- Bahrain, Saudi Arabia, Egypt, and the United Arab Emirates severed diplomatic relations with Qatar, accusing it of supporting Islamist terrorist groups and Iran. Qatar has invested £35 billion in the UK and has plans for another £5 billion. Qatar supplies 30% of UK gas imports, making it vital for Britain’s energy infrastructure. But Gulf neighbours cut transport and trade links to Qatar, threatening its links with the outside world.

LONDON – Qatar’s diplomatic crisis with its Gulf neighbours could not have come at a worse time for the UK.

With the British political system deadlocked over Brexit and mired in a hung parliament, the UK needs stable trade and investment allies outside of Europe to keep a flow of foreign funding into the domestic economy.

ButBahrain, Saudi Arabia, Egypt, and the United Arab Emirates have severed diplomatic relations with the country, closing down airspace, shipping routes and Qatar’s connections to the Arabian peninsula and the rest of the world. The crisis hit Qatar when its Gulf neighbours accused it of supporting terrorist groups such as the Islamic State and Al-Qaeda. Qatar has denied the allegations.

TRADE

The spat puts the UK in an uncomfortable spot. Both sides of the dispute feature key allies and trading partners for the UK, so the Britain will have to show some balance.

But the situation is so unstable and diplomatic relations have broken down so spectacularly between the two sides that the UAE has barred people from publishing expressions of sympathy toward Qatar.

Feeling sorry for Qatar can earn you as much as 15 years imprisonment and a minimum fine of 500,000 dirhams (£105,446 or $136,115), UAE Attorney-General Hamad Saif al-Shamsi has said.

Prime Minister Theresa May has singled out Qatar as an important trading partner for the UK in the post-Brexit world. In March she signed a memorandum of understanding to "deepen the co-operation between our governments and our businesses across a wide range of vital areas."

These include "education and healthcare, science, research and innovation, tourism and culture, transport, energy, financial services and the development of small businesses," May said in a speech.

In return, Qatar pledged to invest an extra £5 billion into the UK, on top of the more than £35 billion already invested by vehicles such as the Qatar Investment Authority.

Qatar is the UK's third largest export market in the Middle East and North Africa region, according to UK government statistics. And, until now, that market had been growing. British exportsof goods to Qatar rose from £1.31 billion in 2013 to £2.13 billion in 2016.

The exports included industrial machinery and equipment, luxury goods and food, and so any blockade would knock confidence in exporting businesses.

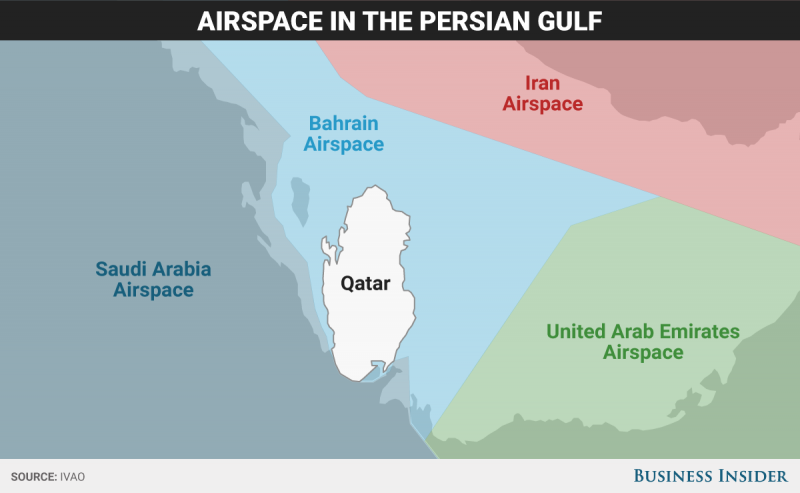

And this map of Gulf airspace shows just how vulnerable Qatar is to to a trade-route shut down:

INVESTMENT

One of the key concerns is that Qatar will need to liquidate some or all of its UK assets, most of which are tied up in property developments, to support the Qatari currency and sustain its domestic economy.

The Qatari riyal experienced unprecedented volatility in the wake of the diplomatic crisis:

Qatar owns more of London than the Queen, more than 21 million square feet of property, including a 95% stake in the Shard, the tallest skyscraper in Europe.

Qatari investors also bought the Olympic Village after the London 2012 games, own Harrods, and have a stake in Canary Wharf.

Apart from property, Qatar is also a major shareholder in Barclays, injecting capital into the bank during the 2008 financial crisis and saving it from a government bailout.

"We have the assets and the security that we need. Our foreign assets and our foreign investment is more than 250% of our GDP. So we are very much comfortable. We know we can defend the currency or we can defend the economy. But I don't think there's anything that we need to worry about in the local economy," Qatari Finance Minister Ali Shareef Al Emadi said in an interview with CNBC on Monday.

CNBC's Hadley Gamble pushed the question further, asking "So no chance of a sell down in assets like Barclays or VW or Sainsbury's?"

To which Al Emadi responded with: "I will say we are extremely comfortable with our positions and on our investment or actually liquidity in our systems."

ENERGY

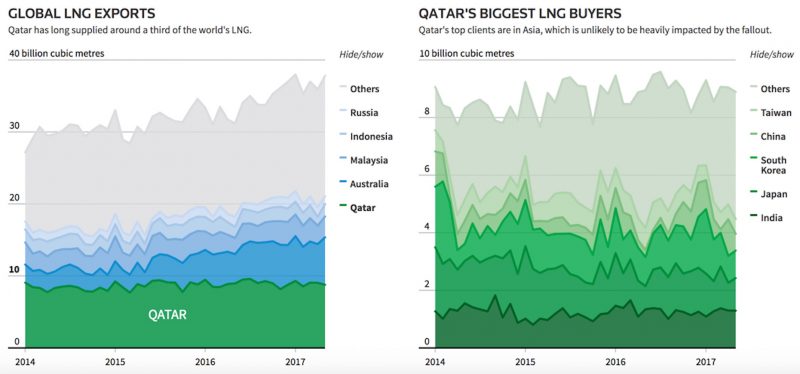

Qatar is a huge exporter of gas, both to the UK and the rest of the world.

Here's the chart:

While the UK might not be among the biggest buyers, the diplomatic spat has highlighted the vulnerability of the UK's gas supply, the Financial Times reported. The UK is becoming more dependent on gas, which powers around 42% of electricity generation, but dwindling supplies in the North Sea have led Britain to focus more on imports.

Qatar supplies just under a third of the UK's imports, but the Gulf crisis could cause transport disruptions, the FT said, if Egypt decides to squeeze liquified natural gas ships out of the Suez canal.