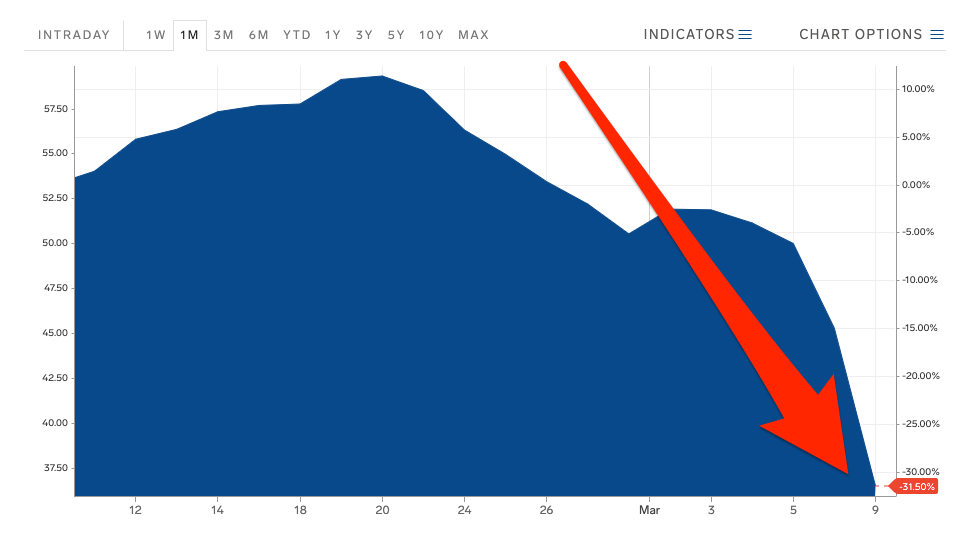

- Oil prices tumbled as much as 34% – their most in decades – between Sunday and Monday.

- In later trading prices stabilized to about 21% below the previous day’s.

- The Dow Jones Industrial Average and S&P 500 indices both slumped around 7% when trading opened in New York on Monday.

- The dramatic plunge was prompted by Saudi Arabia, which sharply cut prices. It was a response to Russia, which over the weekend refused to restrict how much oil it was producing.

- This was the biggest single-day drop since the Gulf War in 1991.

- Visit Business Insider’s homepage for more stories.

The price of oil tumbled more than 30% on Monday, its sharpest single-day decline since the Gulf War in 1991.

The price recovered somewhat after that initial fall and was trading about 21% down in the early morning.

At their lowest, oil prices were down 34%, CNN reported.

As of 10:50 a.m. ET, according to data from investing.com:

- Brent crude was trading at $36.42 a barrel - down about 19%.

- West Texas intermediate was trading at $33.50 a barrel - down about 19%.

- The Dow Jones Industrial Average index was down 1,551 points - a drop of 6%.

- The S&P 500 index was down 173 points - a drop of 5.8%.

- The UK FTSE 100 index was down about 499 points - a drop of 7%.

The crash was fueled by sinking demand amid the worldwide spread of the novel coronavirus, which in turn sparked a series of price cuts.

Saudi Arabia started the price wars by cutting prices by its most in at least 20 years over the weekend, retaliation after a dispute with Russia on Friday over how much to restrict production.

At a meeting in Vienna, Saudi officials asked Russia to cut back on production, hoping to keep the price higher during the outbreak.

Russia refused. As a result, the Saudis cut their prices, effectively launching three-way price war between the OPEC oil-producing alliance (led by Saudi Arabia), Russia, and the US.

Goldman Sachs analysts have warned that the price of oil could tumble further still, as low as $20 a barrel.

The prices of oil companies were also down, with BP shares experiencing price drops of as much as 20% and Shell of 14%.

Markets and assets across the board were also hit hard by the crash, Business Insider's Theron Mohamed reported.