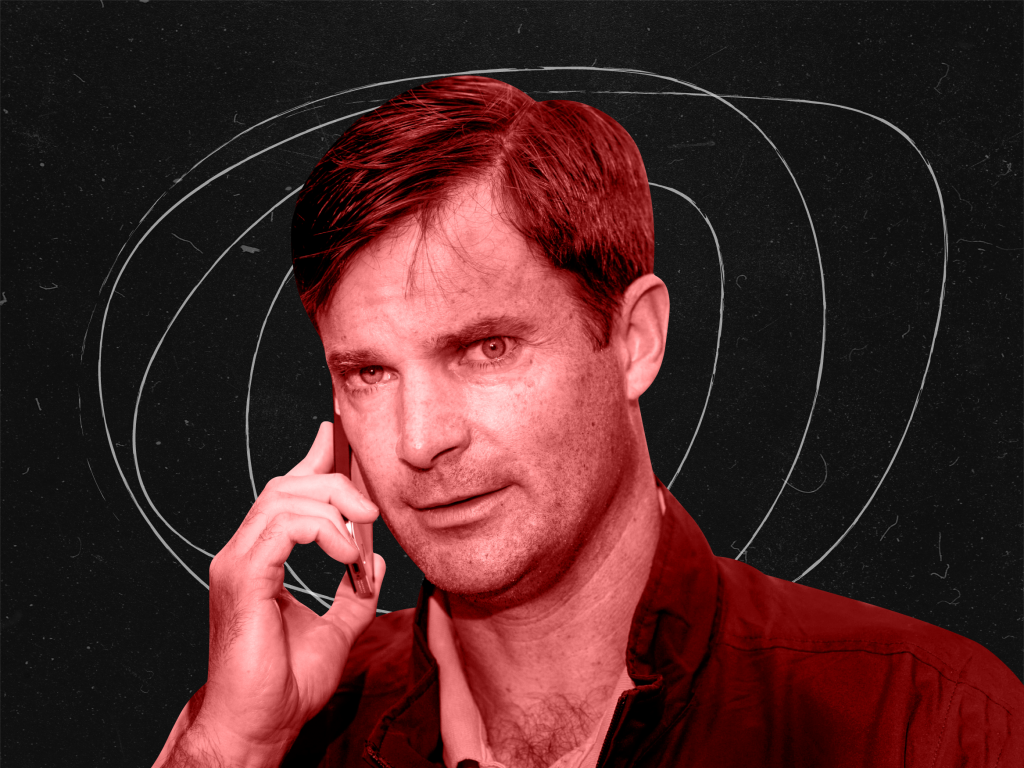

Dennis Lynch, the once high-flying portfolio manager who runs Morgan Stanley Investments' Counterpoint Global funds, is now facing the biggest test of his career.

After posting triple-digit gains in 2020 and earning a rare public shout-out from Morgan Stanley CEO James Gorman, several of his Counterpoint funds have plummeted 40% or more this year, and clients have pulled billions of dollars. At the same time, people close to the firm are starting to talk about the Counterpoint's vaunted culture, describing an atmosphere behind closed doors that's sharply at odds with the collegial think tank Lynch likes to portray in TV interviews.

Former employees told Insider that as Lynch's profile rose, he increasingly avoided confronting problems on his team by leaving culture matters to other executives in his inner circle, to the detriment of morale in the wider investment-management division. Behind the scenes, his lieutenants have yelled and bullied, wielded power over colleagues, and acted with impunity, these people told Insider.

Lynch's team sits within Morgan Stanley's $1.2 trillion asset-management division, which is run as a collection of independent boutiques, complete with their own idiosyncrasies and customs. Lynch's star power has given the Counterpoint team more autonomy than most, more than a dozen current or former employees or others familiar with the Counterpoint team told Insider.

Lynch "was allowed to make his own rules," one former MSIM employee told Insider. "His rules were not everyone else's rules."

A Morgan Stanley spokesperson disputed that characterization, noting that the firm's rules apply to Counterpoint Global "as they do to any other investment team or employee," she said.