- Many celebrities go from being rich and famous to being involved in lawsuits or spending sprees that trigger bankruptcy.

- One president was broke after leaving the Oval Office, and he had a famous author (who also went broke) write his memoirs.

- MC Hammer, Meat Loaf, and 50 Cent all went from being top musicians with great wealth to bankruptcy and debt.

The lives of the rich and famous often seem glamorous, but even the biggest celebrities have issues with money.

Despite many inspiring stories of celebrities who came from nothing and worked their way out of financial hardship, the opposite also happens. For many stars, their career arcs are riches to rags.

From musicians to athletes to movie stars, sometimes fame and wealth results in a disastrous spending spree. Many celebrities have ended up declaring bankruptcy. A bunch of famous people had trouble paying off loans and making child-support payments.

Take these 18 examples of rich and famous celebrities who lost all their money. Some of them managed to bounce back, while others remain in financial trouble.

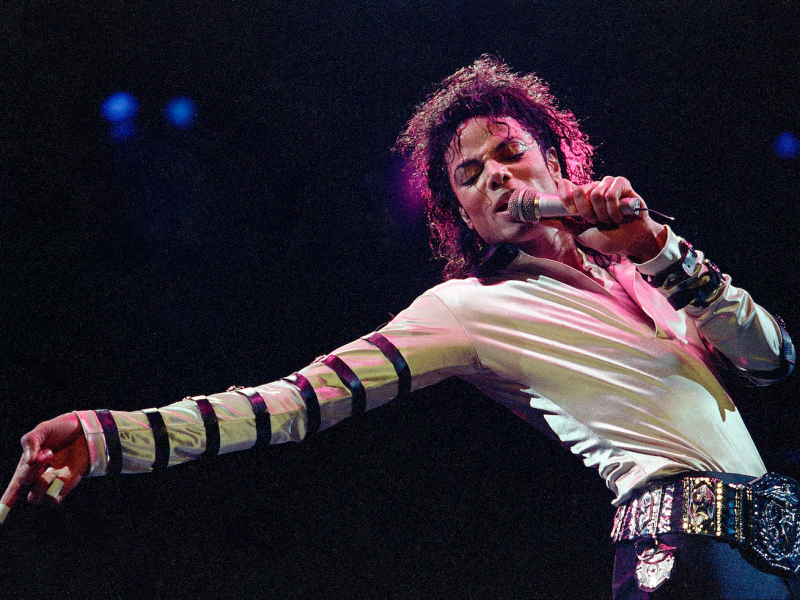

Michael Jackson

The King of Pop was supposedly $400 million in debt when he died unexpectedly in 2009. He was also close to foreclosure on his famous Neverland home.

Large amounts of spending required Jackson to take out loans, many which he never paid back. Jackson's money problems got worse once he was involved in numerous expensive lawsuits.

Before he died, Jackson had planned on getting out of debt by touring. His estate resolved the financial issues, and Michael has been the top-earning dead celebrity for five straight years.

Nicolas Cage

Cage was one of Hollywood's biggest stars, earning $40 million in 2009 alone, but also one of its biggest spenders. He purchased many homes, automobiles, and rare artifacts.

The IRS placed tax liens on multiple properties he owned, and then had Cage hand over more than $6 million for failing to pay his 2007 tax bill. Cage's precarious financial situation led him to sell many of his belongings, including a treasured comic book, and take many film roles.

Floyd Mayweather Jr.

Mayweather has never lost a match in the boxing ring, earning the nickname "Money." Yet Deadspin reported that Mayweather has owed the IRS money for over a decade.

The boxer's failure to pay taxes resulted in a $22.2 million debt to the IRS, even as he came out of retirement for a high-grossing fight. There are rumors that Mayweather will again come out of retirement to settle his debts.

Mike Tyson

Heavyweight champion Mike Tyson earned $300 million over his career, but he was knocked down with a $23 million debt in 2003. He declared bankruptcy, returned to jail, and went through rehab before he again reached financial stability.

By 2003, he owed money to the IRS, British tax authorities, lawyers, a personal trainer, a financial manager, and a music producer, among others. Tyson had to pay $9 million in a divorce settlement and was also behind on child support.

Stephen Baldwin

Alec's younger brother filed for bankruptcy in 2009 while owing money on taxes and a couple of mortgages. Troubles repeated as Baldwin's house was foreclosed in 2017 after six years of no mortgage payments.

On another occasion, Baldwin was arrested and served five years' probation for failing to pay taxes for three straight years.

50 Cent

50 Cent broke out as a rapper, but he makes most of his money from a diverse business empire. He first encountered trouble in the 2008 recession when his stocks took a dive.

In 2015, 50 Cent was $32.5 million in debt while caught up in lawsuits and unpaid child-support payments. The next year he declared bankruptcy.

More recently, he got lucky when Bitcoin surged in value. He received 700 bitcoins as payment for a 2014 album and his share of cryptocurrency came to be worth millions.

Ulysses S. Grant

It is tough to imagine a president going broke after leaving the White House, but that in fact happened to esteemed Civil War General Ulysses S. Grant.

The 18th president became a partner in financial firm Grant and Ward, but Ferdinand Ward embezzled investors' money, leaving the firm and Grant bankrupt in 1884. Grant was receiving a military pension, but it was not enough as the president was also suffering from throat cancer.

To make money, Grant had Mark Twain publish his memoirs, but he died before he could make money from his life story.

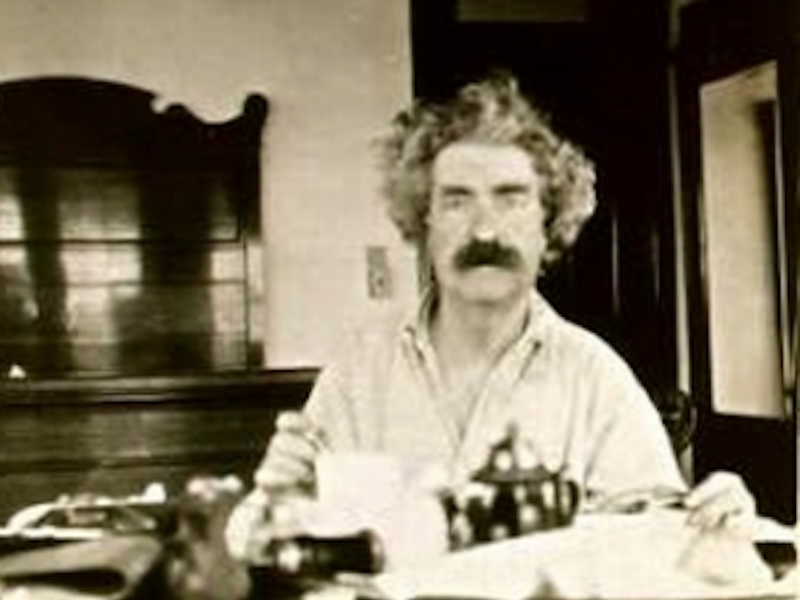

Mark Twain

Speaking of Twain, the American author grew up poor after his father died when the novelist-to-be was 11 years old. Throughout his career, Twain desired to become rich, and even though he married up on the social ladder, his dream never came true.

After the success of Grant's biography and "The Adventures of Tom Sawyer," Twain's publishing house went bankrupt. His financial failings contributed to depression and, in 1894, the satirist declared bankruptcy.

With more successful writing and a popular speaking tour, Twain got back to financial security, but then lost a $30,000 investment in a protein powder.

MC Hammer

MC Hammer had a legitimate hit with "U Can't Touch This," and the rapper soon had $30 million in the bank. But Hammer went on a spending spree and declared bankruptcy in 1996 while he was $13 million in debt.

Before he went broke, Hammer bought a $1 million mansion that he made $30 million worth of adjustments to, and staffed 200 people in his home. He also bought a horse stable where he kept 19 racehorses.

Combined with his unrestrained spending and numerous lawsuits, it's easy to see how MC Hammer fell.

Dennis Rodman

Rodman was known as a great rebounder and teammate of Michael Jordan before becoming an eccentric celebrity with a short marriage to Carmen Electra and eventually an unofficial US ambassador to North Korea.

In 2012, Rodman's lawyers said he could barely afford living expenses and could not pay child support for his two kids. At the time, he owed over $800,000 in back child support but claimed to be broke and sick.

Kim Basinger

In 1989, actress Kim Basinger paid $20 million for a 1,691-acre town. Basinger was expected to create a tourist attraction such as a theme park or movie studio in Braselton, Georgia, but she instead declared bankruptcy and had to sell the property for a huge loss.

Basinger settled with Main Line Pictures in 1995 for dropping out of performing in the film "Boxing Helena," avoiding the initial $8.1 million judgment.

In 1995, Basinger was "living in three homes on both coasts and spending $31,000 a month on clothes, pets, and an ex-husband [Alec Baldwin]" while failing to pay a maintenance company $8,100 for yard work on her Los Angeles home.

Marvin Gaye

The soul singer of hits "Let's Get It On" and "I Heard It Through the Grapevine" made plenty of money from his records, but he was also a free spender.

Gaye filed for bankruptcy and fell behind on alimony payments to his first wife, Anna Gordy Gaye. In 1976, a judge forced Gaye to pay his ex-wife $600,000 from royalties of his upcoming album, "Here, My Dear."

Gaye refused to make the court-ordered payments, and claimed his expenses exceeded his income even as he continued to spend money recklessly, purchasing luxury automobiles, boats, and beachfront properties.

Gaye moved to Europe in 1981 to avoid pressure from the IRS. Gaye was shot and killed by his father in 1984, and at the time, the 44-year-old Gaye still owed Anna $300,000 in back alimony.

Curt Schilling

Schilling was a successful pitcher who broke the Red Sox' World Series drought through sweat and blood. In his post-playing days, Schilling created a video-game studio to make one of his hobbies into a business.

Schilling put $50 million of his own money into 38 Studios and managed to secure $75 million in bonds from the state of Rhode Island. His business failed, and he was asked to pay back $2.5 million to Rhode Island even though he had gone through all his savings and his company was $120 million in debt.

The situation got worse for the former baseball player when he was fired from ESPN in 2016.

Burt Reynolds

"I've lost more money than is possible because I just haven't watched it," Reynolds told Vanity Fair. Starting with two bad ventures into chain restaurants during the '80s, Reynolds had a string of failed investments.

Meanwhile, the movie star was spending heavily on real estate, a private jet, 150 horses, and over $100,000 in toupees. After an expensive marriage to Loni Anderson, Reynolds experienced a costly divorce.

Because of large costs and dwindling income, Reynolds couldn't pay back a $3.7 million loan to CBS and declared bankruptcy in 1996 while he was $11.2 million in debt.

Meat Loaf

Meat Loaf was a huge success in the late '70s, starring in the cult classic "Rocky Horror Picture Show" and releasing hit album "Bat Out of Hell." The '80s were less friendly to the singer of "Paradise by the Dashboard Light."

Meat Loaf told Guardian: "I had 45 lawsuits totaling $80 million thrown at me, it was a game. And the only way to stop them playing their game was to declare a chapter 11 bankruptcy. Because every time we'd get one case dismissed, they'd throw another one at me. And everybody thinks I had all this money but I didn't, because CBS did not pay my royalties until 1997."

He turned things around in the '90s. As he would say, being successful in two out of three decades "Ain't Bad."

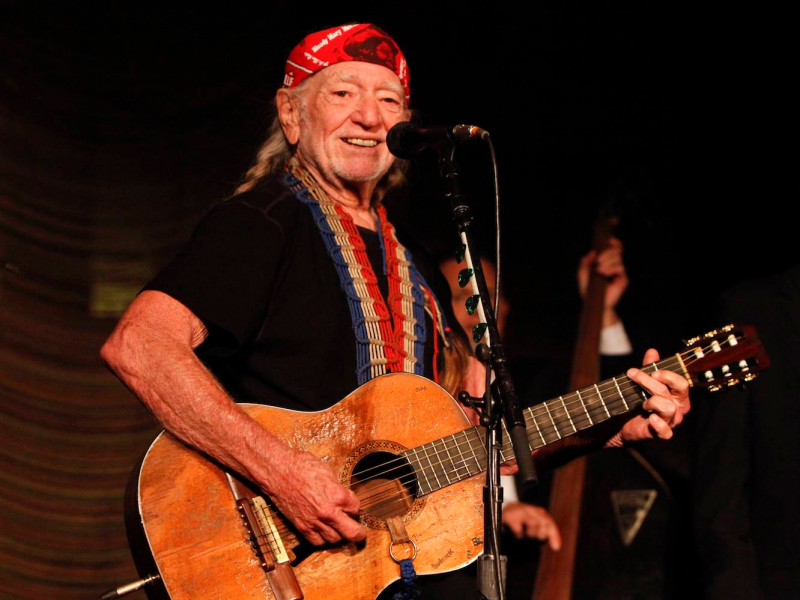

Willie Nelson

Nelson is known as a country singer and marijuana-smoking icon, but he has also gotten into notable money problems. Nelson was avoiding federal taxes and the IRS came looking for a tax bill of $16.7 million, including interest and penalty.

His lawyer negotiated the bill down to $6 million, but Nelson still couldn't pay up. In 1990, the IRS raided his home and seized nearly everything Nelson owned - including 20 properties and most of his instruments and music collection.

Nelson was forced to record "The IRS Tapes: Who'll Buy My Memories" and fans organized fundraisers for the down-on-his-luck musician.

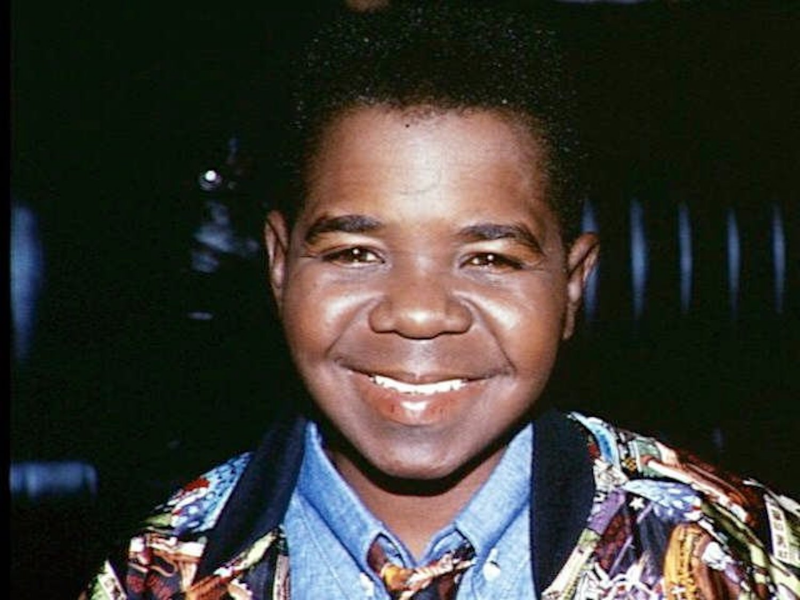

Gary Coleman

Coleman was a childhood star, making $70,000 per episode of "Diff'rent Strokes" in the '80s. By the time Coleman had wrapped up saying "What you talkin' 'bout Willis?" he was 18, but his adopted parents had squandered all his earnings.

Coleman's hit sitcom ended in 1986, but he had trouble finding other work in Hollywood. He eventually won a settlement against his parents, but that was not enough to avoid bankruptcy in 1999.

After lawyers' fees and bad investments, the diminutive Coleman had to work as a security guard. At the time, he had $100 in cash.

Wayne Newton

Newton had a few hits in the '60s, but he made it big as a Las Vegas lounge singer and was even the highest-earning performer in 1983. By 1992, he was bankrupt and $20 million in debt.

Even though he made his way out of debt, Newton's money problems didn't stop there. The IRS sued him in 2005 for failing to pay $1.8 million on the sale of a house. Newton's property was seized in 2010 for failing to pay off a $3.35 million loan.

Financial issues and legal problems have continued to plague Newton for the past 30 years.