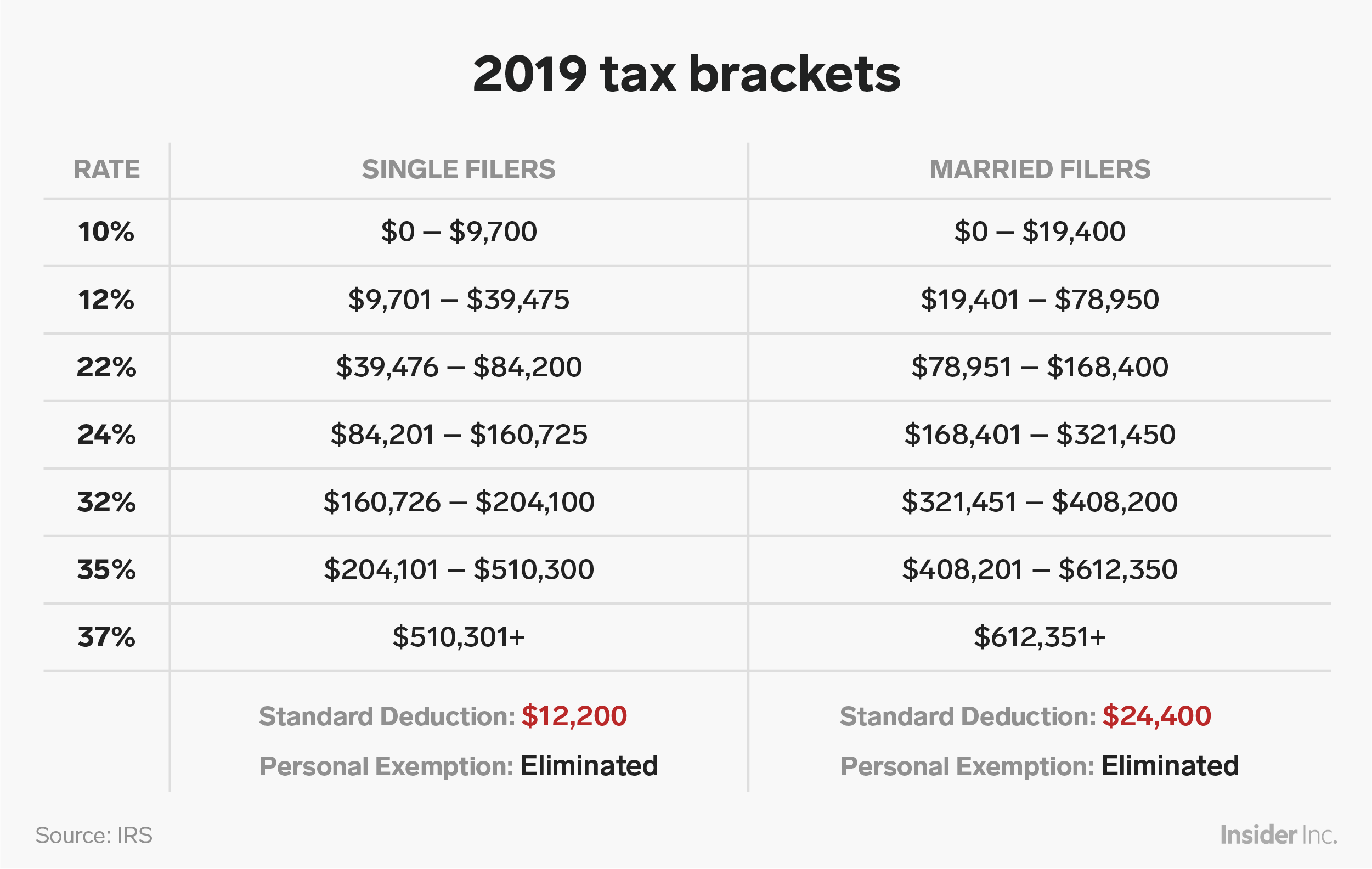

- The IRS took inflation into account when it released new tax brackets, which will apply to income earned in 2019.

- Tax Day 2019, when taxes are due for income earned in 2018, is Monday, April 15.

- The federal income-tax ranges have shifted slightly, and the standard deduction will be $12,200 for single filers and $24,400 for married filers.

Tax Day 2019 is April 15. That means taxes are due for income earned in 2018, the first tax year under the 2017 GOP tax law.

The IRS recently updated the seven federal income-tax brackets for 2019 to reflect inflation. So any income earned this year will be subject to the new tax brackets.

The standard deduction will be $12,200 for single filers and $24,400 for married filers, up $200 and $400, respectively.

Here’s how the brackets have changed for the new year compared with 2018:

For single filers:

For married filers:

For head-of-household filers:

Other tax changes for 2019 include increased limits for retirement contributions:

- $19,000 limit for 401(k), 403(b), and most 457 plans. (If you're 50 or older, you can put away an additional $6,000.)

- $6,000 limit for IRAs. (If you're 50 or older, you can put away an additional $1,000.)

And higher exemptions for gifts and estate taxes:

- $11.4 million limit for lifetime gift and estate-tax exemption.

- $15,000 limit for annual gift and estate-tax exemption (same as 2018).

- Read more:

- Tax Day is April 15. Here's what you can expect when filing under the new tax law.

- The IRS can't pay out tax refunds during the partial government shutdown, and it's the biggest problem for people who need it the most

- The IRS can't pay out tax refunds during the partial government shutdown, but experts say you should still file ASAP

- Here's when you can expect your employer to send the form you need to file your taxes for 2018