six months later, so I was actually living with my grandparents. They would take me to school, they basically raised me for a little bit, and I moved over in 1992, around the summer when I was 5 years old.

My parents were decidedly risk-averse - they really were pushing me very hard to enter the financial industry, where they both work, but not really to enter it in the way that I did as an entrepreneur. They've been working the same job for over 25 years each, both working at the World Bank, so I didn't really grow up with entrepreneurship in mind. But I came over to Stanford for college, met my cofounder there, and in 2008 I went to grad school, he went to grad school, he joined a trading firm just north of San Francisco.

His first month on the job and my first month in grad school, Lehman Brothers went under, the market collapsed, and things just completely changed, and it was a very, very interesting time for the industry. At, really, my cofounder Baiju [Bhatt]'s urging and insistence, we started a little trading firm and moved out here to New York City to actually begin it, and that was the beginning of our entrepreneurial journey.

Starting startups

Shontell: You had a few kind-of finance-related startups before this, right?

Tenev: Our previous company, which was called Chronos Research, started in New York. And essentially what we were offering were tools for hedge funds and banks to build automated trading strategies. This was the spiritual precursor to Robinhood.

If you think about the stock market today, it looks very different than maybe what we were expecting when I was growing up, at least. I watched movies like "Trading Places" where you'd have a bunch of people in the pit waving around paper tickets and the burliest, tallest one would make the trade happen, right? And nowadays, that's not the case. All of the action happens in data centers, a lot of which are in New Jersey, and it's really about who has the fastest systems, the most automated systems, the best software. And those firms have an advantage when it comes to trading. With maybe a team of 10 people, that would have taken 300, 400, 500 people to do at a conventional trading desk at a big bank.

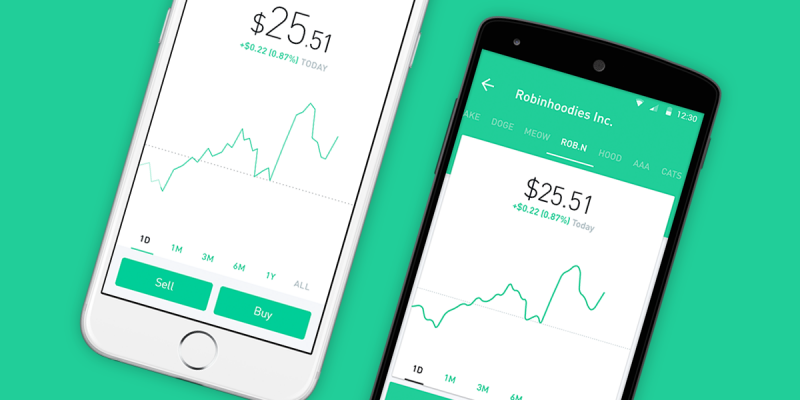

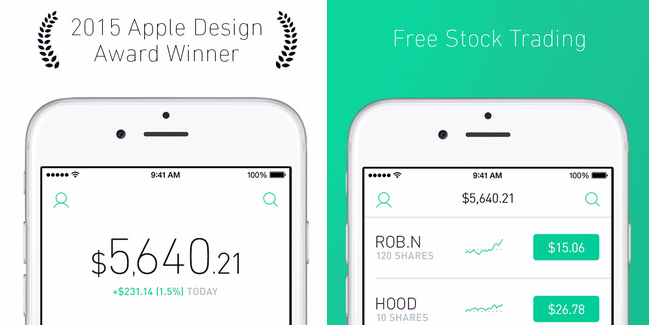

It became clear to us that the smartphone would be your primary tool for accessing the markets and doing financial transactions in general. When we looked at the space and we compared what we saw with the institutional world, where maybe firms were placing millions of trades per day at effectively no cost, we realized that from a technology standpoint, that's not that different from millions of customers placing trades per day, and that we could offer that at low cost by leveraging that same automation.

How to get nearly 1 million users signed up before a product launches

Shontell: And so the app, while it might sound complicated because it's financial services and all that, it's really not - to the point that it is so simple to use it's almost scary. But before I get into that app and what it looks like now, I want to go to you launching a website first before you even had an app, right? And from what I understand, it was more or less an overnight success. From the sounds of it, you basically put up a website and then have all these people suddenly on the wait list when you wake up.

Tenev: To preface it, before we started Robinhood and launched it, we had very little experience with mobile app development and, really, consumer product development. I mean, our previous company, like I mentioned, was enterprise software, so -

Shontell: And you were a physics and math major, right? You weren't engineering and -

Tenev: No, I had no formal engineering background and no prior work experience, really, in consumer companies. And we actually had a couple of experimental apps while waiting for the regulatory approval for Robinhood that we launched and we actually tried to get some traction on, and it was very difficult for us to get customers because ultimately we made a lot of mistakes that first-time developers of mobile products make, like packing a ton of features into apps and not really addressing a really deep customer pain point. So the last thing from our minds when we launched Robinhood, the initial website, was that it would blow up overnight, so we were kind of cavalier in the way we approached it.

Shontell: What did the website say?

Tenev: It had a description in very simple language saying, "Commission-free trading, stop paying up to $10 per trade." And then there was a button that let you sign up, and then when you signed up, you put in your email, and you would join this wait list where we would actually show you: There's this many people ahead of you, this many people behind you.

This has become a relatively common thing since then. I think a lot of that has to do with how well our wait list did, but we were actually inspired by this other product that launched about a year before called Mailbox.

I remember distinctly it was a Friday night. We had been working on the wait list in preparation for our press launch, which would have been, I think, the following Wednesday or Thursday. Everyone goes home, and I wake up Saturday morning, and I open up Google Analytics, and I see something like 600 concurrents on our site, which nobody knew about at that point. I was just like, "What's going on? This is not normal. Something must be wrong." Right?

And I'm looking at the analytics - I see a lot of traffic, or the majority of it, coming from Hacker News. And I open up Hacker News, and I see No. 1: "Chinese Land Spaceship on the Moon," No. 2: "Google acquires Boston Dynamics, the Robotics Company," and No. 3 was: "Robinhood: Free Stock Trading." So, first of all, I was like, "Oh man, like No. 3 on Hacker News? This is sort of like every engineer's dream in the Valley, right?"

Shontell: Hacker News is really big, especially on the West Coast within the tech community. It's kind of how you find cool things that are bubbling up, big stories that are breaking in tech. How did you get on Hacker News? Who put you there?

Tenev: We have absolutely no idea, and we've tried since then to get to No. 1 on Hacker News, and people at Robinhood I guess don't have a ton of karma, which is your Hacker News cred that helps. But both times we've been to No. 1, it's been a completely random person that we just have never been able to identify.

My second thought was there's no way we'd get up to No. 1. I mean, the Chinese just landed on the moon and Google made a huge acquisition, so we probably have to settle at No. 3. But 20 minutes later we get up to No. 2. Maybe 15 minutes after that, we're at No. 1 on Hacker News.

I'm just screenshotting the page; I'm calling my parents saying, "Oh, this is crazy. It might actually be working." And up until that point, we never really had an idea of what success, at least in the consumer space, was like. That was sort of the first moment where we built something that actually worked.

Maybe about 20 minutes after that wore off, we realized, "Crap. None of the emails are wired up. The website's broken." And everyone just had to go to the office to staple everything together - make sure things were up, emails were getting sent. We ended up de facto doing our press launch on a Saturday, which every single person I've talked to in the PR world has told me was, like, the worst move you can possibly make.

Shontell: Absolutely.

Tenev: But we ended up getting 10,000 sign-ups that first day, over 50,000 the first week, and almost 1 million in the first year.

Shontell: And do you think it was just the idea was exciting? That's been done before. Are there any other platforms that don't charge you a commission other than yours?

Tenev: Not to my knowledge, and some people have promotions like your first five or 10 trades are free. That's been tried before, but I think what allows us to offer unlimited commission-free trading was a technological step change and the ability to attract a customer base organically in a space where customer acquisition has been entirely paid-advertising-driven.

Shontell: At the time you put up this website, it goes to the top of Hacker News, and all of this is happening, you still don't have an app, right? There's nothing for people to actually physically download.

Tenev: No.

Shontell: It's just "You know this is coming, wait and see," and it builds some intrigue. How many people did you get on this wait list before you actually revealed the app?

Tenev: We had almost 1 million.

Shontell: And how many months was that from the time the website went up to the app coming out?

Tenev: The app fully launched on the App Store in March of 2015, so about two and a half years ago. The time between announcement and public launch was almost a year and a half.

Finding investors after 75 rejections

Shontell: And had you raised money at that point?

Tenev: We did. When we launched the website and launched the service, we had closed our seed round, so that was about $3 million, and it was led by Index, Google Ventures, Andreessen -

Shontell: Snoop Dogg.

Tenev: Snoop Dogg came in at the A, so that was a little bit later.

Shontell: A few months before Snoop. How do you have no product and still raise $3 million?

Tenev: Nowadays, it's sort of a relatively common amount. I shouldn't say common, but a lot of companies, especially ones that have capital requirements to get started, actually need to raise the capital. So for Robinhood, we didn't really have much of a choice, because the regulators required showing some amount of capital on our balance sheet before approval to launch the service. They don't want just a broker to come up with no capital and get a bunch of customers and then close up shop overnight. That's a really bad situation.

So there are capital requirements, which also make it more difficult than launching a typical startup, because there's a little bit of a catch-22 situation. Investors want to be sure that you're going to get that regulatory approval before entrusting you with the capital, but you need that capital to get the regulatory approval.

The people that invested in the company at that point were making a big bet on the founding team, on Baiju and myself and on this idea that was pretty unproven at the time, of us actually being able to acquire customers organically through word of mouth and actually deliver this product.

Shontell: So, like, a Marc Andreessen invests in you with no product, no financial approval yet, and no wait list. This is a pretty big gamble. Investors don't usually do this. You must have had one heck of a pitch.

Tenev: I think it was actually pretty challenging early on. There were a lot of people who just didn't believe in it, and we had to bang down a ton of doors, and we were really relentless. We probably knocked on 75 doors before we actually made it work.

Shontell: Wow, so 75 venture-capital doors slammed in your face?

Tenev: Yeah.

Shontell: Sometimes bets pay off. It sounds like so far so good now that your last round, I think, valued the company at $1.3 billion. Those guys are probably pretty happy.

Tenev: Yeah, yeah.

How to get Snoop Dogg to invest in your startup

Shontell: So talk to me about Snoop. How does one pitch Snoop Dogg and get him to invest in their startup?

Tenev: Well, I think what really attracted a lot of our individual angels to Robinhood was this idea that you're doing something very important, and you're doing it in a new way. And it was a little bit rebellious, but rebellious in a good way in the sense that the financial industry over the past several decades has just not earned the trust of consumers, especially in our demographic. I mean, they've been actively ripping off consumers.

You look at 2008 where we bailed out the banks, and the middle class, in a lot of ways, got stuck with the bill, and then in the years of the recovery since then, 90% of the returns have accumulated to the top 1%. It feels very, very unfair, and the margins for these services, which used to be brick-and-mortar but are now completely electronic, are way too big. The margins of financial-services companies are astonishingly large relative to what's actually going on, and what that translates into is almost literally they're taking money out of your pocket and putting it in theirs.

As part of this latest funding announcement, we released some numbers about the business, and the one that I'm most proud of is that we've taken half a billion dollars, over $500 million in saved commissions, and put that money back into customer's pockets. That's money that elsewhere would have just gone into the -

Shontell: Which is all great, but is still doesn't answer the question of how you pitch Snoop and Snoop got involved.

Tenev: I think - let me try to remember how we actually met him. I think we met Snoop Dogg through Jared Leto.

Shontell: OK, so then how did you meet Jared Leto?

Tenev: Through Aaron Levie.

Shontell: OK, so all of these people just know all of these people. The Hollywood and tech scenes are coming closer, I think.

Tenev: Yeah, Aaron Levie is the founder of Box and also an angel investor in Robinhood. He was very helpful to us quite early on because he pushed us really, really hard to get Robinhood.com. We were Robinhood.io at the time, and I don't know the full story behind Box, but I vaguely remember them being Box.net, and maybe by the time they were Box.com that was very, very expensive, so we were lucky to go from Robinhood.io to Robinhood.com when we were still a teeny-weeny company.

Shontell: So an intro, it sounds like, from an investor - which is why angel investors can be really helpful, if only for their networks. I'm sure for other reasons too, but they can introduce you to maybe future investors and things like that.

Tenev: Yeah, definitely. And a lot of our angel investors actually really liked the idea of the product. Some of them traded before and give product feedback from time to time as well.

Shontell: I want to talk about where the product is now. So about 2 million people are using this, and the company was recently valued at $1.3 billion, and you still are doing these commission-free trades. But you now have something called Gold, which is your freemium model. So you're going to basically have a large portion of the app that can be free to use, but then if you want kind of some bells and whistles on top, you pay.

Tenev: We launched that late last year, in December, and we had done a lot of user research. We have an awesome user research team at Robinhood, where we're constantly talking to customers and understanding their pain points, understanding what products they might enjoy. And we had an idea that Robinhood Gold would be successful at the onset before we launched it, and we were optimistic about it.

But then when it launched, it basically tripled our expectations. So it was super, super successful. It was growing 17% month over month. We were just generating a lot of revenue from this, and I think that's sort of a large part of what led to the funding round earlier this year and sort of resulted in a step change in kind of the trajectory and traction of the business.

Buying a stock as quickly as you'd post an Instagram photo

Shontell: And one thing I wanted to touch on is just the design is so easy to use and almost gives you pause. I downloaded Robinhood recently, I bought myself some Snap shares when they sunk back down to their IPO price, and the whole thing start to finish for me, from download to buying Snap, took about 20 minutes -

Tenev: Yeah, and that's never been done before -

Shontell: Before my husband could even be like, "Alyson, stop, I don't know if I agree with this decision," I already had bought the shares. Is that safe? Is that OK?

Tenev: I think it's important to separate the transactional elements of that from the actual decision-making of what stock you want to buy. People have really been used to a long process to set up any type of financial account. It used to be, for the vast majority, the bank account, brokerage account. You'd have to go in person, fill out some forms, talk to a person, they'd call you back - it would take maybe two or three weeks to buy your first stock.

The first generation of online brokerages put up some forms online and a marketing page, but that process behind the scenes was still the same. That's why when you open up a brokerage account that's not Robinhood, you can't buy stock right away - you have to wait one or two weeks, usually. So we were really the first to create that experience of being able to go from nothing to being an owner of a stock instantaneously, because that's what people expect from products.

You're usually downloading Robinhood precisely because you want to do something. Something gives you the idea, you want to buy a stock - let's download Robinhood to do it. So removing that friction is just categorically a good thing. The brokerages might say, "We slow down the process so that you can make sure you're making a well-informed deliberate decision," but that's just a load of crap. They slow it down because they don't have engineers, they don't have the ability to make an awesome user experience, and it's not a priority.

How millennials are investing

Shontell: A lot of your users are first-time people dabbling in the stock market. They've got a few hundred dollars to spend. They skew a little bit younger. So what are some of the habits that you're seeing this younger generation do with their money? Where are they investing it, how are they acting, do you think the recession affected their habits at all?

Tenev: It's so interesting because there are a lot of habits that we see that have surprised us and that, frankly, we haven't seen before.

One thing is now that we have several years of activity, we've built a really interesting data set, and we can track people as they spend more time in Robinhood. And the customers that joined Robinhood two years ago, we collect their self-reported liquid net worth, so how much money they have in liquid form in cash. Their Robinhood account balance today is larger than their self-reported liquid net worth two years ago. So we had this idea that Robinhood would function as a savings vehicle, and that seems to be bearing out.

Another thing that we noticed is that that money, rather than being diverted, as we might have thought, through checking and savings, really looks like it's coming out of spending money. So this is money that would have been spent on coffee or on Amazon or just discretionary stuff, and because Robinhood has the experience that you might get from buying a physical product or something on Amazon, it sort of feels like spending in a way that's very positive and very engaging, but people end up building a portfolio over time.

And one thing that's super unique is there's a lot more buying than selling activity on the platform, and you have these people that maybe are buying 50 different stocks but one or two shares of each and they're creating these diversified portfolios using small amounts of money. That type of transaction would have cost thousands of dollars in the past - people just wouldn't have done it. So we're actually giving people the ability to do something that they haven't been able to do anytime in the past.

Shontell: If you're giving advice to someone else who wants to start the next consumer-app rage, what's your advice to them? How do you think that they should get it off the ground? How can they see some success like you've seen?

Tenev: I think the biggest thing is to make sure that you understand the space super well and that you're actually really, really passionate about it. I think there's a lot of people who come at it from the business angle of: What's a market need? How do my skills align with this market need? How much money can we make from this?

But the process of actually building something really, really big can take a really long time, and I read somewhere that the vast majority of value is created past Year 10 of a company's existence.

So if you think about all of the crap that happens between Year 0 and 10, if you're not really, really passionate about something, I think it's very hard to keep going during that time period.

Shontell: Great. Well, thank you so much for your time.

Tenev: Thanks, Alyson.